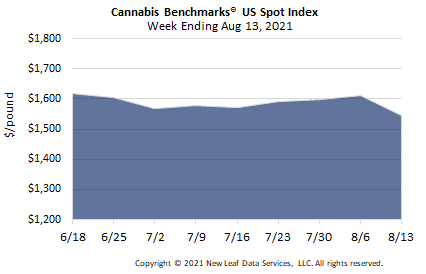

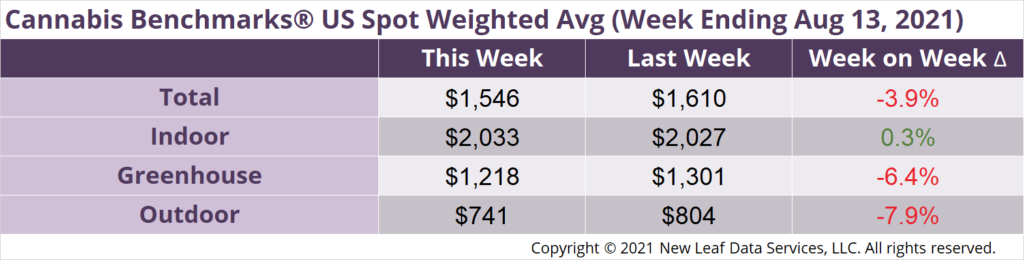

U.S. Cannabis Spot Index decreased 3.9% to $1,546 per pound.

The simple average (non-volume weighted) price decreased $16 to $1,870 per pound, with 68% of transactions (one standard deviation) in the $1,031 to $2,709 per pound range. The average reported deal size was 2.5 pounds. In grams, the Spot price was $3.41 and the simple average price was $4.12.

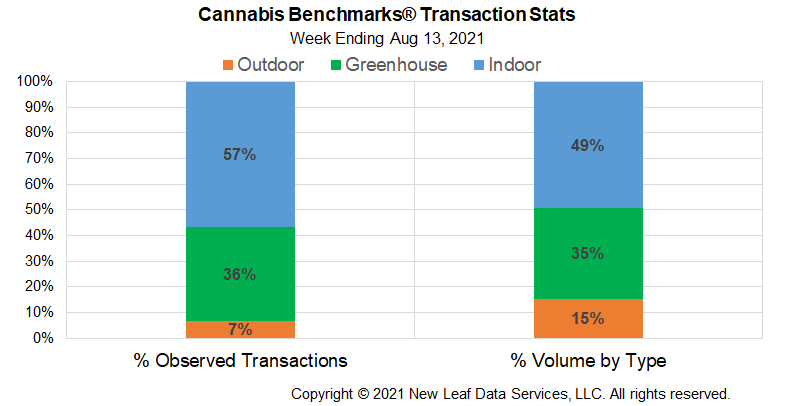

The relative frequencies of trades for each grow type were relatively stable from last week.

The relative volume of indoor flower contracted by 3% this week. The relative volumes of greenhouse and outdoor product expanded by 2% and 1%, respectively.

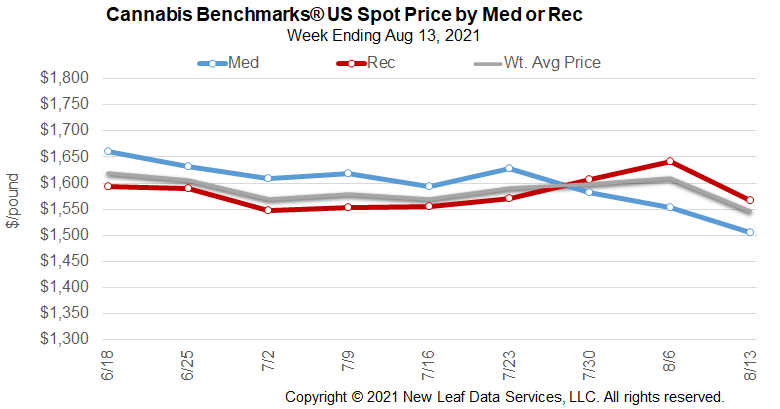

The U.S. Cannabis Spot Index saw a notable drop this week, breaking with the gradual uptrend that had been observed previously. Based on reports from the field and our analysis of state sales data, it appears that there are currently two countervailing pressures on the national wholesale flower price: Surging supply from light-deprivation crops and other expanded production, particularly in California and Oregon, and sales rebounding in July after stagnating across many state markets in Q2.

At the moment, the former is ascendant and is pushing down wholesale prices in the large Western markets, which in turn are pulling down the U.S. Spot. In addition, and perhaps in response to expanded summer light-deprivation crops coming in, growers in Oregon and California may be trying to move last year’s harvests so as not to be stuck with months-old inventory with fresher product entering the market. We have in the past documented that Oregon growers in 2020 harvested 37% more wet weight than in 2019, with much of that increase generated by outdoor cultivators. While Cannabis Benchmarks did see a post-harvest price decline in the state, we did not observe one commensurate with such a large year-over-year supply increase. That product may be coming to market now, with this year’s fall harvest set to begin next month for some growers.

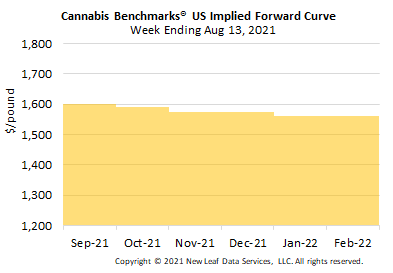

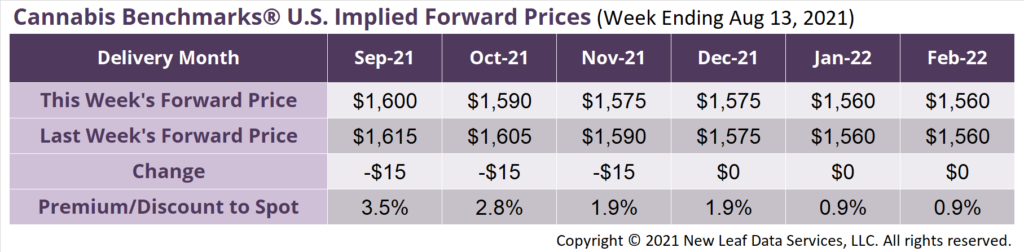

September 2021 Implied Forward assessed down $15 to $1,600 per pound.

The average reported forward deal size increased 6% to 67 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 47%, 40%, and 13% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 85 pounds (up nearly 8% from 79 pounds last week), 52 pounds, and 29 pounds, respectively.

At $1,600 per pound, the September Implied Forward represents a premium of 3.5% relative to the current U.S. Spot Price of $1,546 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Report: Mendocino County Growers Seeing Lower Prices Now & In the Future

Colorado

Colorado Sales Downdraft Slows in June

Oregon

Growers Report Downward Price Pressure, but Market Conditions Vary Regionally

Massachusetts

July Gross Sales Continue Strong Uptrend