![]()

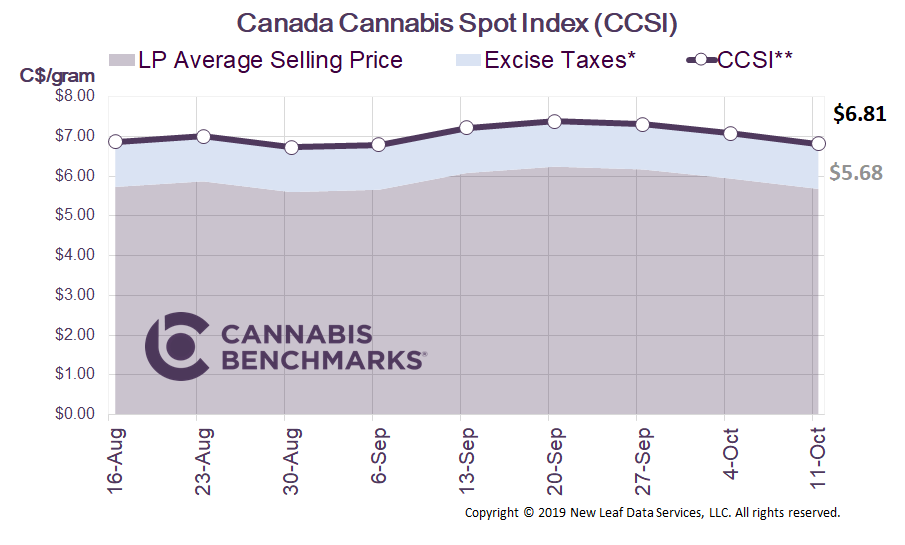

Canada Cannabis Spot Index (CCSI)

Published October 11, 2019

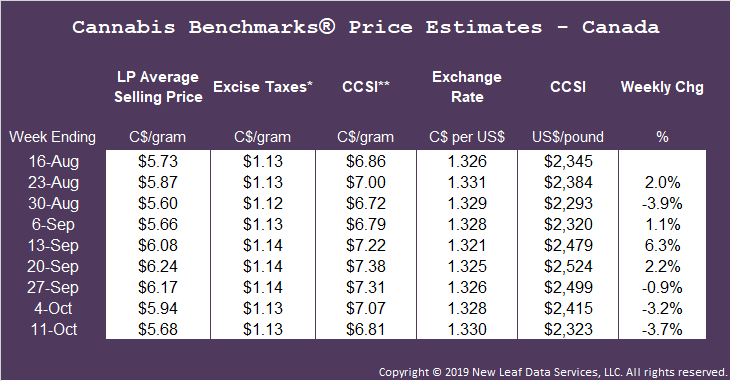

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.81 per gram this week, down 3.7% from last week’s C$7.07 per gram. This week’s price equates to US$2,323 per pound at the current exchange rate.

This week we examine the state of the medical cannabis market since adult-use legalization almost a year ago. According to data from Health Canada, there is a very noticeable downward trend in the purchase of cannabis for medical purposes. We do not necessarily believe that use of cannabis for medical purposes is diminishing. Instead, those that may have previously registered as patients are likely turning to the recreational market for their product for some very apparent reasons.

Source: Cannabis Benchmarks, Health Canada

We have routinely mentioned the three “Ps” – product, price, and proximity; once again, these factors can help explain the downward slide in medical cannabis purchasing shown in the chart above.

Product

The products available through recreational channels are cultivated by the same licensed producers (LPs) in the same locations; hence they are a fungible commodity.

