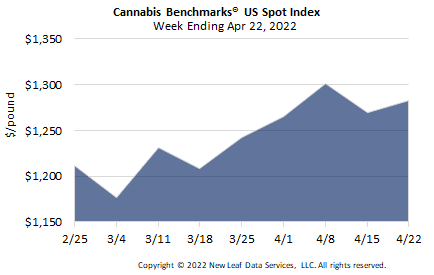

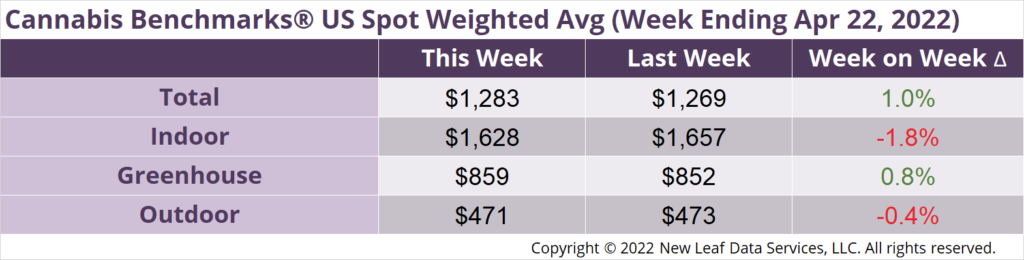

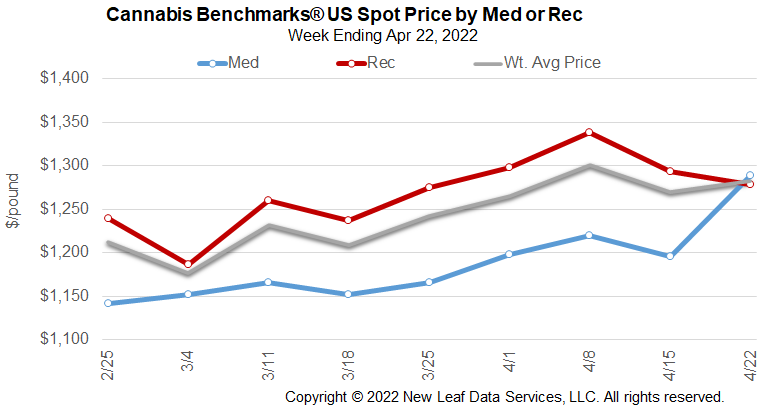

The U.S. Cannabis Spot Index increased 1% to $1,283 per pound.

The simple average (non-volume weighted) price decreased $4 to $1,506 per pound, with 68% of transactions (one standard deviation) in the $665 to $2,346 per pound range. The average reported deal size declined to 2.2 pounds. In grams, the Spot price was $2.83 and the simple average price was $3.32.

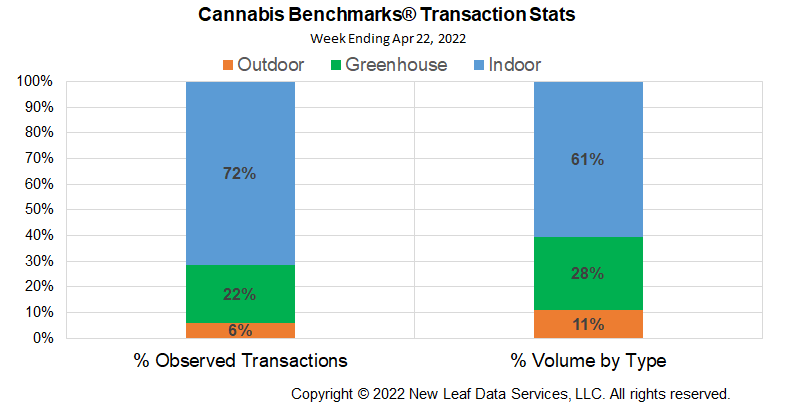

The relative frequency of transactions for indoor flower increased by 2%. The relative frequency of trades for greenhouse flower decreased by 2%, while that for deals for outdoor product was unchanged.

The relative volume of indoor flower increased by 3%, while that of greenhouse flower decreased by 2%. Outdoor flower’s relative volume declined 1%.

The U.S. Spot Index continued its bumpy April, a month that has seen the national average price alternately rise and fall each week thus far. While previous rises have been due largely to expanded observations of trading in higher-priced markets, this week saw the country’s two largest legal cannabis systems – California and Colorado – both experience increases in their overall composite prices. Massachusetts’ Spot price also bucked its recent downtrend to rise this week, which saw the industry and consumers celebrate the 4/20 “holiday.”

The big sales day was not enough to push prices upward in numerous markets, however, with spot prices in Oregon, Washington, and Michigan, among others, maintaining their dramatic and ongoing declines this week. Still, the downtrends in Illinois, Michigan, and Arizona have leveled off in recent weeks, though not before the latter two markets saw their composite prices fall below the U.S. Spot.

Also this week, the industry celebrated the commencement of adult use sales in New Jersey, where Reuters reports that 13 medical dispensaries were given approval to open their doors to general consumers on Thursday, April 21. The stores that have so far been permitted to sell to the adult use market are all operated by existing, vertically integrated businesses that previously served the state’s medical cannabis system and that have been building up expanded production capacity in the wake of adult use legalization. Consequently, there is likely little, if any, wholesale activity taking place in New Jersey at this time, with the approved stores likely receiving their supply almost exclusively from associated cultivation and product manufacturing operations. This situation will change once new businesses are licensed and operating, though when exactly that might occur is not entirely certain at this point.

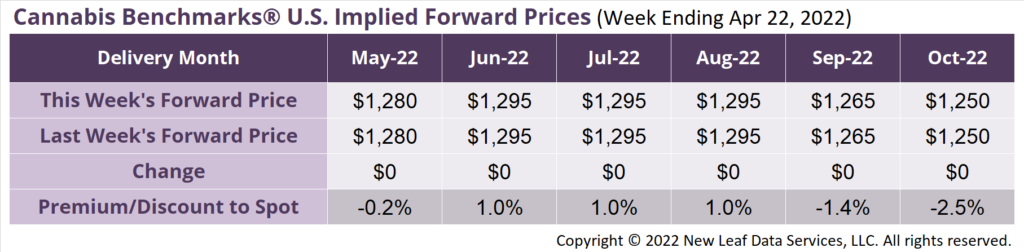

May 2022 Implied Forward unchanged at $1,280 per pound.

The average reported forward deal size declined to 77 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 40%, 46%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 82 pounds, 77 pounds, and 60 pounds, respectively.

At $1,280 per pound, the May 2022 Implied Forward represents a discount of 0.2% relative to the current U.S. Spot Price of $1,283 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Michigan

March Sales Decline from February as Downtrend in Wholesale Price Continues

State’s Top Regulator Sees Strong Demand, Stability in Market Despite Price Drop – Interview

Arizona

February Sales Tick Down for Second Straight Month as Adult Use Sector Increases Market Share

New Jersey

Adult Use Sales Opened this Week, But Vertically Integrated Operators Mean Little Wholesale Activity Until New Businesses Enter