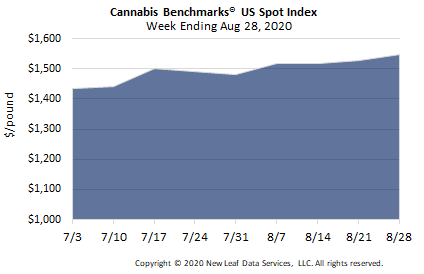

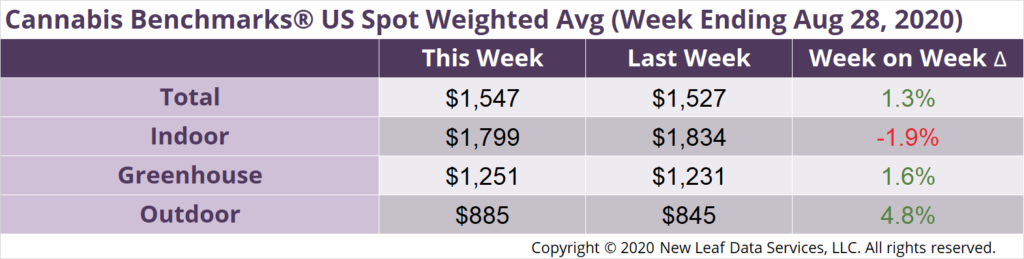

U.S. Cannabis Spot Index up 1.3% to $1,547 per pound.

The simple average (non-volume weighted) price decreased $14 to $1,762 per pound, with 68% of transactions (one standard deviation) in the $958 to $2,566 per pound range. The average reported deal size was nominally unchanged at 2.1 pounds. In grams, the Spot price was $3.41 and the simple average price was $3.88.

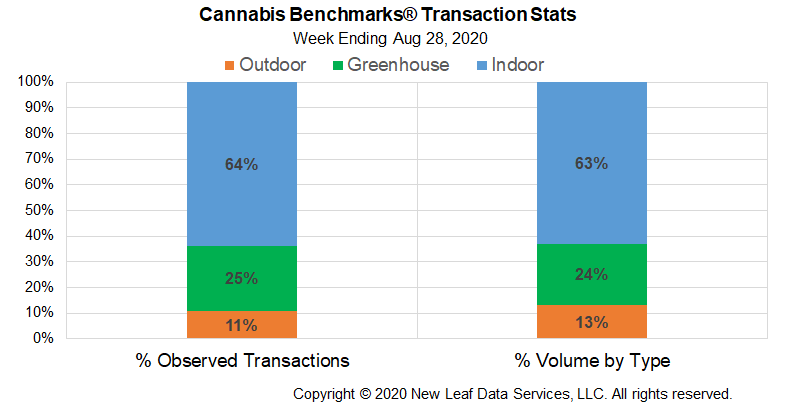

The relative frequency of trades for greenhouse flower decreased by over 4% this week. The relative frequencies of transactions for indoor and outdoor product increased by about 2% each.

The relative volume of warehouse product expanded by over 4%. The relative volumes of greenhouse and outdoor flower contracted by about 3% and 1%, respectively.

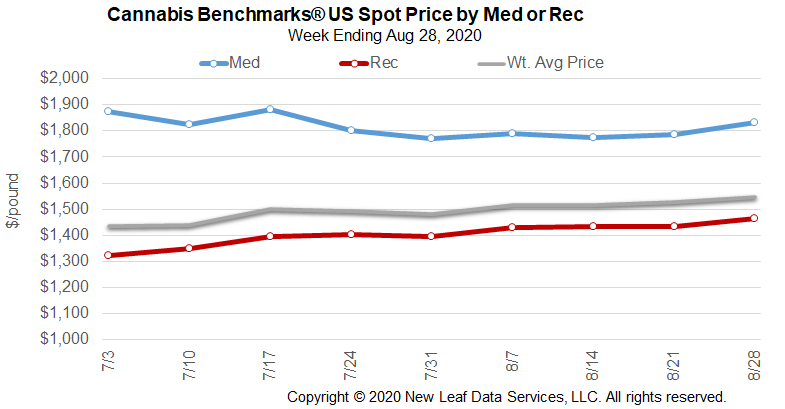

Already elevated relative to pre-COVID observations, the U.S. Spot Index climbed each week this month. This even as wholesale flower prices on the West Coast stabilized somewhat. New tax figures from California’s legal cannabis market indicate that overall demand is up significantly compared to 2019, with adult-use purchasing increasing from Q1 to Q2.

Meanwhile, wholesale prices have continued to trend upward in Colorado, Illinois, and Michigan. The latter two markets are quickly expanding their influence on the U.S. composite price, as their growing sales account for greater proportions of the national total each month. For example, whereas Nevada was earlier this year one of the top markets by revenue, with sales reaching over $60 million monthly, both Michigan and Illinois saw total cannabis revenues top $100 million last month, in line with sales in Oregon. Those figures should also continue to grow as production and the retail footprints of their adult-use sectors develop and expand further.

Looking ahead, higher wholesale flower prices in Michigan and Illinois, where production has largely remained indoors to this point, could help buoy the U.S. Spot in the coming months as the autumn harvest comes in, at least more so than in prior years. Early reports have indicated favorable growing conditions on the West Coast, but severe wildfires in California could complicate harvests, with the potential that product could be made unmarketable by smoke and other contaminants from the blazes.

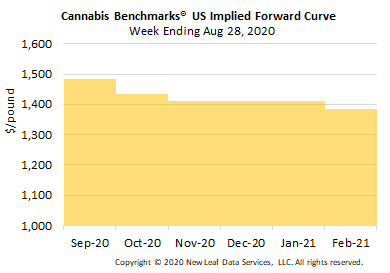

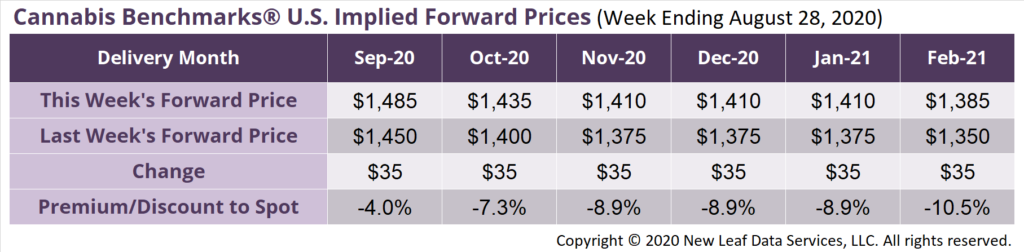

September Forward closes up $35 to $1,485 per pound.

The average reported forward deal size was 29 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 40%, 33%, and 27% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 30 pounds, 25 pounds, and 31 pounds, respectively.

At $1,485 per pound, the September Forward represents a discount of 4.0% relative to the current U.S. Spot Price of $1,547 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

National

August 2020’s Monthly Average U.S. Spot Index Highest Since September 2017 on Unprecedented Sales in Many States

California

New Tax Figures Show Sales Elevated from 2019, Increase in Adult-Use Purchasing in Q2 2020

Proposed Bill Would Prevent Increases to Cannabis Tax Rates for One Year

Colorado

Local Cannabis Measures That Could Result in More Growth Being Considered