Canada Cannabis Spot Index (CCSI)

Published October 16, 2020

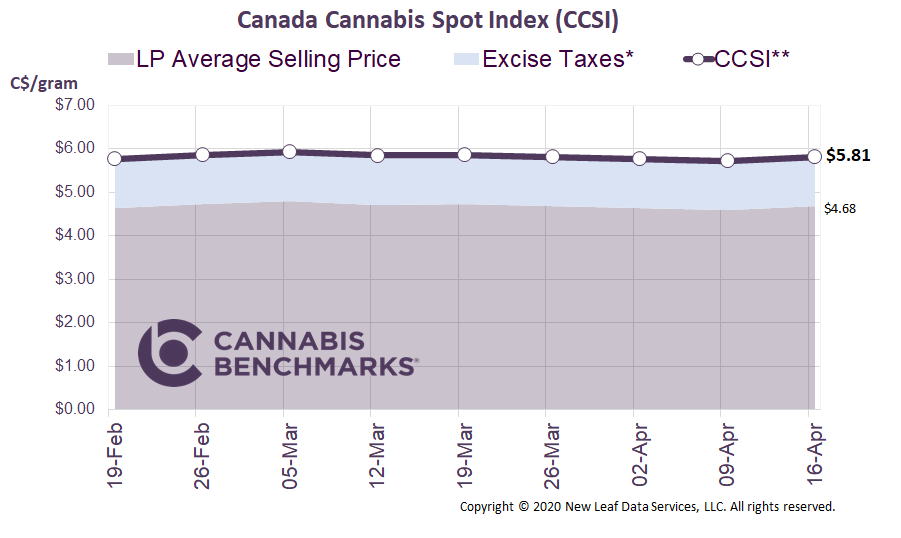

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.04 per gram this week, up 1.3% from last week’s C$5.96 per gram. This week’s price equates to US$2,073 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

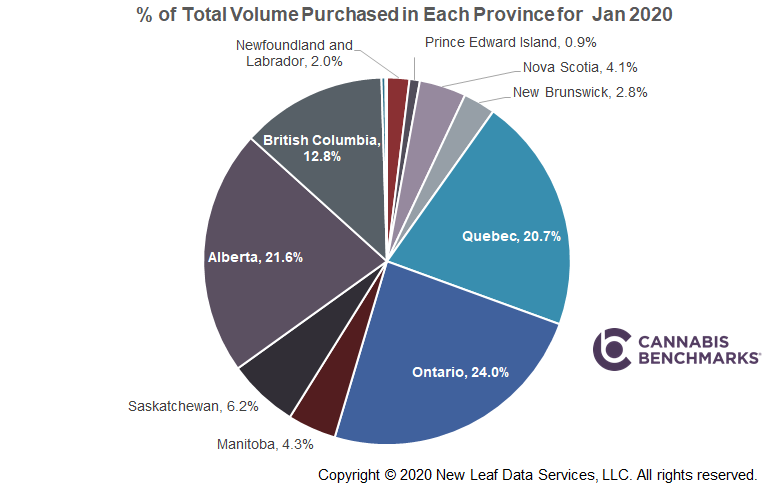

This week we continue to delve into data from the Ontario Cannabis Store’s (OCS) Q1 Cannabis Insights report. The report contains a wide variety of useful data to show how Ontario’s market is developing. In today’s report, we will focus on expanding cannabis product variety and sales breakdowns by product type.

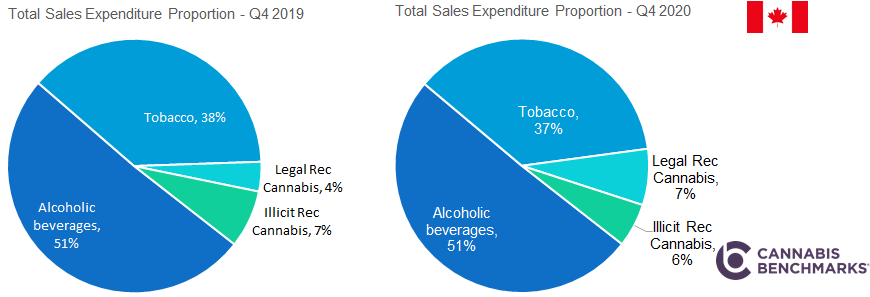

With the introduction of cannabis 2.0 products, consumers seeking more variety presumably have greater reason to purchase products from legal channels. While illegal mail-order-marijuana websites do sell the types of products included in the legal market’s cannabis 2.0 phase, traditional dealers usually only carry a small variety of dried flower.

The latest data from the OCS shows cannabis 2.0 products are already accounting for a significant portion of legal sales just a few months after their launch. For the three-month period starting April 30, cannabis 1.0 products (dried flower and pre-rolls) accounted for 70% of total sales in legal cannabis channels, while cannabis 2.0 products grew to 30% of the total.

As part of the reported data, the OCS broke out sales revenue by product category. Additionally, the OCS calculated a dry cannabis equivalency (DFE) for cannabis 2.0 products, providing an estimate of the number of grams of dried flower represented by the sales of each respective product type. The DFE breakdown shows that while cannabis 2.0 products made up about 30% of all sales revenue for the period, they only accounted for 23.5% of all grams sold. This means that, overall, cannabis 2.0 products commanded a greater per-gram premium relative to dried flower.

Source: Cannabis Benchmarks, AGCO

However, the overall premium commanded by cannabis 2.0 products is not distributed equally across the various product types. Taking the total sales with the DFE for each product category gives us a rough idea of which cannabis 2.0 products achieved a premium compared to the same gram of cannabis sold as dried flower. In other words, how much did a gram of cannabis sell for as dried flower versus being converted to a cannabis 2.0 product? Keep in mind we did not assess the cost to produce each product, which varies across – and within – product categories.

As the chart below shows, topicals, vapes, and capsules received the greatest premiums. On the other side of the spectrum, edibles, concentrates, and beverages commanded the lowest price for a gram of cannabis, based on the OCS’s DFE. It should also be noted that lower-grade cannabis plant material is typically used in the manufacture of cannabis 2.0 products, enhancing the premiums commanded by some of the products.

Source: Cannabis Benchmarks, AGCO

Lastly, we look at where these products were sold – through the provincial online store or at brick-and-mortar retailers. This dynamic has likely already shifted with 78 more stores opening between the end of June and the end of September, but this data gives us a good snapshot in time.

As can be seen in the charts below, almost every product had a greater proportion of sales through retail stores. However, oils saw online sales make up a greater percent of the total, while the proportions of capsules, concentrates, and beverages sold online versus in-store were roughly or nearly equal. All of the products that saw a greater or almost equal proportions of online sales are highly finished and standardized. Consumers may feel more confident selecting such products online, compared to dried flower or even an edible product, which buyers might prefer to inspect in person before purchasing. It should be noted that availability issues at some store locations may have skewed sales somewhat, as cannabis 2.0 products were still being rolled out during the period under discussion.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.