Proximity

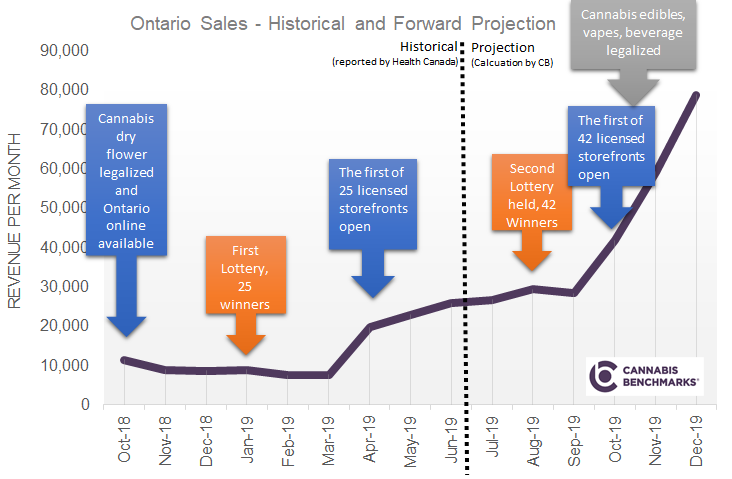

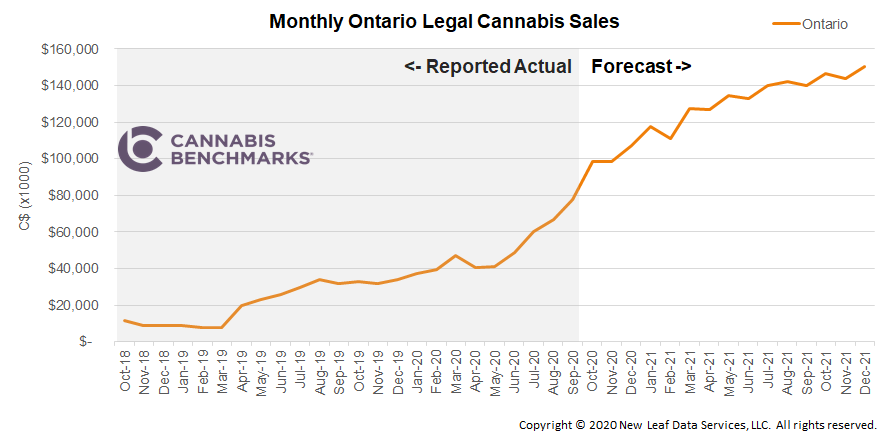

Patients will continue to change the way they access their cannabis for medical usage as more retail store locations open and make product more accessible. This will be driven by provinces such as Ontario and Quebec, which are currently home to 60% of the total population but have a severe shortage of retail stores.

The last reported figures for June 2019 show these two provinces consumed 50% of medical dry cannabis (780 kg), but only had 38 licensed retailers, or 13% of the total number of Canadian stores at that time. Over the past four months, an additional 12 stores opened in those two provinces, while 253 stores opened in other provinces.

Source: Cannabis Benchmarks

Price

In our view, price is one of the biggest reasons patients are turning to the recreational markets for their cannabis. We reviewed the average net selling prices contained in recent quarterly reports from some of the top producers and found that there is a large discrepancy in the average selling prices of recreational and medical cannabis, despite their being fungible, as we noted above.

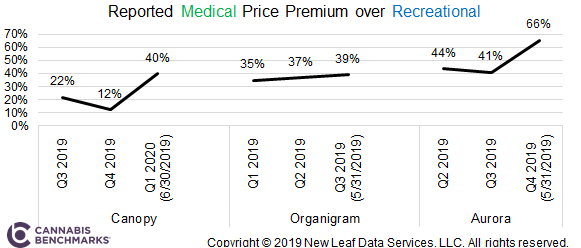

Below, on the following page, is a table showing the average net selling prices from Canopy, Organigram, and Aurora over the past three quarters. There is a massive spread between the price per gram of recreational and medical cannabis. Additionally, this gap continues to grow as prices drop in the recreational market.

Source: Cannabis Benchmarks, Company Quarterly MD&A

With the most recent quarterly reports, the average premium for medical cannabis grew for all three of the LPs we analyzed. Aurora topped the list by commanding a 66% premium for their medical cannabis for their fiscal Q4 2019 ending on May 31.

Over the coming months, we expect medical sales to continue to trend lower as recreational market prices continue to decline on increasing supply and inventory levels, and as more stores and product types become available in the adult-use market. If you would like to access more data like this, including proprietary Cannabis Benchmarks data, please sign up to be a BETA tester of our new fundamentals data platform for the Canadian market. Click the link below to register.

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..