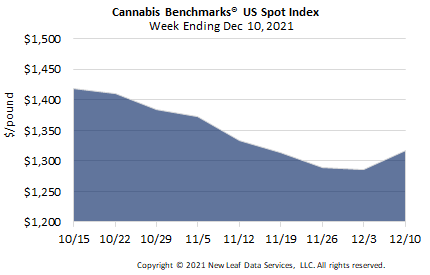

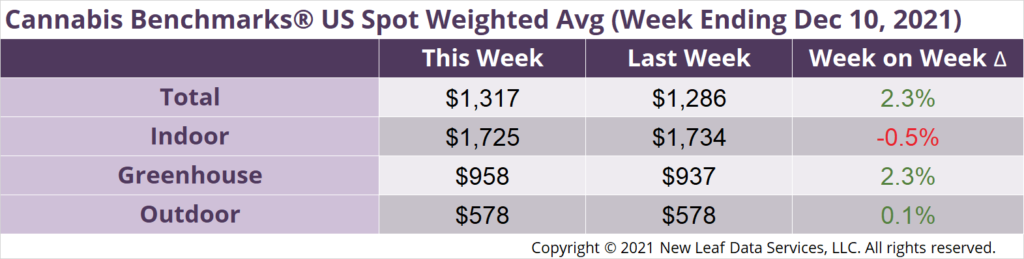

The U.S. Cannabis Spot Index increased 2.3% to $1,317 per pound.

The simple average (non-volume weighted) price decreased $8 to $1,623 per pound, with 68% of transactions (one standard deviation) in the $827 to $2,419 per pound range. The average reported deal size decreased to 2.4 pounds. In grams, the Spot price was $2.90 and the simple average price was $3.58.

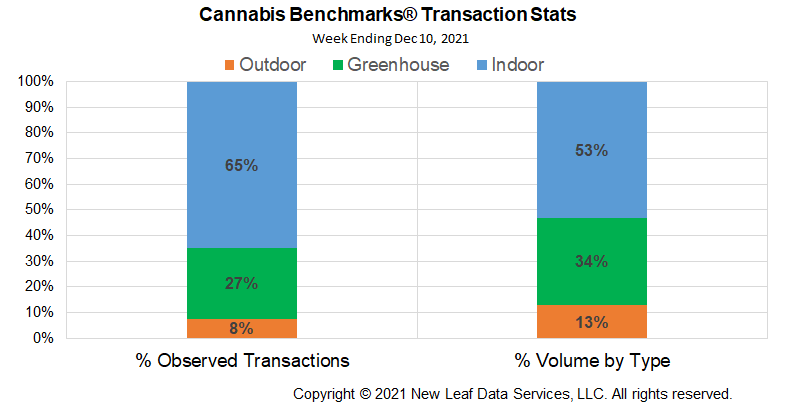

The relative frequency of transactions for indoor product rose 1%, that for deals for greenhouse product fell 1%, and the relative frequency of outdoor transactions was unchanged this week.

The relative volume of indoor flower rose 3%, that of greenhouse fell 2%, and that of outdoor fell 1%.

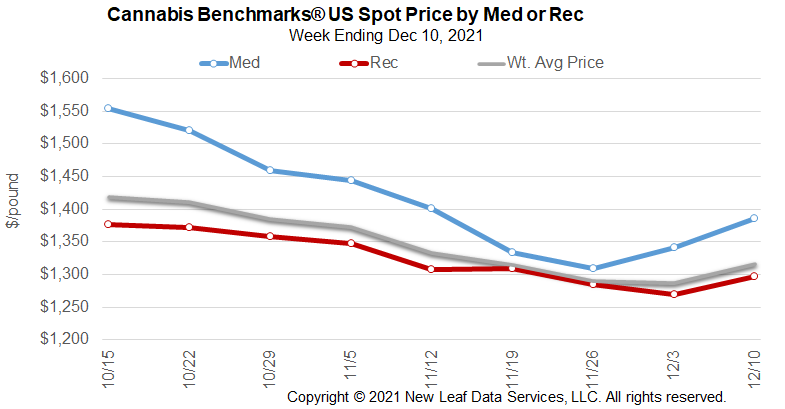

Outdoor flower prices in legacy states have undergone a rout this year, but there are signs the losses may be slowing in the post-harvest environment. Expanding yields will no doubt weigh on prices, but demand for extracts and manufactured products is growing, which may provide a bit of a counterbalance to oversupplied markets.

U.S. Outdoor Spot price ticked up this week, albeit by just $0.38 to $577.94, on the back of outdoor product price gains in California and Colorado.

An improvement in outdoor product prices rests in large part with growers’ production and inventory management strategies. In addition to ever-increasing production, some western growers overestimated demand due to the pandemic-related buying surge in 2020. The situation was exacerbated by growers holding back 2020 inventory going into 2021, only to have the floor drop out of the market. Price movement over the next few months will reveal whether large inventories are holding the outdoor market down. One Colorado grower’s pragmatic approach is “it’s a renewable resource” and he does not see a reason to hold inventory hoping for better prices. See his story in the Colorado section of this week’s Premium Report.

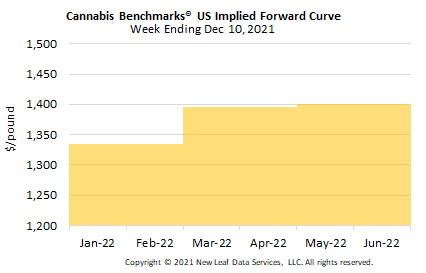

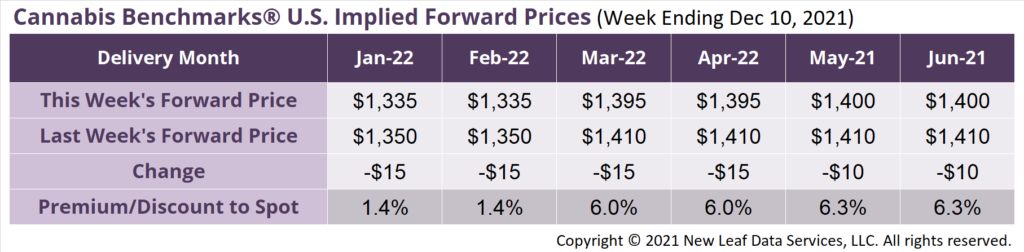

January 2022 Implied Forward assessed down $15 to $1,335 per pound.

The average reported forward deal size declined to 66 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 37%, 47%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 98 pounds, 51 pounds, and 34 pounds, respectively.

At $1,335 per pound, the January 2022 Implied Forward represents a premium of 1.4% relative to the current U.S. Spot Price of $1,317 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Illinois

Year-to-Date Adult Use Sales Top $1.2 billion

Oregon

Sales Drop for Fourth Straight Month in November

Colorado

The Pragmatic Grower

Maine

November Adult Use Sales Drop 12%