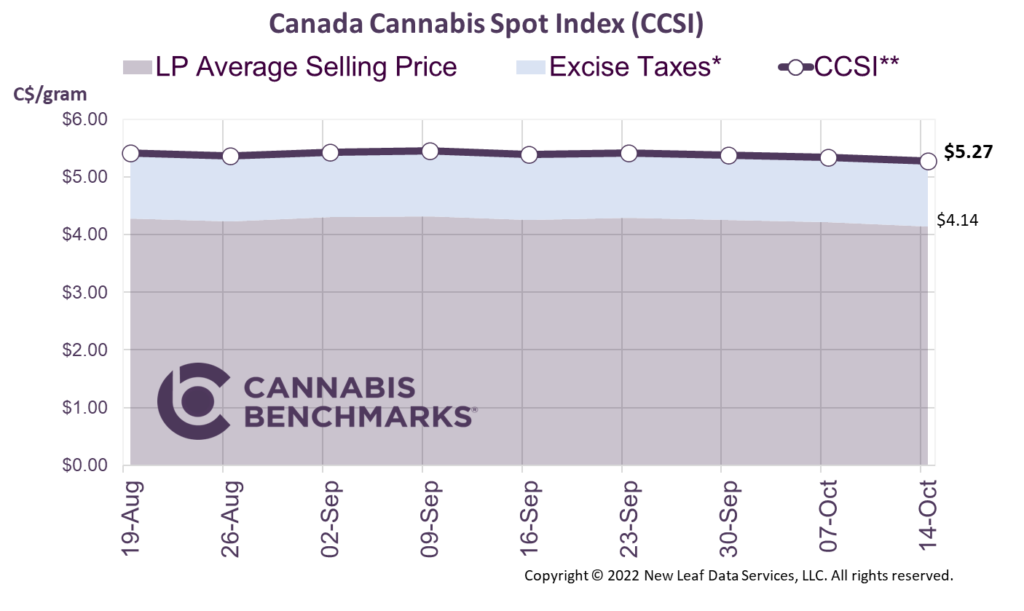

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes.

The CCSI was assessed at C$5.27 per gram this week, down 1.3% from last week’s C$5.34 per gram. This week’s price equates to US$1,732 per pound at the current exchange rate.

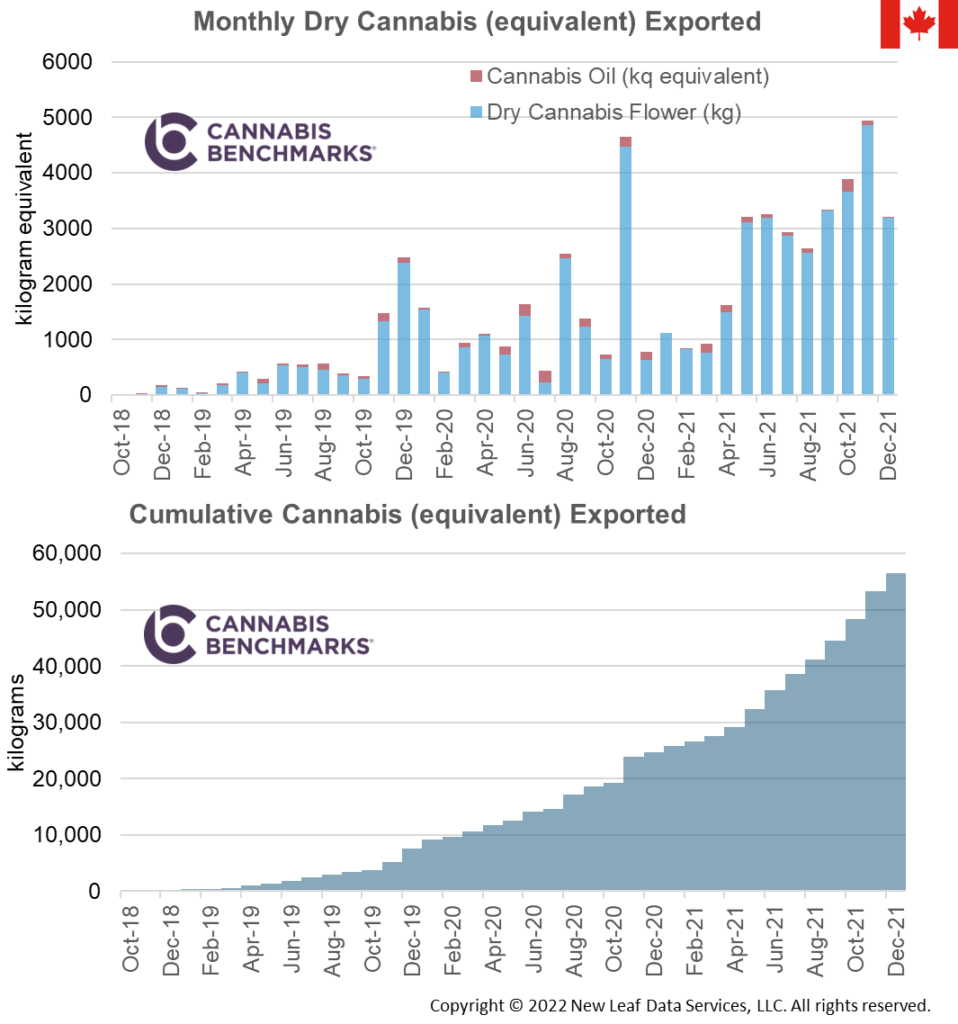

- This week Cannabis Benchmarks analyzed Statistics Canada’s data on dry cannabis and cannabis oil exports. As more countries legalize medical cannabis, Canada’s expertise in cultivation methods and quality has made it an export leader. Canada is the largest exporter of cannabis flower and oil in the world, but under the Cannabis Act it is only allowed to export cannabis for medical purposes.

- Statistics Canada reports both the permitted quantities and the actual quantities that were shipped by licensed producers. The current dataset provides monthly export quantities through December 2021. As seen in the chart above, the growth in exports has been steady, with the majority of the cannabis exports being in the form of dry flower. The peak export month was November 2021 with 4,853 kg equivalent of cannabis exported.

- In 2021, total cannabis exports reached 31,852 kg, an increase of 86% over the previous year. On a cumulative basis since cannabis was legalized for adult use, a total of 61,334 kg equivalent has been shipped to other countries. Of this product, 87% was shipped as dry flower to countries that have growing medical cannabis markets such as Germany, Israel, Belgium, Croatia, Chile, Brazil, New Zealand, and Australia.

- In the future, we do not anticipate a significant amount of growth for Canadian cannabis exports. Latin America, Australia, and more progressive European nations are competing with major cannabis exporters like Canada and the Netherlands. Additionally, nations like Germany and Israel who have historically imported medical cannabis are now expanding their local manufacturing capabilities.