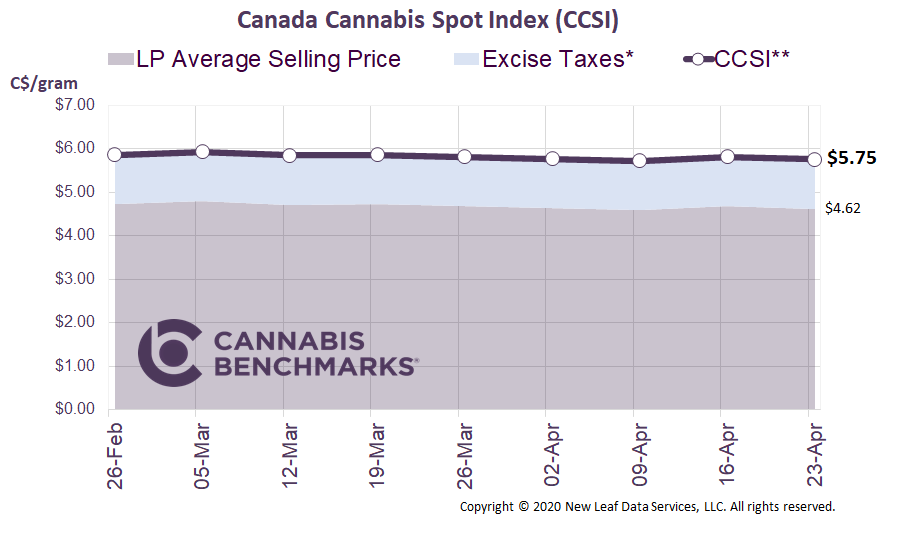

Canada Cannabis Spot Index (CCSI)

Published October 30, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.96 per gram this week, up 0.6% from last week’s C$5.92 per gram. This week’s price equates to US$2,041 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

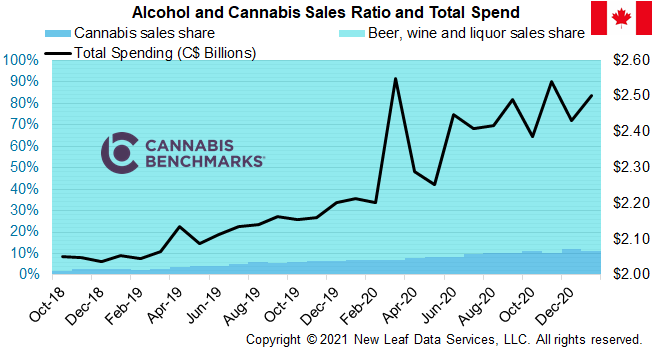

This week, we turn our attention to supply and demand dynamics for cannabis 2.0 products in Canada’s legal cannabis market. The three main product categories that fall under the cannabis 2.0 umbrella are edibles, extracts, and topicals. The official Health Canada definitions of each are as follows:

Edibles: Products that are solid or liquid at a temperature of 22 ± 2°C and that are intended to be eaten or drunk the same way as foods such as chocolate, cookies, sodas, teas.

Extracts: Products made using extraction processing methods or by synthesizing phytocannabinoids and intended for inhalation or ingestion, including by absorption in the mouth or other routes of administration (e.g. vape pens, hash, tinctures, softgels, suppositories).

Topicals: Products that include cannabis as an ingredient and that are intended for use on external body surfaces such as skin, hair, or nails.

In today’s report, we look specifically at the supply and demand associated with edibles and extracts, which are the two larger categories. To date, Health Canada has compiled and published monthly data for production, consumption, and inventory of packaged units through July 2020.

Below are two groupings of charts that show the monthly supply and demand for edibles and extracts from the introduction of cannabis 2.0 products in October 2019 through July 2020.

