![]()

Canada Cannabis Spot Index (CCSI)

Published October 4, 2019

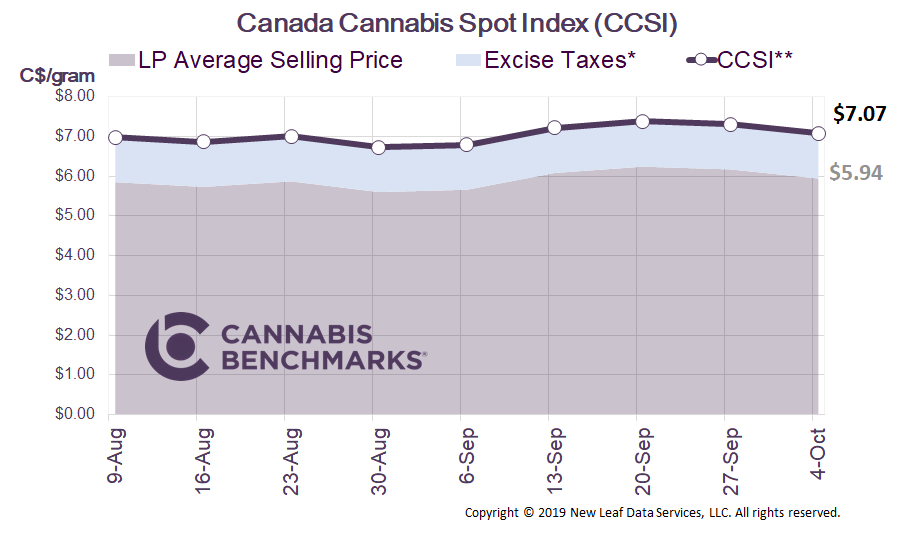

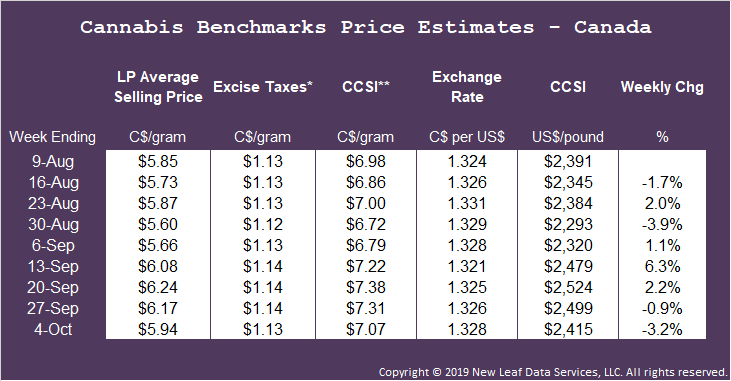

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$7.07 per gram this week, down 3.2% from last week’s C$7.31 per gram. This week’s price equates to US$2,415 per pound at the current exchange rate.

This week we examine legal monthly Canadian sales across Canada. Statistics Canada reports this data each month but with a three month lag. The current report gives sales figures by province up to July 2019. The current report shows a steady increase in sales with July growing by 14.1% to C$104M. Although the growth trend is in the right direction, the market remains dramatically smaller than projected when the legal market opened last Fall. We attribute the slow migration from the illicit market to the legal market to be the three Ps: Product, Price, Proximity.

Consumers have complained that the quality of the product in the legal market is simply not as good as the cannabis that is available in the illegal market. In addition, the prices in the legal market are significantly higher than the prices offered by local dealers and illegal pop-up retail stores.

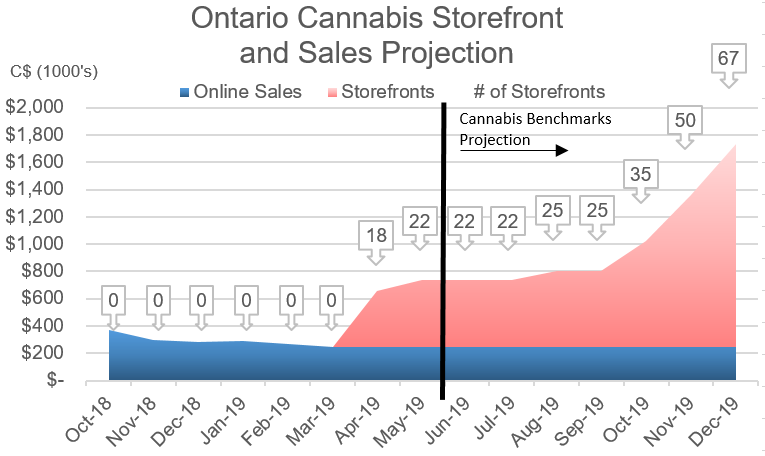

Finally, in many provinces legal cannabis can still be hard to procure. At Cannabis Benchmarks we have been tracking the build out of retail stores in each province. Our analysis shows that some provinces have very limited storefronts, while others have more than required. In total there are 561 stores currently operating in Canada, which is 200 more than were open in July.

Alberta has 52% of the total Canadian stores, while Ontario (the most populated province) has only 4.4% of the total stores. As a result, we have heard reports that in some provinces the legal market is less than 15% of the total cannabis market.

Store counts are clearly a critical component to driving sales. We found an incredibly close relationship between store counts and reported monthly sales. For the statisticians out there, our 10 months of historical data shows an extremely tight correlation of 0.97.

Each new store helps draw customers away from illicit sources by providing easier access. In addition, the stores offer product experts and conduct their own local marketing campaign to convert clients to the legal market. Using our current store count data we have been able to project monthly sales through October.

As seen in the chart above, we anticipate October sales to be approximately C$144M (or C$1.7B annualized). Based on our analysis, we project total recreational sales of C$1.04B in the year since the legal market opened last October.

We expect that these sales figures will continue to grow each month as more stores and product types become available, with cannabis 2.0 starting in late Q4 2019 (as edibles, topicals, vapes, beverages and other products hit the shelf). If you would like to see more information like this, please sign up to be a BETA tester of our new fundamentals data platform for the Canadian market. Click the link below to register.

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..