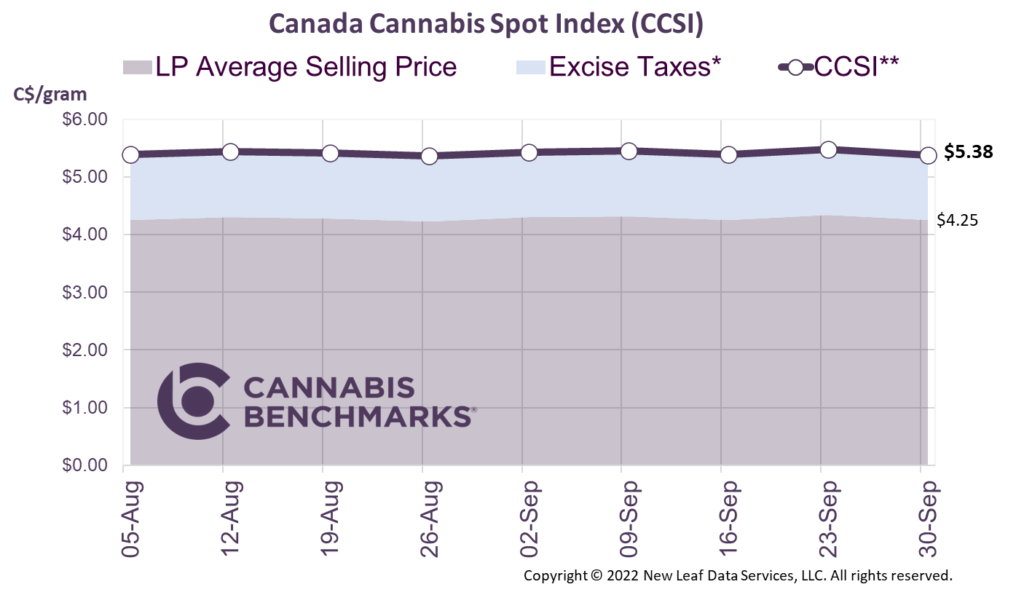

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes.

The CCSI was assessed at C$5.38 per gram this week, down 0.8% from last week’s C$5.42 per gram. This week’s price equates to US$1,781 per pound at the current exchange rate.

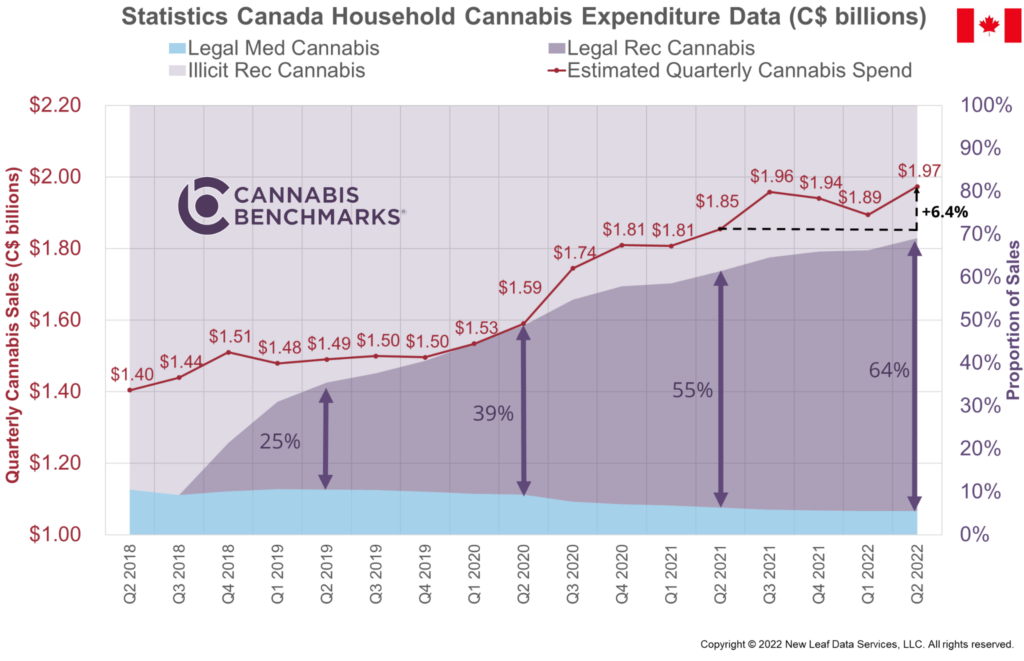

- This week Cannabis Benchmarks analyzed Statistics Canada’s data on household spending to determine the trends in the country’s cannabis market. The data is released every quarter and the most recent dataset provides an overview of consumer spending patterns through Q2 2022. The data set continues to demonstrate strong growth in overall cannabis sales in both legal and illegal markets. Canadians spent C$1.97B on cannabis products in Q2 2022. This is an increase of C$119M, or 6%, from the previous year.

- Taking a deeper look at the statistics, we can see that legal recreational cannabis sales account for all of the growth. Legal recreational sales increased by 23% between Q1 2022 and Q2 2022, while illicit recreational sales decreased by 15% and sales for medical use decreased by 7% over the same time frame. Better accessibility, cheaper prices, and higher quality are driving growth in the legal recreational market, with that growth coming at the expense of both the legal medical and illicit sectors. In Q2 2022, more than two-thirds of all cannabis sales (recreational + medicinal) were legal. As more shop licenses are issued by provincial governments like British Columbia and Ontario, we believe that this trend will continue.

- Since the adult use cannabis market opened in October 2018, the medical cannabis market has been contracting steadily. Though the medical cannabis market was relatively small before the opening of the adult use market, sales have shrunk by 30% to C$109M in Q2 2022. For the most recently reported quarter, medical sales made up just 6% of all sales. As noted above, more varied and price competitive product offerings in the recreational market has clearly had an impact on the medical sector, to the detriment of large cultivators that invested extensive capital and resources in developing their medical cannabis business.

- Cannabis Benchmarks estimates that the total Canadian cannabis market in 2023 will exceed C$8.3B, inclusive of the legal adult use and medical sectors, as well as the illicit market. Of this amount, the pie for legal supply continues to grow with 69% of sales expected to be generated by the legal recreational market next year.