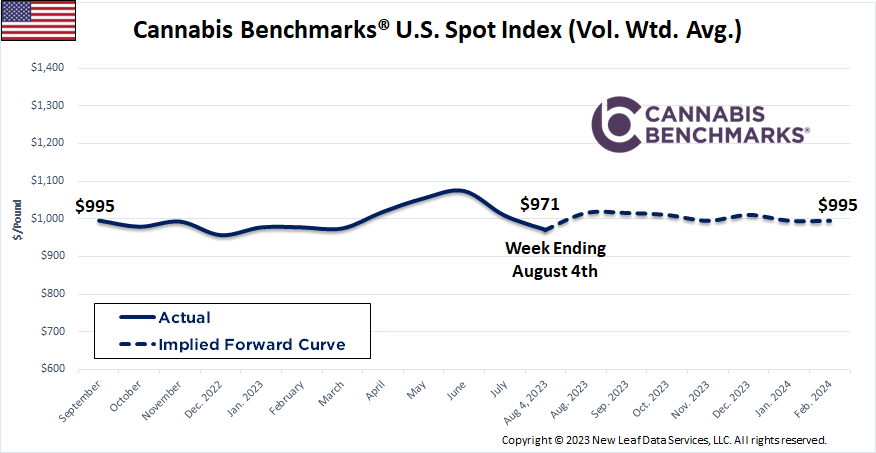

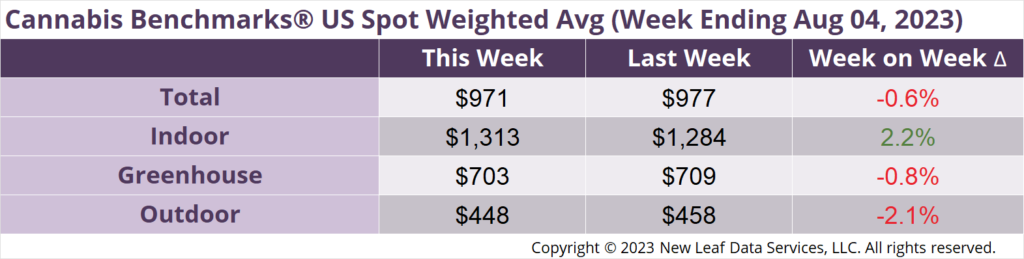

The U.S. Cannabis Spot Index decreased 0.6% to $971 per pound.

In grams, the Spot price was $2.14.

The U.S. Spot Index continued its recent slide this week. After rising 14.1% from mid-February to early June, the national composite price has since lost 11.4%, settling this week just $21 above its all-time low of $950 per pound, established in December 2022.

The current downturn in the U.S. Spot Index is being driven almost entirely by declines in wholesale prices for greenhouse and outdoor flower in the West Coast markets. State data out of Oregon, examined in more detail below, shows that summer crops began to be brought in last month, while anecdotal reports out of California tell of large volumes of product coming out of the Emerald Triangle.

The next three to four months will provide a clearer picture of the scope of sun-grown production this year and whether talk of California and Oregon growers pulling back, going under, or exiting their respective markets was overblown or not. In any case, given the scale of oversupply in those states, balancing of supply and demand would likely be a multi-year process requiring a reduction in overall cultivation capacity to an extent that does not appear to have taken place based on licensing statistics.

While Arizona does not see outdoor and light-deprivation cultivation like that which occurs on the West Coast, its spot price continues to mimic that of California’s, perhaps an indication of the extent of overproduction by both licensed and unlicensed growers next door in the Golden State that is flowing eastward across the U.S., as it has for decades.

Apart from Arizona, states with sizable legal cannabis markets that do not have large summer harvests – including Colorado, Michigan, Massachusetts, and others – are seeing remarkable stability in wholesale flower prices. Based on historical trends, it is likely that this year’s demand peak is behind us and most states will see sales decline for much of the remainder of the year.

At the same time, Colorado, Michigan, and Massachusetts have their autumn outdoor harvests looming, potentially portending even lower prices. Notably, though, while Massachusetts’ spot price sank by 57.8% from the first week of November 2022 to the first week of March this year, wholesale flower prices in Michigan and Colorado did not slump to nearly the same degree. Michigan’s spot declined by 4.8% in the same span, while Colorado’s ticked downward by only 0.6%. Given the dramatic price correction that took place in Massachusetts last year and into Q1 of this year, it is unlikely that the state will see such a sharp downturn in price in the wake of this year’s outdoor crop.

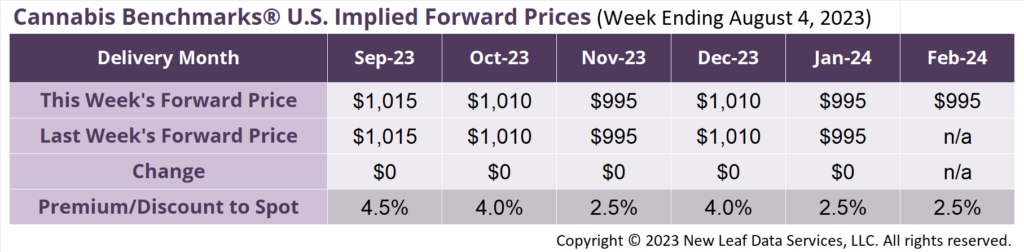

February 2024 Implied Forward initially assessed at $995 per pound.

At $1,015 per pound, the August 2023 Implied Forward represents a premium of 4.5% relative to the current U.S. Spot Price of $971 per pound.

Why an Industry Group Sued to Stop Aspergillus Testing – Interview

State Posts 2nd-Highest Adult Use Sales Figure Ever in July

Sales Slumped in May; Low Wholesale Prices Persist

Wholesale Prices Volatile, but No Longer on Steep Downtrend