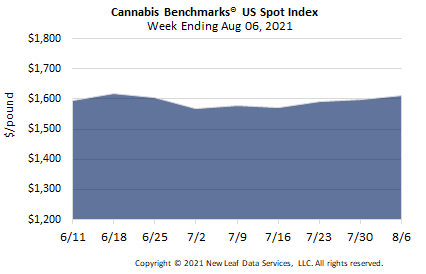

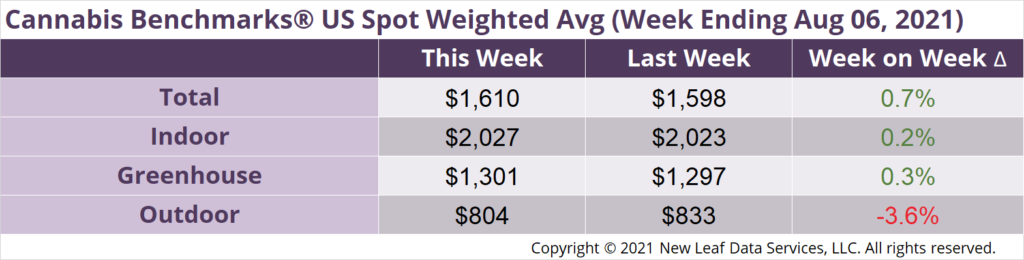

U.S. Cannabis Spot Index increased 0.7% to $1,610 per pound.

The simple average (non-volume weighted) price increased $5 to $1,885 per pound, with 68% of transactions (one standard deviation) in the $1,057 to $2,714 per pound range. The average reported deal size decreased to 2.4 pounds from 2.6 pounds. In grams, the Spot price was $3.55 and the simple average price was $4.16.

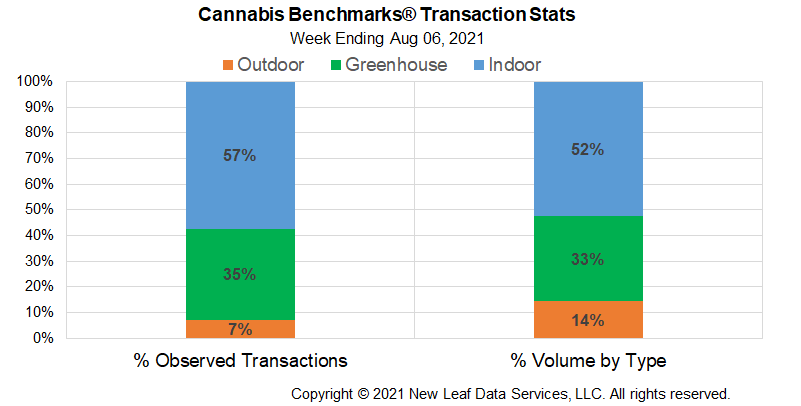

The relative frequency of transactions for greenhouse flower decreased by 1% this week. The relative frequency of deals for indoor product increased by the same proportion, while that for trades for outdoor flower was unchanged.

The relative volume of greenhouse flower contracted by 3% this week. The relative volumes of warehouse and outdoor product expanded by 2% and 1%, respectively.

July sales data released this week by officials in Oregon and Illinois show that the stagnation in sales seen from April to June was broken last month, with both states’ adult-use markets experiencing significant upticks in retail revenue. Based on previous observations, we can reasonably expect that other states will also see increased sales in July. With the exception of Nevada, demand trends have been relatively consistent state-to-state since late Spring of 2020, when the COVID-19 pandemic began impacting the U.S. in earnest.

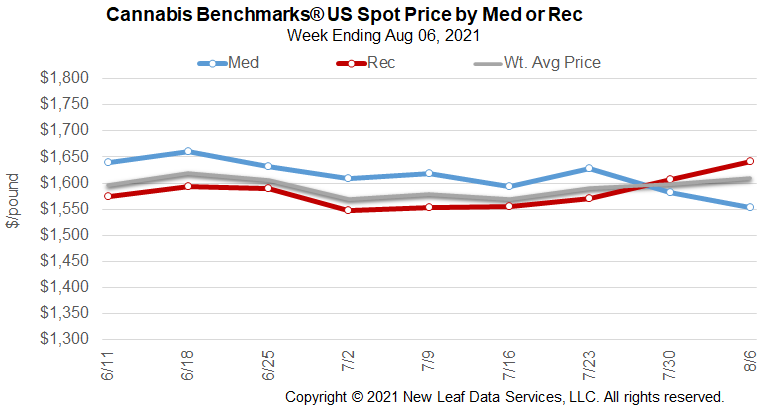

Although delayed a bit compared to prior years, the summer increase in demand observed in the aforementioned markets has coincided with an upward trend in wholesale flower prices in those states, as well as the U.S. Spot Index. Oregon’s state data indicates that summer light-deprivation harvests are being brought in currently, constituting new supply in West Coast states where such practices are most prevalent, on top of that generated by indoor growers.

However, sun growers are also contending with drought, high heat, and wildfires that have manifested with increased severity compared to previous years, when supply was largely unscathed by such extreme weather and natural disasters. Added costs to irrigate plants and manage staff are in addition to generally increased costs for labor compared to last year. Such factors may lead growers to press for higher prices even as new supply comes to market.

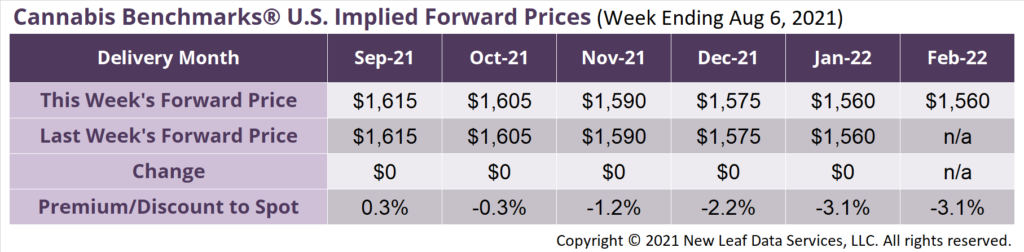

February 2022 Implied Forward initially assessed at $1,560 per pound.

The average reported forward deal size was 63 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 50%, 38%, and 12% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 79 pounds, 52 pounds, and 29 pounds, respectively.

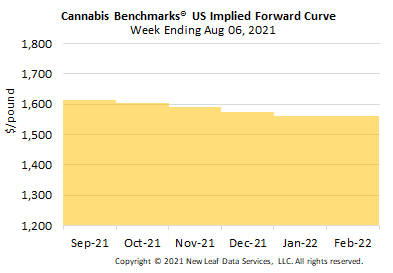

At $1,615 per pound, the September Implied Forward represents a premium of 0.3% relative to the current U.S. Spot Price of $1,610 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Report: Fresno to Issue First Adult-Use Business Licenses, Possibility of Lawsuits Loom

Oregon

Sales Back on the Rise in July After Declining in May and June

Illinois

Adult-Use Sales Jump 10% in July to Over $127 Million, Another New Record

Recent Issuance of New Craft Grower, Infuser Licenses and Lotteries for Retailer Licenses Signal Future Expansion of State’s Adult-Use System