![]()

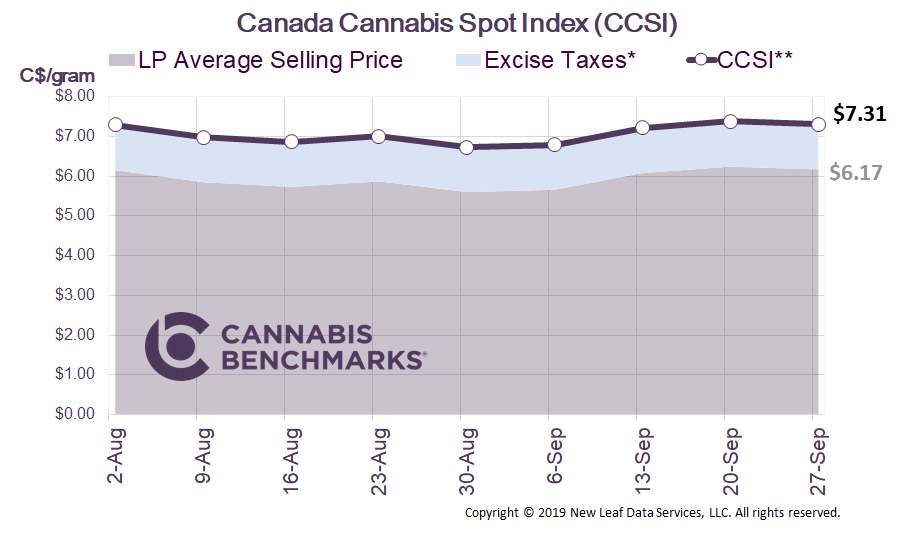

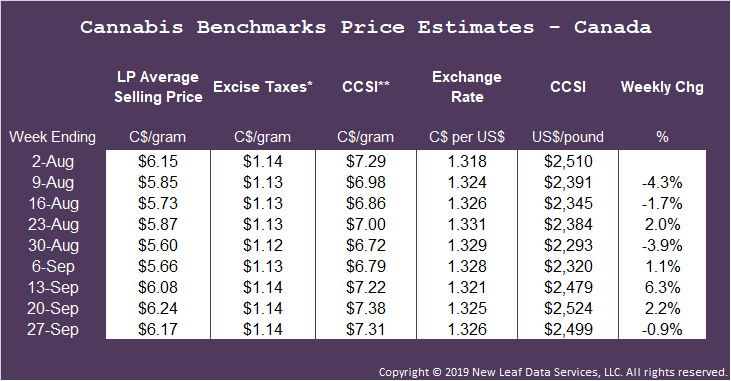

Canada Cannabis Spot Index (CCSI)

Published September 27, 2019

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$7.31 per gram this week, down 0.9% from last week’s C$7.38 per gram. This week’s price equates to US$2,499 per pound at the current exchange rate.

This week we examine the Canadian cannabis market’s supply and demand balance, or lack thereof. Typically, commodity traders analyze the fundamental health of a market to gauge price direction from current levels. This usually involves computing supply, demand, and product inventory levels to measure whether a market is tight (more demand than supply) or loose (more supply than demand).

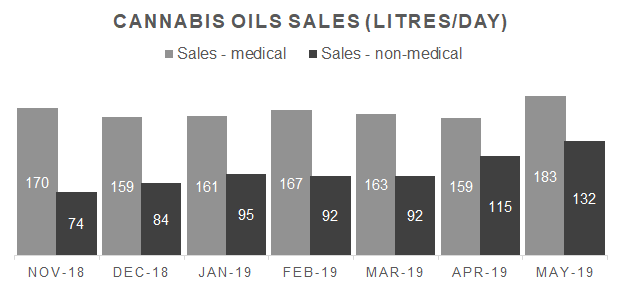

Product inventory is the most important number to monitor. In the case of the Canadian cannabis markets, Health Canada publishes the end-of-month finished and unfinished inventory of both dry cannabis and cannabis oils logged in its Cannabis Tracking System. This number has been growing rapidly, with the most recent report showing end-of-June inventory levels sitting near 329,899 kg. The magnitude of this number is alarming, but what is even more alarming is the path to get there.

Source: Cannabis Benchmarks, Statistics Canada, Provincial cannabis websites

Using the data provided by Health Canada, Cannabis Benchmarks has calculated the massive imbalance between monthly supply coming from the over 200 licensed cannabis producers (LPs) and steady monthly Canadian consumption. For June, the last month reported by Health Canada, we estimate total supply of cannabis to be 62,671 kg, while consumption from the medical and recreational markets is only 11,178 kg. Simply put, supply levels in June were over five-and-a-half times greater than demand, with the excess product pushed to federally or provincially regulated facilities and sitting onsite at the locations of distributors and retailers.

In the near term, this is bad news for LPs as excessive inventory usually leads to declining prices, which could force LPs to write off the value of old, unsaleable inventory and also write down the value of the remaining inventory and biological assets on their balance sheets (which for Canopy Growth, for example, were carried at a value of $500 million as of June 30, 2019).

Longer term, however, lower prices could be a trigger that swings customers from the still robust illicit market to the legal one. Expanding the legal market will increase demand for licensed products, helping to rebalance it by narrowing the spread between supply and demand.

As part of our analysis this week, we projected supply, demand, and inventory from July through September. Inventory projections for Q3 can be seen in the chart below. After June, we grew production by 5% each month, increased non-medical consumption by 10% each month, and dropped medical consumption by 10% each month. The result was a continuous build up in product inventory to a staggering 499,200 kg. Based on our estimated September demand of 13,601 kg, this works out to almost 37 months or just over three years of demand.

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes.