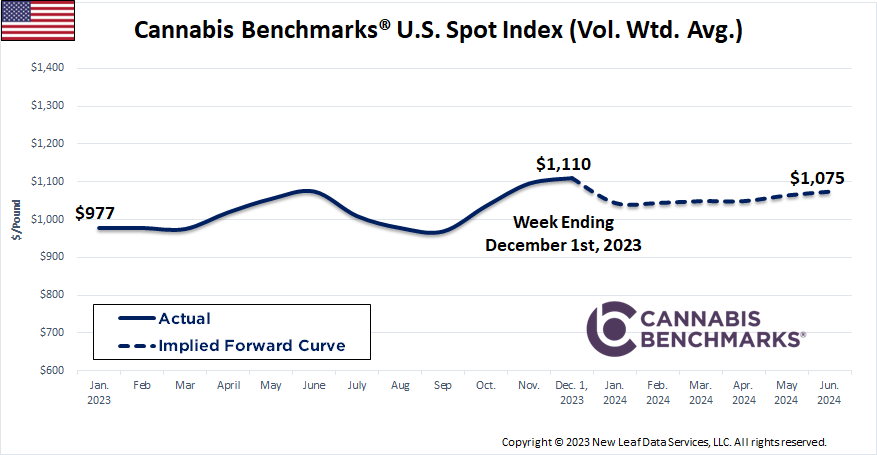

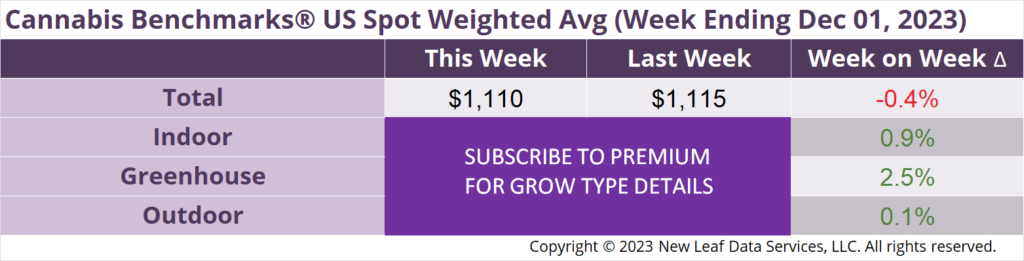

The U.S. Cannabis Spot Index decreased 0.4% to $1,110 per pound.

In grams, the Spot price was $2.45.

Cannabis Benchmarks is pleased to announce that we have begun publishing price assessments for wholesale flower in Maryland and Delaware’s legal cannabis markets.

Maryland’s spot wholesale flower price debuted as the highest of the 21 markets that we now cover. Adult use sales in the state just began in July and have crept upward each month from $51.2 million in July to $55.1 million in October, along with medical sales of between about $34 – $38 million each month during that span.

Spot wholesale flower prices in Delaware’s relatively small medical market were the third most expensive of those we cover this week. The state issued nearly 28,000 patient registrations in fiscal year 2023. Patients are served by 12 dispensaries operated by six companies. Adult use legalization passed into law earlier this year in Delaware, but business licensing is not expected to begin until around mid-2024, with sales likely starting later next year or early in 2025.

In the coming weeks and months, we will be introducing wholesale price assessments for additional state markets, as well as for trim and pre-packaged flower in selected states.

The U.S. Spot wholesale flower price ticked down slightly this week. National prices for all three grow types were on the rise, but the decline in the aggregate price was due to larger volumes of lower-priced sun-grown flower reported by our Price Contributor Network.

Elevated volumes of outdoor flower traded in Q4 of any given year usually work to pull down the national wholesale price index. However, outdoor flower prices in key states have held firm so far this harvest season, while rising rates for indoor flower have pushed the U.S. Spot upward.

In recent weeks, we’ve commented on wholesale flower prices in states with significant outdoor cultivation, as those markets typically drive the direction of the U.S. Spot in Q4 of any given year. While the overall national wholesale flower price has been experiencing an atypical post-harvest climb, outdoor flower prices in some of the highest production markets remain relatively low and are not supporting the upward trend of the U.S. Spot price.

Comparisons of this year’s outdoor flower prices in large western U.S. markets – specifically California, Colorado, and Oregon – with those of prior years indicate that prices in those states found their bottoms late last year or early this year. Since then, outdoor flower prices in the three markets have largely tracked within ranges established in 2022.

That prices have not recovered significantly despite the lapsing of a significant portion of cultivation licenses in California and a more than 25% year-on-year decrease in the peak number of plants recorded being grown in Colorado in 2023 is unsurprising. Given the significant oversupply generated in 2020 and 2021, combined with slowdowns in sales, it will likely take at least another year of contracting production to balance markets and potentially lift outdoor flower prices.

Still, with less sun-grown supply coming to market, indoor spot wholesale flower prices have been on the rise in all three states (although Oregon’s took a dive on news of October’s large harvest volume), helping to lift state and U.S. Spot prices in the post-harvest environment.

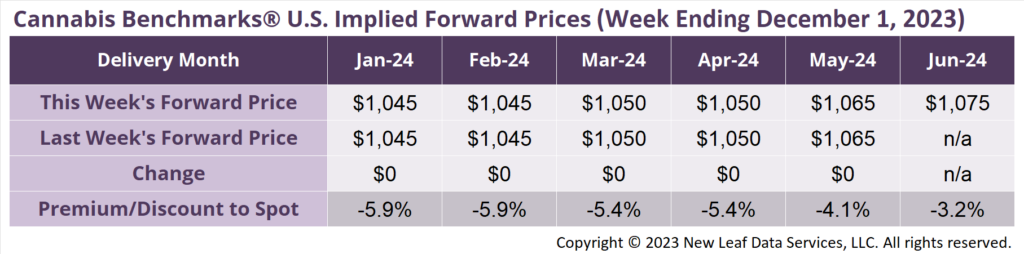

June 2024 Implied Forward initially assessed at $1,075 per pound.

At $1,045 per pound, the January 2024 Implied Forward represents a discount of 5.9% relative to the current U.S. Spot Price of $1,110 per pound.

Outdoor Flower Prices in Key States Hit Bottoms in Late 2022 or Early 2023, Now Holding Firm

Sales and Wholesale Prices Both Slipped Lower in Q3

Demand Softened in August & September

Approval of Settlement in CAURD Lawsuit Portends End to Holdup of Retail Licensing Program