![]()

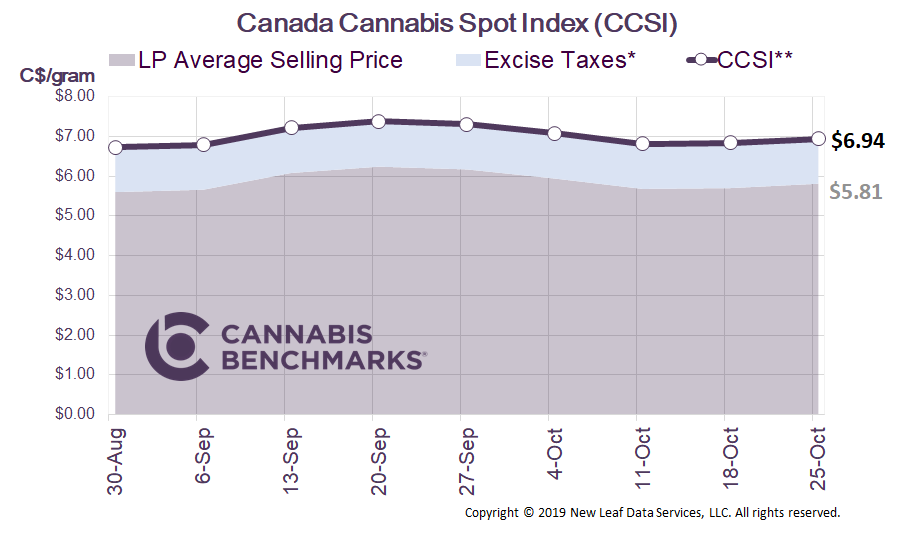

Canada Cannabis Spot Index (CCSI)

Published October 25, 2019

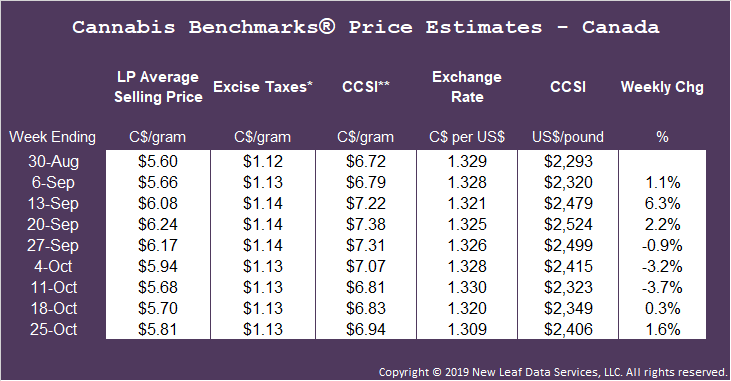

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.94 per gram this week, up 1.6% from last week’s C$6.83 per gram. This week’s price equates to US$2,406 per pound at the current exchange rate.

This week we review new provincial sales data released by the Canadian government and estimate the sales impact of the class of cannabis products that will hit store shelves by the end of the year.

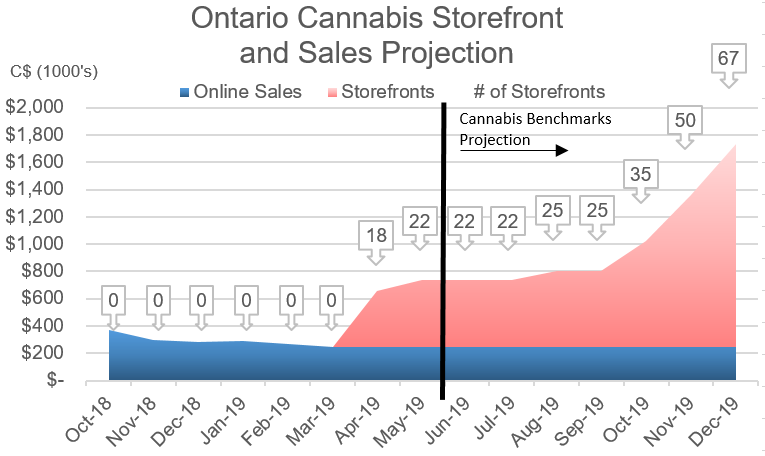

To start, we acknowledge August retail cannabis sales, which jumped significantly and corresponded with the forecast we formulated in our report for October 4. We projected C$127M in sales in August, with the actual total coming in at C$126M. In that report, we estimated that sales for October would increase to C$144M.

Nationwide sales rose by C$23M from July to August, with British Columbia (BC) seeing the most growth of any province. Even with sales in BC rising by 216% month-on-month to C$11.9M in August, the overall level of sales has been disappointing for a province known for its “BC Bud.” Two main factors continue to plague this market: the robust, entrenched illicit market and the lack of legal retail store fronts. We estimate the total number of brick and mortar stores open currently in BC at 95.

With sales significantly lower than most expected for the first full year of cannabis legalization, the question many are asking is how sales will look next year with the introduction of new types of cannabis products. Provincial sales levels to this point have been highly correlated with the total number of stores opened, but going forward we expect there to be a large uptick in total monthly sales per store as vapes, edibles, topical creams, and beverages become fully available.

After surveying market participants and deliberating internally, Cannabis Benchmarks® has developed a summary of the factors that will structurally influence sales after cannabis 2.0 products become available:

-

Consumer spending will shift from dry flower to more premium priced alternative products, resulting in higher sales.

-

The cannabis consumer base will expand. New products with the capability to more accurately control dosage will attract potential consumers opposed or unable to smoke as an ingestion method.

-

A wider variety of products and their attendant consumption methods has the potential to attract casual novelty buyers on top of regular consumers, further expanding the country’s cannabis consumer base.

-

Consumers that to this point have persisted in purchasing from the illicit market could be drawn into licensed retailers by the prospect of new products unavailable from illegal sellers. Such migration could also result in those consumers buying flower from licensed sources, as they will already be at the (legal) point of purchase.

In sum, we expect the consumer base will expand and the average purchase will increase, resulting in increased retail sales per store.

The introduction of these new products will surely be a positive for the industry. Our current estimates show average daily sales per store to be around C$25,000. With the addition of new product types, we expect that to increase by an average of 30% throughout 2020 to approximately C$32,000 in daily sales per store. Sales projections would have been even higher, but we anticipate a drop in dry flower prices as licensed producers such as HEXO lower their rates to compete with the illegal market.

As mentioned above, our current retail sales forecast for the 561 stores in Canada is C$144M for October, which is C$1.72B annualized. With the addition of these new products, the same 561 stores at 30% more sales should generate C$187M monthly, or C$2.25B annualized. We expect the number of sales to substantially increase throughout 2020 in provinces such as Ontario, Quebec, and British Columbia, and with that we anticipate overall Canadian retail sales to follow.

Don’t forget to sign up to become a BETA client of our fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..