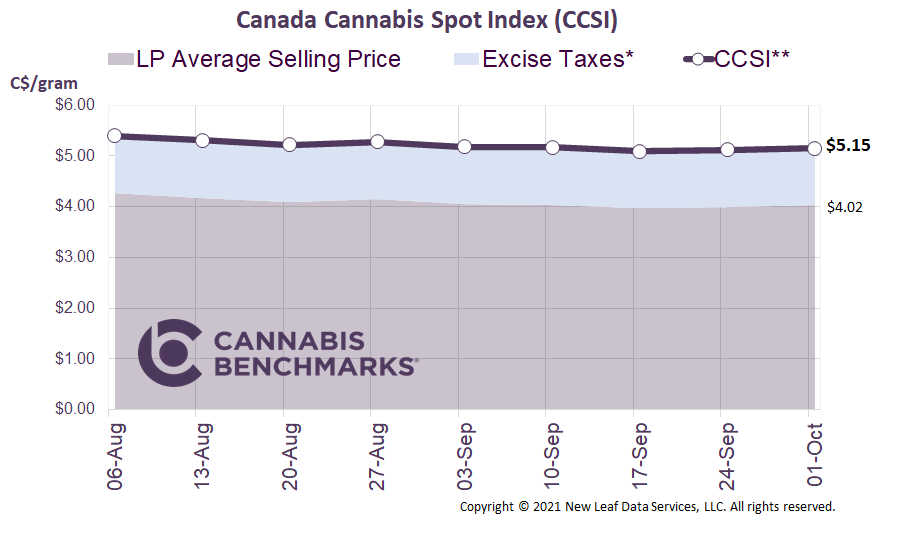

Canada Cannabis Spot Index (CCSI)

Week Ending October 1, 2021

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.15 per gram this week, up 0.7% from last week’s C$5.12 per gram. This week’s price equates to US$1,845 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

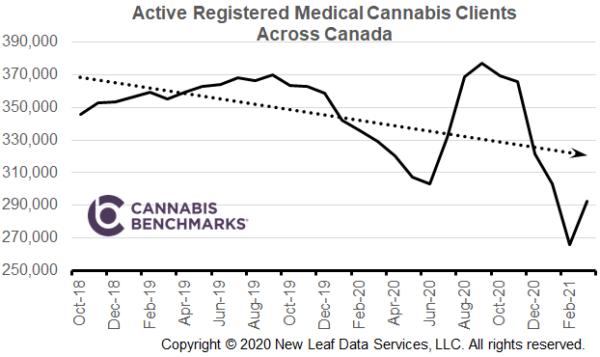

This week we look at the breakdown of monthly sales volumes between the recreational and medical cannabis markets. Before October 2018, all cannabis was sold only for medical use to registered customers. Individuals needed to obtain authorization from a healthcare professional in order to register to buy products from a licensed cannabis producer. According to Health Canada, there are 764 authorized licensed cultivators, processors, and sellers under the Cannabis Act. These authorized parties can sell plants, seeds, smokable flower, and several derivative products to registered clients.With the onset of legalization, many who had registered as medical cannabis clients have shifted to procuring their supply from the recreational market. The ease of purchasing via a provincial online platform or a local retailer, along with the lower-priced products, has put significant pressure on medical cannabis suppliers. As seen in the chart below, the number of active registered medical cannabis clients has trended downward since October 2018. The latest data from Statistics Canada shows 292,399 active registered medical cannabis clients as of March 2021.

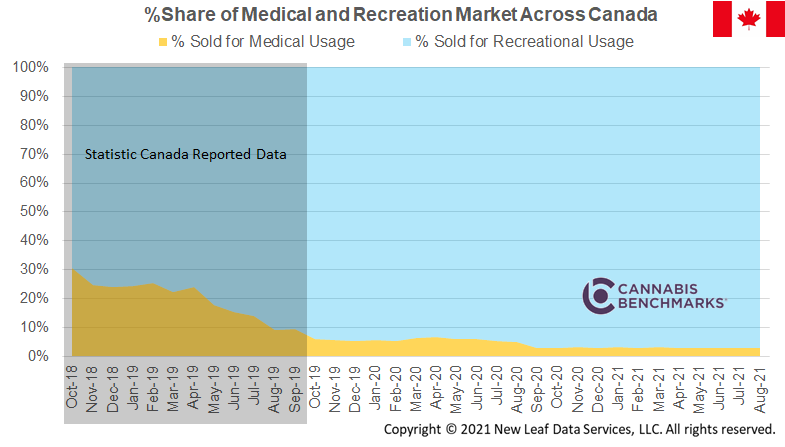

In our September 17 report, we estimated the current total dry cannabis sold in the legal Canadian marketplace. Cannabis Benchmarks estimates that the total dry cannabis sold in August 2021 was 31,314 kg. Today we take that analysis one step further, to break down the monthly volume and show how much was sold in the recreational versus the medical markets. The chart below shows the steep drop in medical purchasing as a percentage of total volume sold. Last month, we estimated that medical dry cannabis sales made up 3% of total sales volumes or 972 kg. To put this number into perspective, this is only 50% of the volume sold for medical use in October 2018.

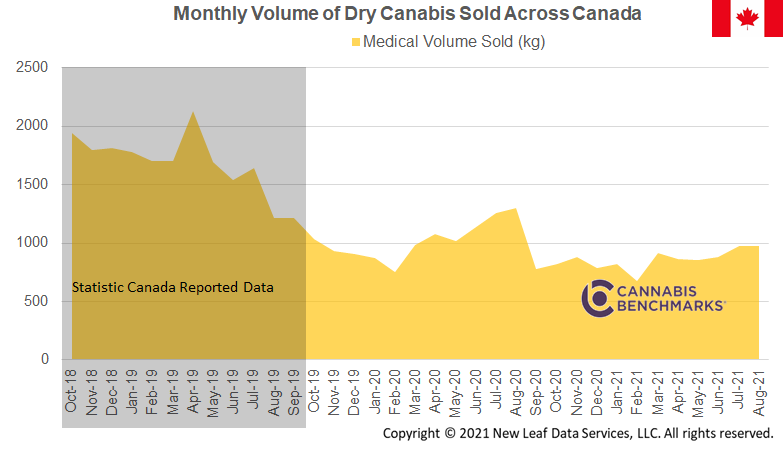

The following chart shows the estimated monthly sales volume for medical use since October 2018. This should be a very concerning trend for those cultivators who specialize in selling a premium product for the medical market, especially as wholesale prices continue to fall in the recreational sector and competition increases.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.