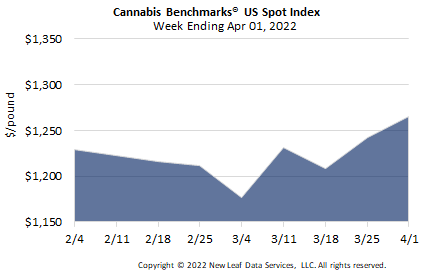

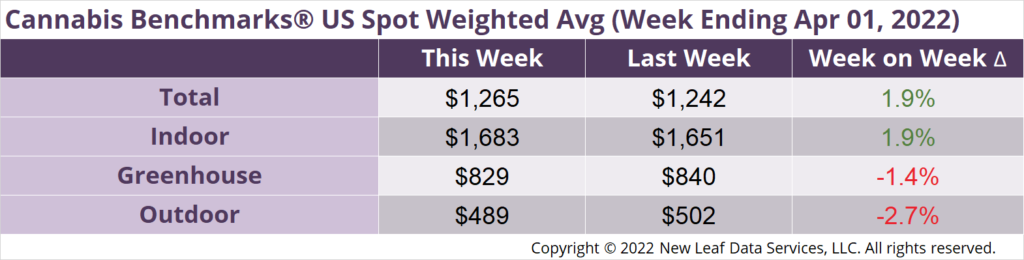

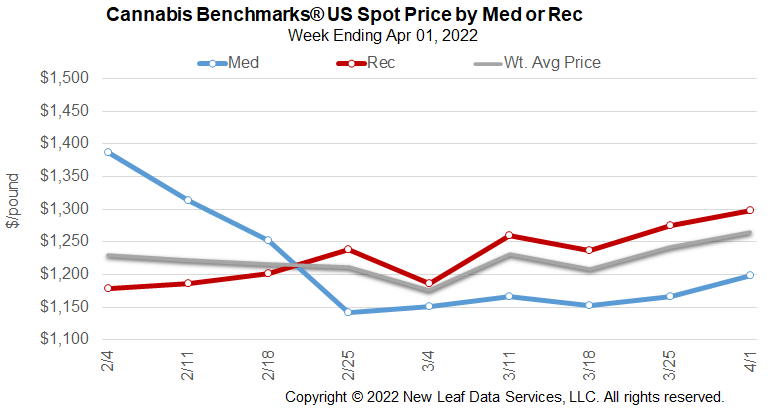

The U.S. Cannabis Spot Index increased 1.9% to $1,265 per pound.

The simple average (non-volume weighted) price increased $11 to $1,534 per pound, with 68% of transactions (one standard deviation) in the $679 to $2,390 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $2.79 and the simple average price was $3.38.

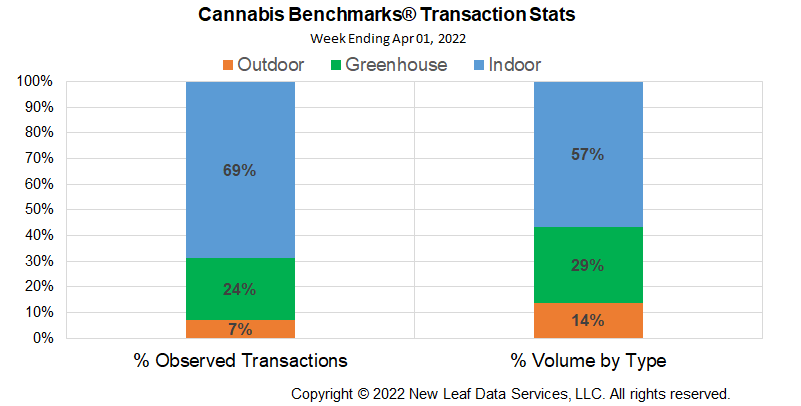

The relative frequency of transactions for indoor flower rose 1%, while greenhouse deal frequency fell 2% and outdoor deal frequency was unchanged.

The relative volume of indoor flower rose 1%; that of greenhouse flower fell 2%, while that of outdoor flower rose 1%.

Legacy state spot prices were mostly lower this week, with Washington State losing nearly $22 per pound on narrowing 10-week average weekly losses of $4.76. The Colorado Spot is likewise has a weekly losses of $4.58, but has been fairly flat for three consecutive weeks. California Spot is on 10-week average weekly loss of $8.62 per pound. Oregon Spot price is on 10-week average weekly losses of $15.43 per pound.

High population states newer to the market have also generally seen falling prices this year. Michigan Spot has tanked over in 2022. Ten-week average weekly losses are running near $60 per pound. Massachusetts Spot is taking a shellacking this year as well, losing nearly 31%. And the Illinois Spot price is off 8% this year.

Illinois and Massachusetts, while suffering significant price deterioration this year, have some fundamental factors working for price in that both states are relatively isolated from price competition, sharing only narrow borders with Michigan and Maine, respectively. Likewise, both states are surrounded by either states with no active adult use retail markets and no medical markets large enough to supply their own state needs, let alone neighboring states. Michigan’s uncapped licensing scheme continues to pressure prices in the state, as does outdoor-grown supply.

In the outdoor spot market, Oregon and California prices have fully converged for the second time in less than a year. The oversupply issues in both states are looming heavily as real world arbitrage across porous borders and illicit supply weigh on legal prices.

As noted previously, price convergence among legacy states continues with the product type boasting the largest production volumes, outdoor flower, leading the way. The spread between legacy state outdoor-grown flower remains around $30 with the expectation that full convergence between California and Oregon outdoor grown will become the norm this year. As well, price convergence of greenhouse and indoor grown is expected to follow suit with legacy states leading the way.

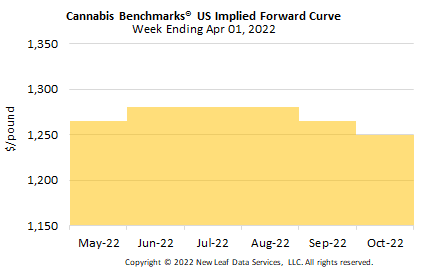

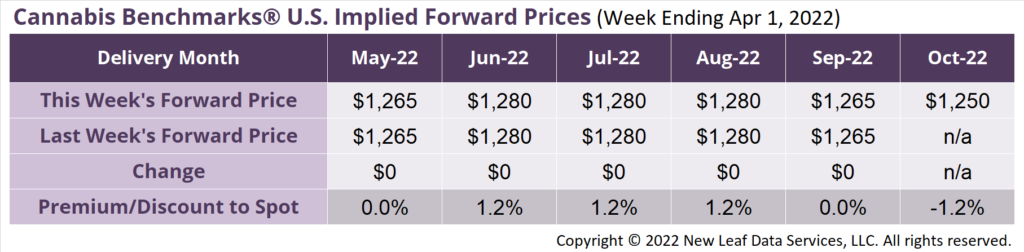

October 2022 Implied Forward initially assessed at $1,250 per pound.

The average reported forward deal size declined fractionally to 78.5 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 37%, 50%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 85 pounds, 79 pounds, and 60 pounds, respectively.

At $1,265 per pound, the May 2022 Implied Forward represents neither a premium nor a discount relative to the current U.S. Spot Price of $1,265 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

New Jersey

CRC Draws Fire From State Senate over AU Delays

New York

Cannabis Tax Debate

Oklahoma

31 Cannabis Bills Under Consideration

National

Schumer Cannabis Bill Will be Filed in April