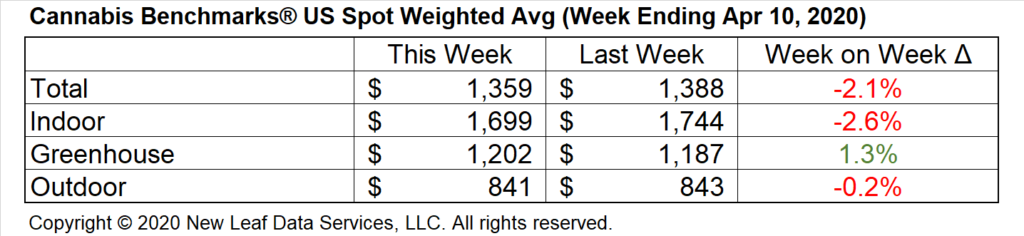

U.S. Cannabis Spot Index down 2.1% to $1,359 per pound.

The simple average (non-volume weighted) price decreased $32 to $1,556 per pound, with 68% of transactions (one standard deviation) in the $820 to $2,293 per pound range. The average reported deal size decreased to 2.1 pounds. In grams, the Spot price was $3.00 and the simple average price was $3.43.

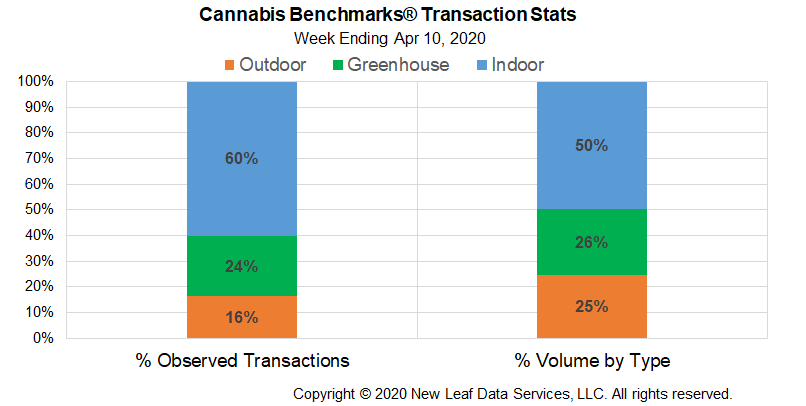

The relative frequency of trades for outdoor flower increased by almost 2% this week. The relative frequency of deals for greenhouse product decreased by the same proportion, while that for transactions for indoor flower was unchanged.

Outdoor flower’s share of the total reported weight moved expanded by almost 2% this week. The relative volume of greenhouse product contracted by the same proportion, while that for warehouse flower was unchanged.

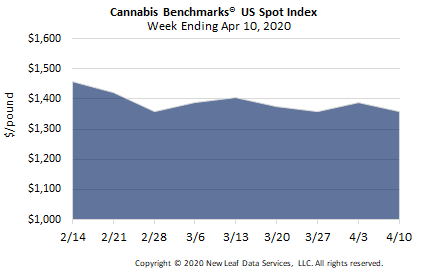

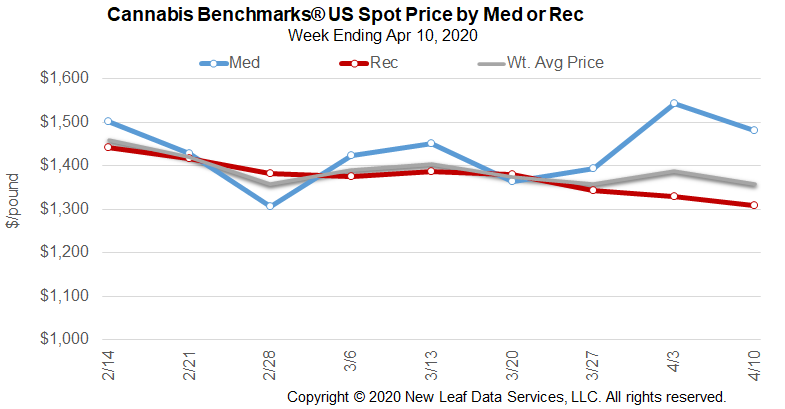

The U.S. Spot Index declined by 2.1% this week to settle at $1,359 per pound. In the weeks since the COVID-19 pandemic has gripped the U.S. in earnest, the national composite price for cannabis flower in legal markets has been relatively stable. From the week ending March 20 through this week, the U.S. Spot has ranged between a low of $1,357 and a high of $1,388 per pound, while averaging $1,370 per pound during the four-week period.

That price is down compared to the average national composite price of $1,415 per pound observed from the opening of this year through the week ending March 13. However, the U.S. Spot was already trending downward prior to the drastic measures taken by federal, state, and local officials in response to COVID-19, after peaking at $1,459 per pound in the week ending February 14. Based on input from market participants and our own analysis, we expect the negative trend to be exacerbated by the pandemic and have in prior weeks adjusted Forward prices downward.

On the state level, the chart above shows that only Washington has seen wholesale flower prices climb since late March. The other three of the Big Four markets – California, Colorado, and Oregon – have seen rates slide downward gradually, continuing previously existing trends. While reports indicate that sales are suffering in numerous markets, it is likely that Nevada will be disproportionately affected, as a significant portion of the state’s sales are to tourists visiting Las Vegas, a consumer base that is now completely absent.

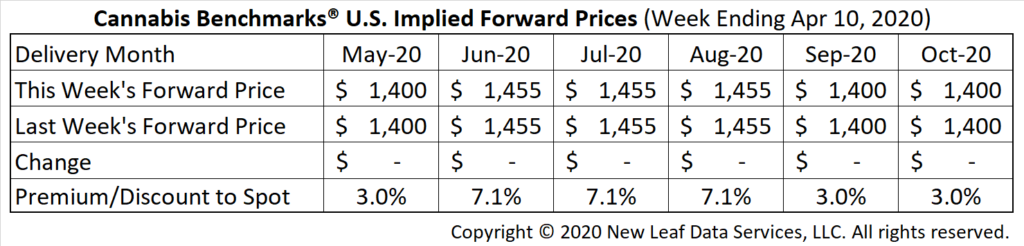

May Forward unchanged at $1,400 per pound.

The average reported forward deal size was 37 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 46%, 37%, and 17% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 43 pounds, 29 pounds, and 37 pounds, respectively.

At $1,400 per pound, the May Forward represents a premium of 3% relative to the current U.S. Spot Price of $1,359 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

Oklahoma

Cannabis Benchmarks Debuts State Spot Index, which Settled at $2,084 Per Pound this Week

Oregon

March Sales Set New Record at Almost $85 Million as COVID-19 Pandemic Gripped State

Michigan

State Officials Abruptly Disallow Caregiver Product to Enter Adult-Use Market

Massachusetts

Adult-Use Sales in March Reached Over $50 Million Despite Ceasing for Final Week of the Month as Part of Governor’s COVID-19 Stay-at-Home Order

Illinois

March Adult-Use Sales Up from February, But Average Daily Sales Figures Show Month-Over-Month Declines