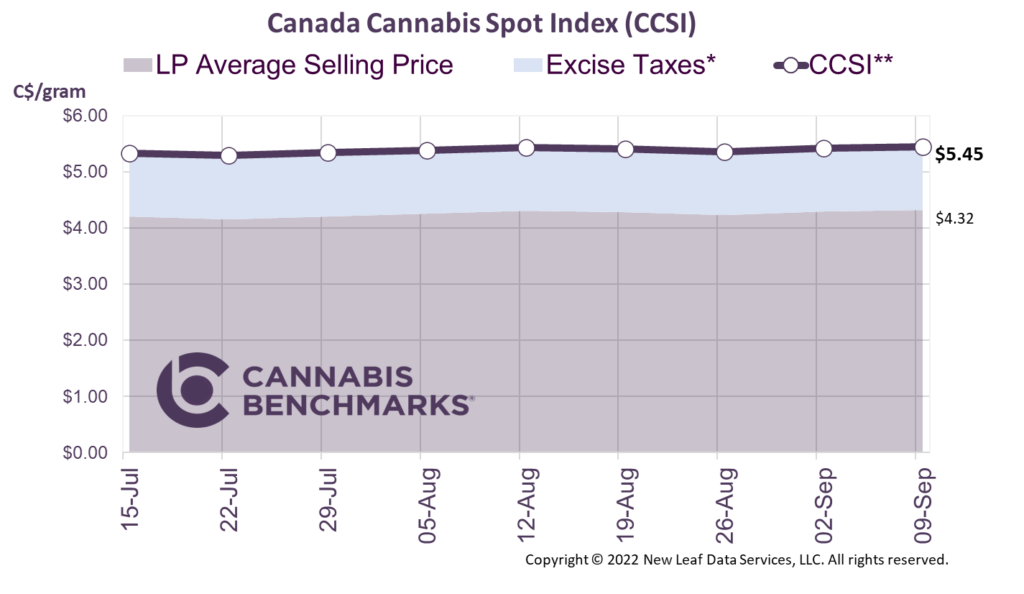

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes.

The CCSI was assessed at C$5.45 per gram this week, up 0.4% from last week’s C$5.43 per gram. This week’s price equates to US$1,883 per pound at the current exchange rate.

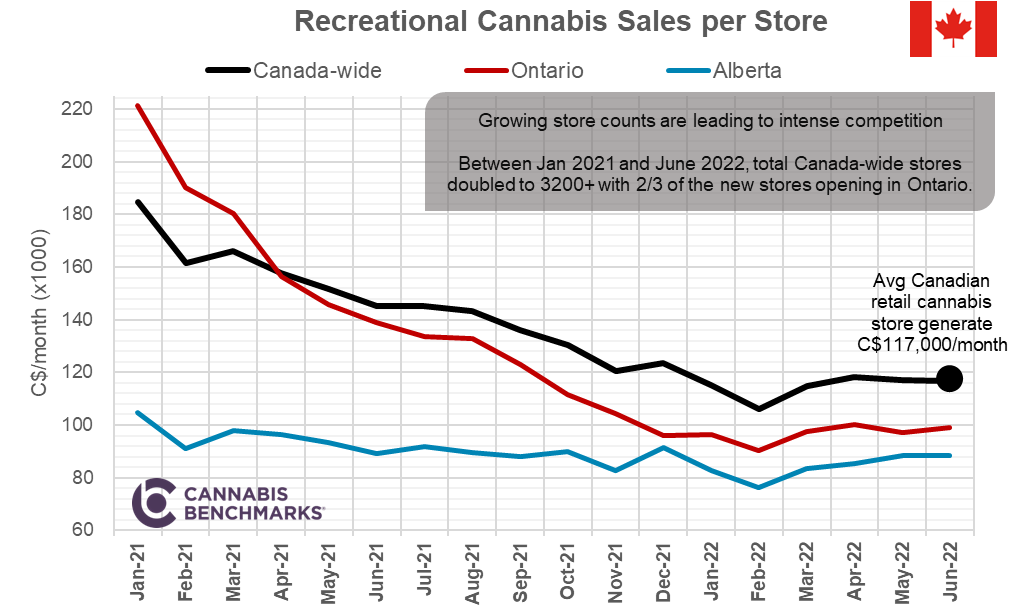

- Statistics Canada recently released June retail cannabis sales for the country. Sales increased from May by C$3.9M to C$377.5M. To correct for the different number of days per month, we look at the data in terms of average daily sales. The latest data shows average daily sales jumped to C$12.5M in June, an increase of 4.4% from May and a new record. The growth in sales comes with the increasing store counts and more flexible online / delivery options. The better accessibility continues to pressure the illicit market’s share of total cannabis sales in the country.

- The continued increase in legal cannabis store counts is putting immense pressure on the retail sector as overall sales per store slide (as seen in the chart above). At the national level, average store sales have dropped by 37% from C$185,000 / month to C$117,000 / month in the 18 month time period from January 2021 to June 2022. During the same timeframe, Ontario saw a drop of 55% in average sales per store, with retailers opening in the province at a rapid rate. Meanwhile, Alberta saw a drop of only 16%, as an already large retail footprint was established earlier on, shortly after the legal market opened in late 2018.

- Another figure to highlight is the number of people each store potentially serves. In January 2021, the average store potentially served over 25,000 people. Today that figure has dropped to one licensed store for fewer than 12,000 Canadians. [Note: These figures do not correct for age.]

- If sales continue at the daily run rate for June, we should exceed C$4.41B in sales for 2022. (That calculation assumes a daily sales average of C$12.5M between June and December.) This should paint the low-end of expected sales this year, as the June figures precede the peak summer season, which generally sees higher seasonal sales, along with the end-of-year holiday period.