Canada Cannabis Spot Index (CCSI)

Published September 4, 2020

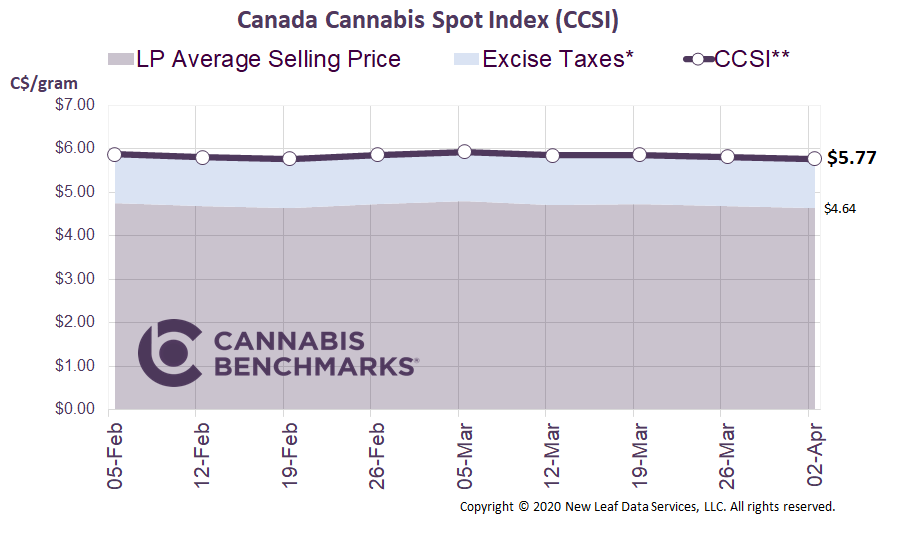

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.15 per gram this week, down 2.1% from last week’s C$6.28 per gram. This week’s price equates to US$2,133 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we outline recent data from Health Canada on the growing Canadian industrial hemp industry. Recently released 2019 statistics detail the number of active industrial hemp licenses for cultivation, registered hectarage, and the type of hemp cultivated in each province.

The Industrial Hemp Regulation (IHR) Program permits farmers to grow low-THC cannabis for industrial use. Industrial hemp has been proven to be a fibrous, fast growing, and high yield crop that has also shown good potential for crop rotation. Its short growth period, averaging 100 days, makes it well-suited for the shorter outdoor cultivation season in many parts of Canada – especially in the Prairie provinces, as seen in the data below.

The data reflects the changes in the hemp industry across Canada. From 2018 to 2019, we saw a modest increase of only 20 hemp cultivation licenses nationwide. Most major provinces saw a dramatic decrease in cultivation licenses, with the exception of British Columbia and Ontario. The reason we see dramatic fluctuations in provincial licensing numbers is likely due to the relatively flexible window that growers have to apply for a license. Applications are accepted as early as mid-November for a license that will be good through the end of the following year. However, most farmers need not apply until they are ready to harvest. Consequently, depending upon the point in any given year that licenses are counted, the numbers could be different and not entirely representative of the number of farmers growing hemp.

Source: Hemp Benchmarks, Health Canada

Registered hectarage also grew year-on-year, with a 19% jump to 37,435 hectares in 2019. As alluded to above, licensing data does not necessarily correspond to registered hectarage in each province. In Ontario and BC, for example, registered hectarage was negligible for 2019 even though roughly 26% of cultivation sites are registered in those provinces. The main provinces to register hemp cultivation sites and hectarage are Alberta, Saskatchewan, and Manitoba.

Source: Hemp Benchmarks, Health Canada

Finally, we look at the breakdown of the types of hemp cultivars planted across Canada. Cultivation for flowering heads, leaves and branches – in other words, varieties high in CBD and other non-THC cannabinoids – was the most prominent, accounting for 42% of the planted hectarage, followed by grain, then fiber. Only 3% of the hectarage was planted for seed.

This data was not available for 2018, so we cannot analyze exactly how this might have changed year-on-year. However, an overview of the Canadian hemp industry published last year by the U.S. Department of Agriculture’s (USDA’s) Foreign Agricultural Service notes that, as of the end of 2018, “high-CBD varieties have yet to be registered for use in Canada.” The USDA report, combined with Health Canada’s 2019 data, suggests that hectarage registered for high-CBD varieties may have gone from nonexistent in 2018 to the most prevalent production target in the country in 2019.

Source: Hemp Benchmarks, Health Canada

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.