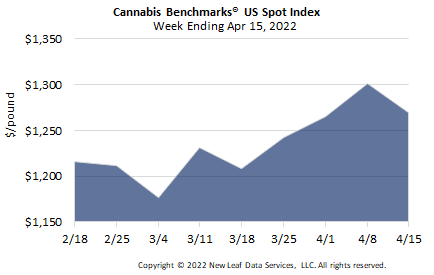

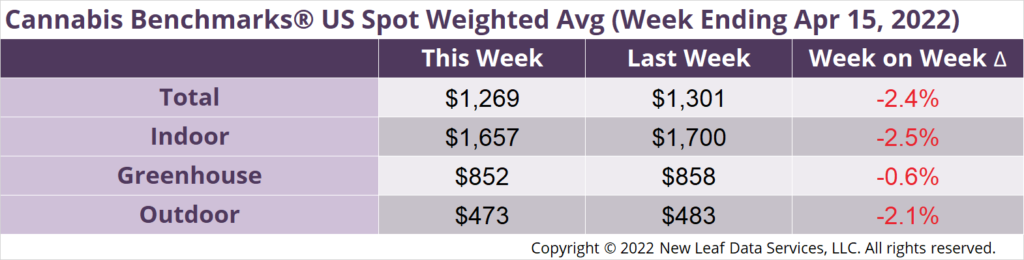

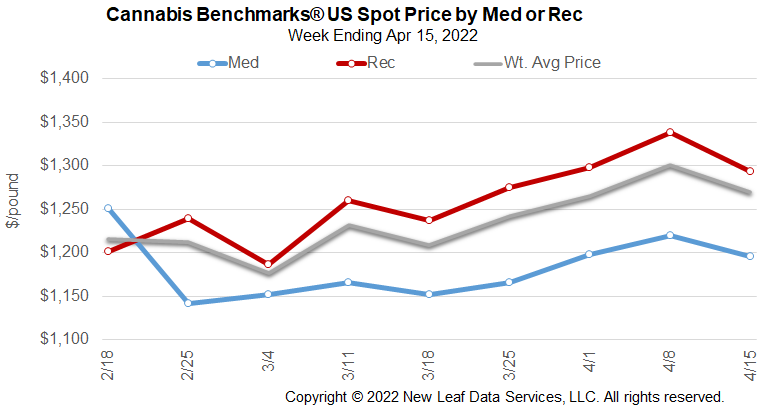

The U.S. Cannabis Spot Index decreased 2.4% to $1,269 per pound.

The simple average (non-volume weighted) price decreased $25 to $1,510 per pound, with 68% of transactions (one standard deviation) in the $684 to $2,336 per pound range. The average reported deal size was nominally unchanged at 2.3 pounds. In grams, the Spot price was $2.80 and the simple average price was $3.33.

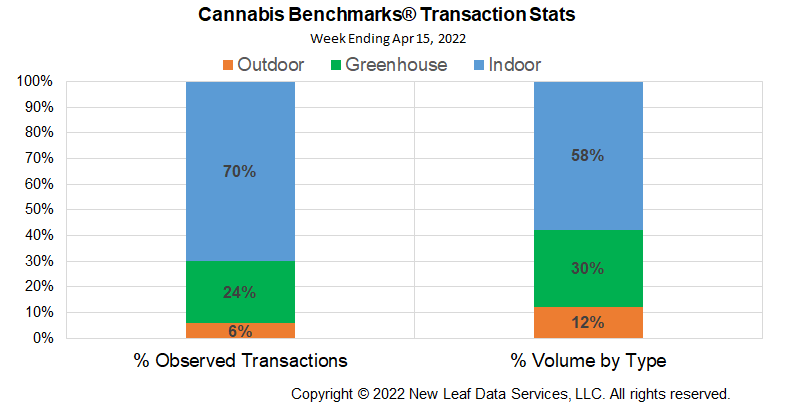

The relative frequencies of transactions for each grow type were unchanged this week.

The relative volume of indoor flower was unchanged, while that of greenhouse flower rose 1%. Outdoor flower’s relative volume fell 1%.

Legacy state spot prices are mostly lower this week with Colorado off nearly $16 per pound, with a 10-week average weekly loss of just $2.46 per pound. California shed just over $39 per pound basis spot with an average weekly loss of nearly $11 per pound, up sharply from last week’s average weekly loss of $5.01 per pound. Oregon Spot slipped another $38 per pound with a 10-week average weekly loss of $9.35 per pound. Washington State jumped $9.00 per pound with an average weekly gain of just under $1.

High population states newer to the market have been undergoing a price transformation as new growers enter and competition heats up. Massachusetts spot prices have undergone a shellacking this year, losing over 32%. That said, Massachusetts Spot losses this week were just over $4 per pound; the 10-week average weekly loss has narrowed to -$65.54 per pound versus $95.46 per pound last week.

Despite Illinois massive location advantage and highly concentrated production landscape, spot prices there are down over 23% this year. However, this week Spot gained better than $26 per pound, the second uptick in price in the past 10 weeks. The 10-week average weekly loss is just -$16.93 per pound versus -$27.41 per pound last week.

Michigan managed to eke out gains this week, rising just under $7 per pound. The 10-week average of weekly losses narrowed from -$71.86 to -$58.62 per pound this week.

Outdoor-grown flower in legacy states – Washington, Oregon, California, and Colorado – averaged $474 per pound this week. Price convergence among these states points to a recently emerging trend in cannabis prices that is worth paying attention to; it suggests, again, the propensity of prices of like commodities to converge at some point and, for outdoor flower in legacy markets, that point is now. Using the law of one price, with a nod to fundamental differences, we might expect rapid convergence of prices on the East Coast among the most prevalent grow types to occur rather quickly once markets in northeastern states are fully functioning. Growers know to make hay while the sun shines, which is good advice to legal states without significant competition.

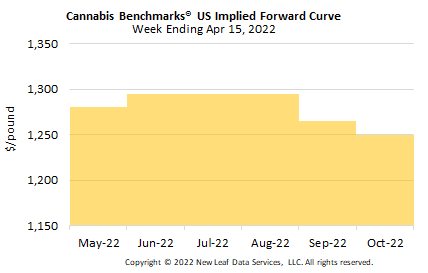

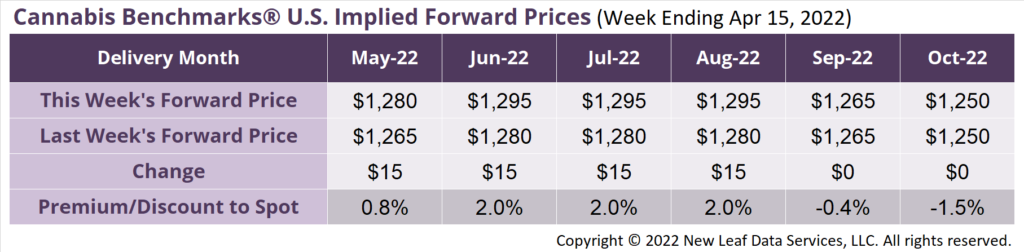

May 2022 Implied Forward assessed up $15 to $1,280 per pound.

The average reported forward deal size declined to 76 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 39%, 48%, and 13% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 80 pounds, 77 pounds, and 62 pounds, respectively.

At $1,280 per pound, the May 2022 Implied Forward represents a premium of 0.8% relative to the current U.S. Spot Price of $1,269 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

February Sales Slip Again

Massachusetts

March Cannabis Sales Rebound, up 9.4%

Cannabis Control Commission Chairman – Interview

New Mexico

First Week Adult Use Sales Exceed Expectations

Oklahoma

February Cannabis Sales Rebound