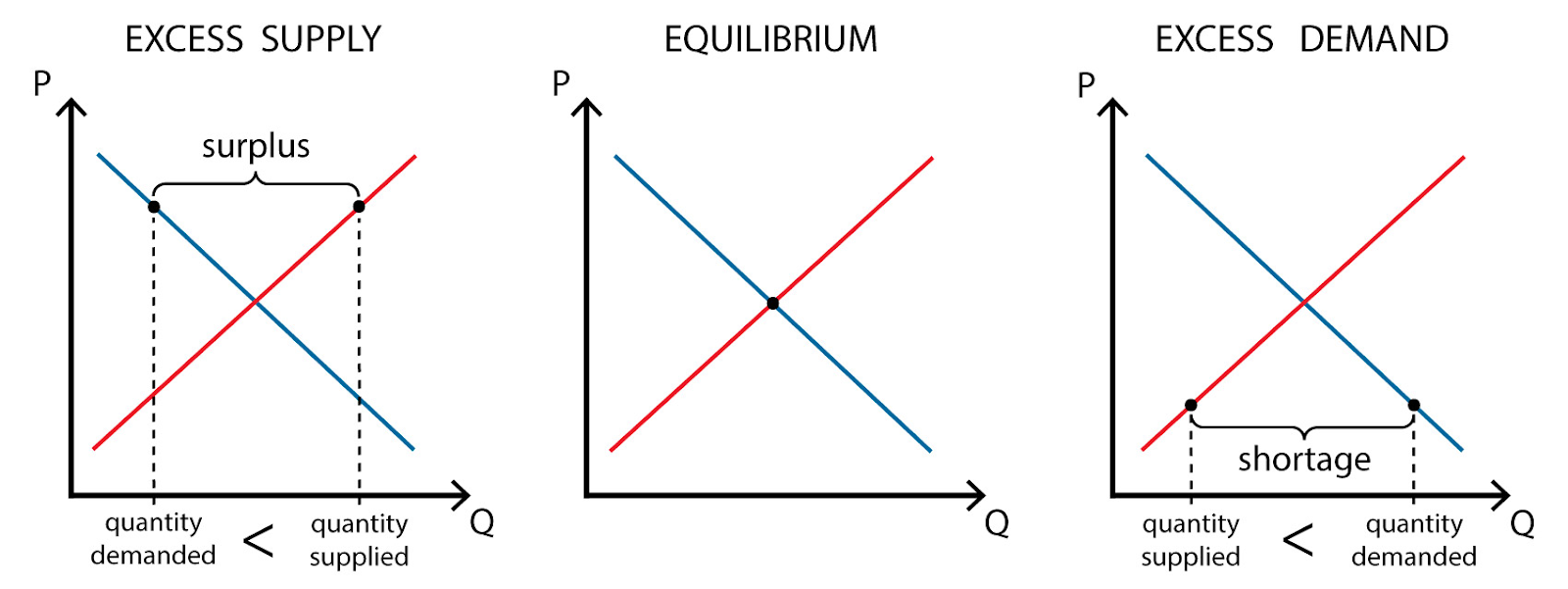

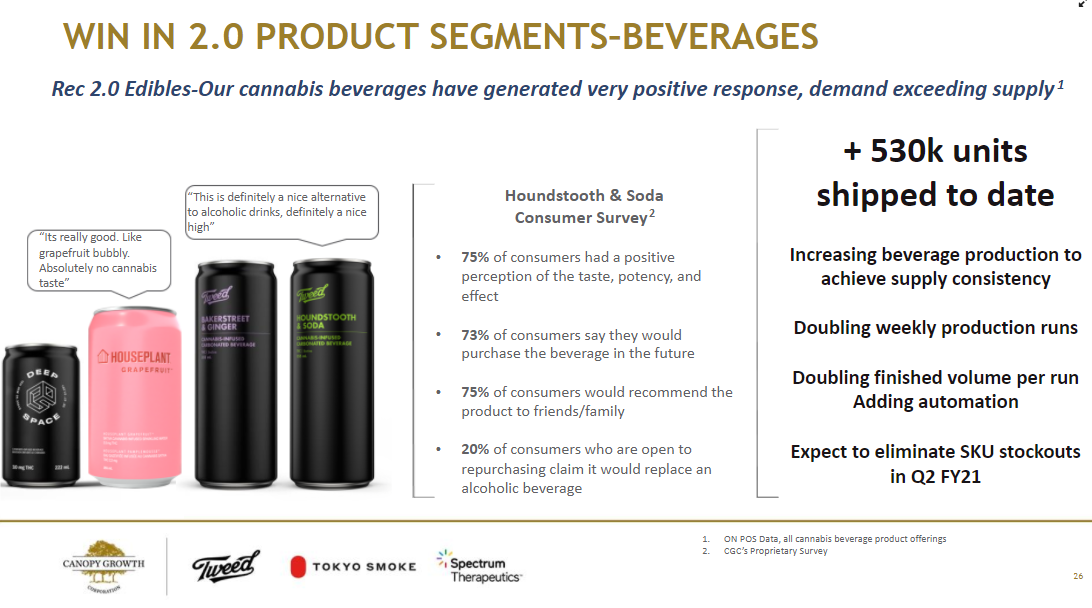

Starting with edibles, we see the production of packaged units by licensed producers ramped up quickly and at a consistent rate until the most recent month. With the production increase, we see medical and non-medical sales picked up as well, but not at the same rate, leading to excess production going into inventory at the federal, provincial, or retail level.

Just as with dry flower cannabis in 2019, the mismatch between supply and demand is causing inventories to rise at massive rates. The current inventory of edible packaged units sits at 8.4M, which is approximately 6.3 months worth of supply at July’s consumption rate.

Source: Cannabis Benchmarks, Statistics Canada

The story for extracts is broadly similar. Production ramped up at a faster rate than domestic consumption, leading to growing inventory. The current inventory of extract packaged units sits at 9.8M, which is approximately 7.3 months worth of supply at July’s consumption rate.

Source: Cannabis Benchmarks, Statistics Canada

Cannabis 2.0 products seem to be following a similar trajectory as cannabis flower in 2019, with excess inventory leading to declining prices and write-offs of older products. Cannabis 2.0 products, however, typically have a longer shelf life than dry flower. When we inspected edible and extract packaging, there was a clear packaging date, but no expiration date.

In analyzing the Health Canada data, it is clear that there is a massive gap between supply, consumption, and storage in the market. We anticipated all this monthly data to perfectly net out to zero, but that is not the case. We have backed into the gap and labeled it as “unaccounted” inventory, which is identified in the charts above with the boxed pattern. We show unaccounted inventory only in the charts below to more clearly see the size of it each month.

Source: Cannabis Benchmarks

The growing size of the “unaccounted” category is concerning, although it is not clear if these products are being consumed somewhere in the system or it is going into inventory. If it is going to inventory, there are an additional 1.45M packaged units of edibles and 1.31M packaged units of extracts to account for, making the inventory overhang even larger.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.