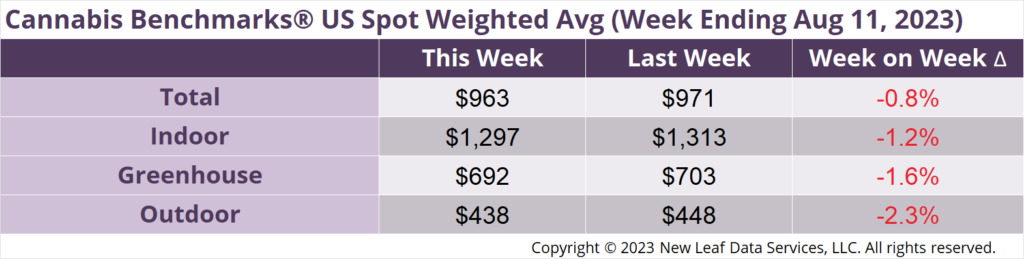

The U.S. Cannabis Spot Index decreased 0.8% to $963 per pound.

In grams, the Spot price was $2.12.

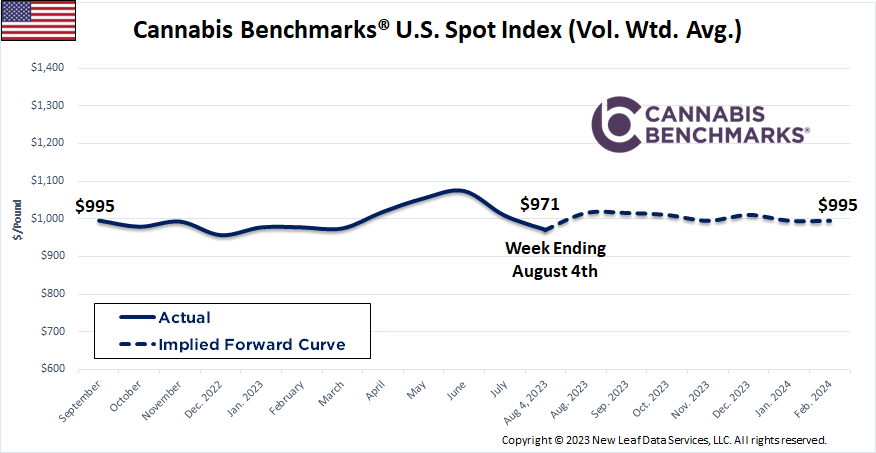

The U.S. Spot Index slipped again this week, falling 0.8% to $963 per pound. The national wholesale flower price has declined each week since the first week of July and is approaching its all-time low of $950 per pound, established in December 2022.

While the recent downturn in the U.S. Spot price was triggered initially in June by declining indoor flower prices, the past few weeks have seen warehouse-grown product prices tick up as rates for the sun-grown product types slide. We noted recently that state data out of Oregon showed that summer harvests began to be cut down in significant volumes in July, signaling the start of light-deprivation harvest season more broadly in the West Coast markets.

Seasonal price changes aren’t always consistent, however, and historical price data shows it can be overridden by other factors. We have discussed the 2020 Covid sales and price spike extensively and the chart shows that record-breaking demand overrode any seasonal pressure on price from summer harvests, driving the national wholesale flower price upward until the autumn crop came in. Expanded demand continued to buoy prices into June in 2021, but thereafter slackening sales and large summer harvests resulted in the U.S. spot sliding in earnest beginning in August that year.

In 2022, the national wholesale price didn’t even make it to summer before beginning to deteriorate, which it did starting in April and continuing through the end of the year. Steadying sales and production pullbacks stabilized the U.S. spot late last year and through the first quarter of this year, with a bit of a recovery even occurring from the end of Q1 through the bulk of Q2, before price turned downward again in mid-June.

Apart from the anomalous behavior of 2020, trends from prior years indicate that 2023 is now seeing the seasonal price downturn that marked both 2021 and 2022, although it has commenced at various points between April and August in each of the past three years. Even with reports of scaled back production and testing challenges suppressing supply in states with outdoor cultivation, without any major foreseeable event-driven demand on the horizon it is likely that this year’s greenhouse and outdoor harvests will continue to push down price over the next several months, and likely into 2024.

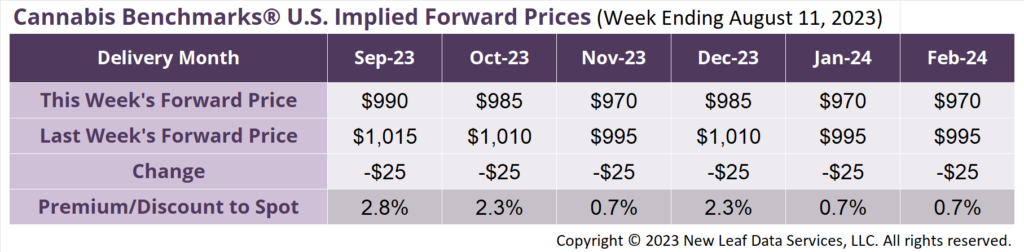

September 2024 Implied Forward assessed down $25 to $990 per pound.

At $990 per pound, the September 2023 Implied Forward represents a premium of 2.8% relative to the current U.S. Spot Price of $963 per pound.

Wholesale Flower Prices Stabilizing; Retail Price Sees Rare Uptick in July

From Street Deals to Real Estate Challenges – Interview with Recent CAURD License Winner

Adult Use Sales Set New Record in July

Overall Demand Climbs in July