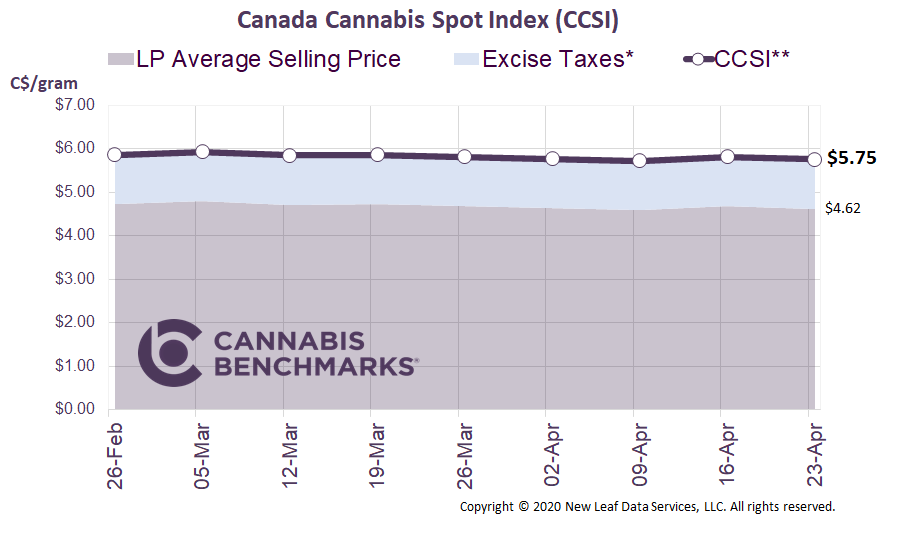

Canada Cannabis Spot Index (CCSI)

Published November 27, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.94 per gram this week, up 1.3% from last week’s C$5.86 per gram. This week’s price equates to US$2,067 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week Statistics Canada released retail sales data for September 2020. Sales have been increasing steadily across Canada. September continued that trend with sales of C$256M for the month, C$11.4M higher than August 2020 and up C$133M year-over-year. The monthly increase is not as large as those observed during the summer months, but it is still very notable. September’s figures point to an annual run rate of C$3.1B, which solidifies the prospect of retail sales eclipsing C$3B in 2021.

Source: Cannabis Benchmarks, Statistics Canada

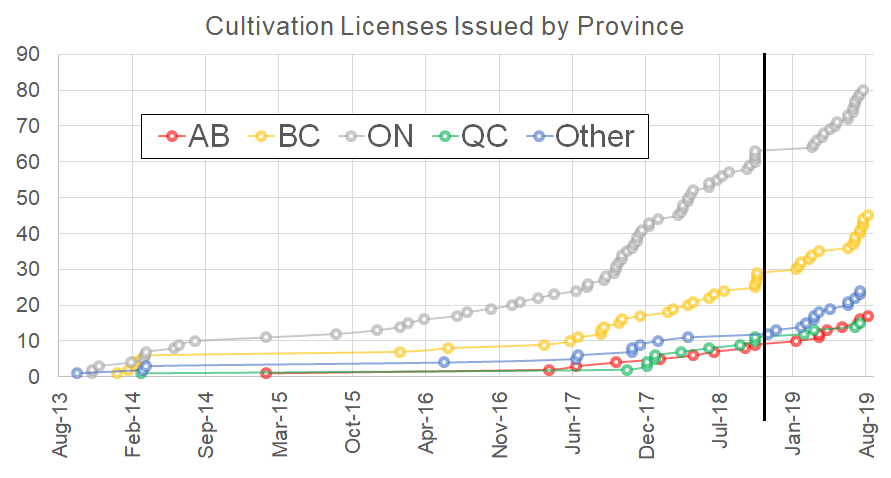

On an average daily basis, September sales were higher across every province except for Newfoundland and Labrador. While average daily sales nationwide expanded by 8.2%, increases varied significantly at the provincial level. Of the major provinces, Ontario has been consistently outperforming all other provinces in daily sales growth. Ontario led the way with a 20.3% rise in average daily sales, while other major provinces saw increases of 4.0% to 6.5%. The growth in Ontario has been higher than expected, with daily sales averaging C$2.6M per day in September.

Source: Cannabis Benchmarks, Statistics Canada

As of September 30, we counted 178 stores across Ontario. Increased accessibility along with more sales of premium cannabis 2.0 products has kept revenue growth strong in Canada’s most populous province. With the latest data point, we have recalibrated our model and now expect Ontario sales alone to eclipse C$1.2B in 2021.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.