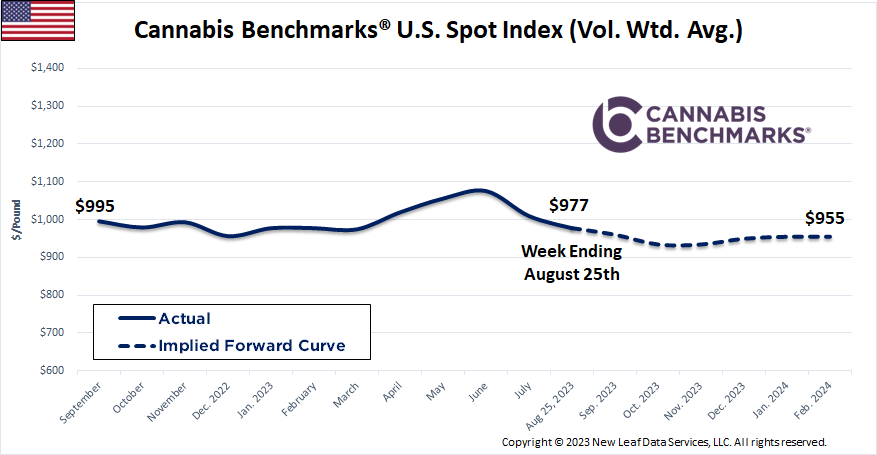

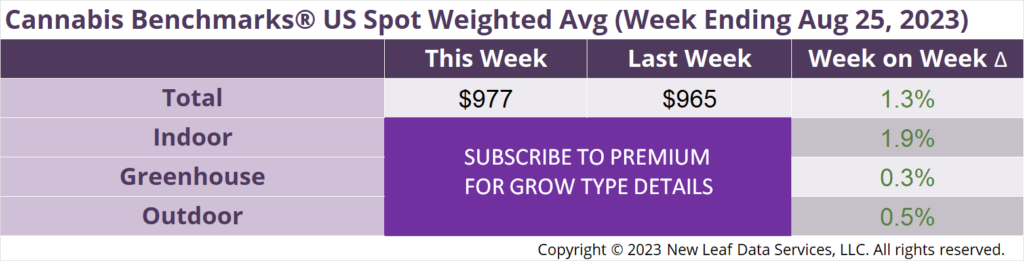

The U.S. Cannabis Spot Index increased 1.3% to $977 per pound.

In grams, the Spot price was $2.15.

The U.S. Spot wholesale flower price ticked up for the second straight week as it works to shake free of a downtrend that gripped it from the beginning of June into early August. The increase in the composite price was due primarily to a rise in the price for indoor flower. Outdoor and greenhouse product prices displayed marginal increases, but were essentially flat week-on-week. Both have been sliding after trending upward for roughly the first half of this year. We’ve noted in recent reports that summer harvests began to be cut down in June and July, with reports and data out of California and Oregon telling of substantial amounts of product making its way to market.

Some of the increase in prices for indoor flower is coming from states off of the East Coast. In New England, every state with an adult use market apart from Vermont is seeing wholesale flower prices ascend in recent weeks, with some states exhibiting longer-term uptrends. Massachusetts is the state with the largest and longest-standing adult use market in the region and it has seen its spot price bounce off a historic bottom of $968 per pound in March to climb back up above the $1,500 threshold this week.

While Massachusetts does allow outdoor cultivation, sun-grown production in the state is not nearly as prolific as on the West Coast and rising prices may be attributable to the depletion of last year’s harvest. Although sales have been fairly steady this year in terms of revenue, depressed wholesale and retail prices in the Bay State indicate that demand is up this year compared to 2022 with larger volumes of product being sold.

Additionally, Massachusetts is unique in having a regulation that specifies a one-year shelf life for flower, after which it must be retested or destroyed. Operators in the state reported that the rule contributed to last year’s price crash, as cultivators looked to move product nearing its expiration date for low prices rather than shouldering the cost of retesting and attempting to sell year-old flower in an oversupplied market. However, the rule also has the effect of eventually taking supply off the market as well.

With Massachusetts prices on the rise, it appears that much of the rest of the region is following. We have in the past discussed regional convergence in cannabis prices, which is especially germane to an area such as New England where interstate travel is relatively easy. When Massachusetts prices dived in 2022 into the early months of this year, operators in other states may have felt the pressure to lower their own prices, lest they lose business to a cross-border neighbor. Now that Massachusetts’ spot is up nearly 60% over the last six months, prices in other states are climbing as well.

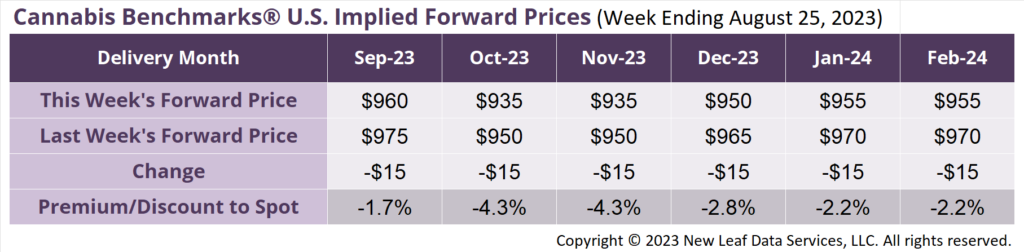

September 2024 Implied Forward assessed down $15 to close at $960 per pound.

At $960 per pound, the September 2023 Implied Forward represents a discount of 1.7% relative to the current U.S. Spot Price of $977 per pound.

Wholesale Prices Show Signs of Slipping as Sales Remain Steady

Stable Demand Continues in July

Q2 Sales Inch Upward as Retail Rollout Remains Sluggish

“Growers Showcases” Provide Retail Outlets as CAURD Licensing Remains Stalled