Canada Cannabis Spot Index (CCSI)

Published November 13, 2020

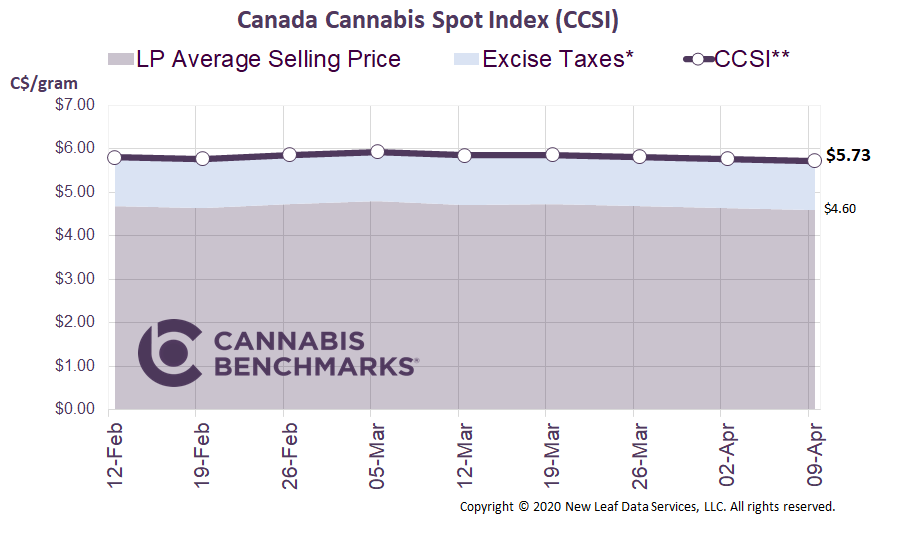

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.93 per gram this week, up 0.3% from last week’s C$5.91 per gram. This week’s price equates to US$2,059 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

Earlier this year, tough financial realities forced numerous Licensed Producers (LPs) to scrap costly greenhouse expansions. Now, an increasing number of Canadian cannabis cultivators are shifting production capacity to outdoor cultivation. Outdoor cultivation has significantly lower operating costs relative to growing indoors or in a greenhouse, including lower infrastructure and labor costs, and no energy costs for lighting, heating, and ventilation.

The latest data from Statistics Canada shows outdoor cannabis cultivation capacity expanding at a rapid rate. As of August 2020, there were 544 hectares licensed to grow cannabis outdoors. This is a massive jump relative to the first data point from October 2019. Over the 11 month period, outdoor cannabis cultivation capacity grew by 312 hectares, or 134%.

Source: Cannabis Benchmarks

The next chart takes the same data and standardizes the units to square feet. While this chart does not reflect the amount of actual cannabis production, since an indoor-grow will have multiple harvests annually, compared to one per year outdoors, it does show the dramatic shift towards outdoor production.

Source: Cannabis Benchmarks

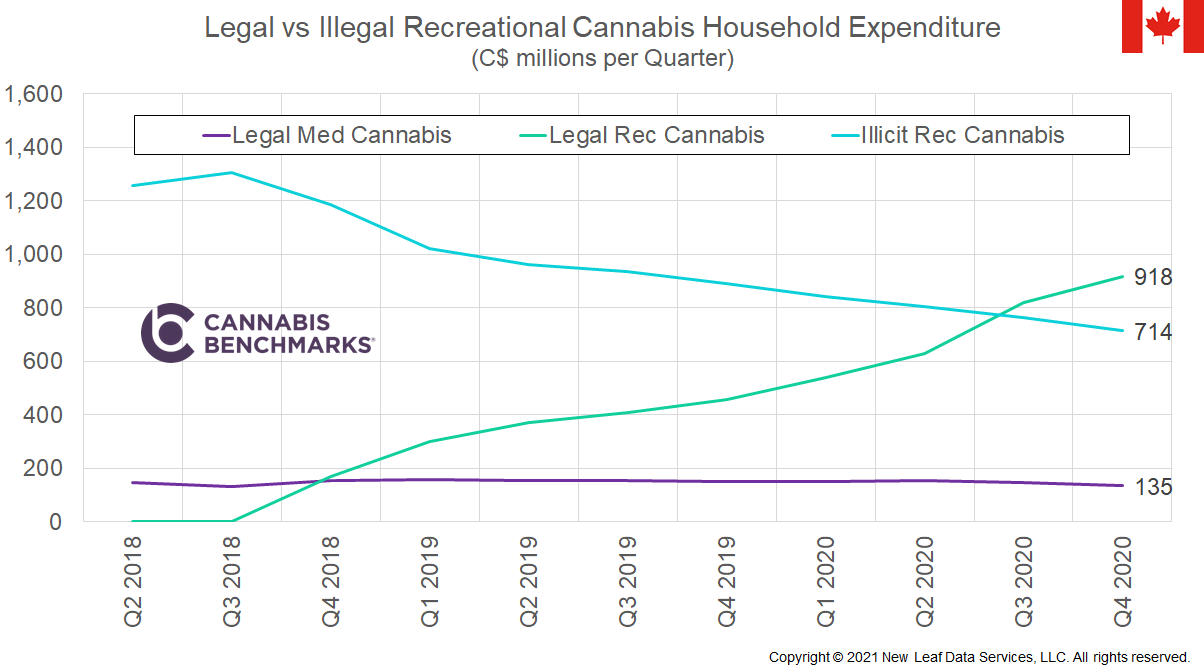

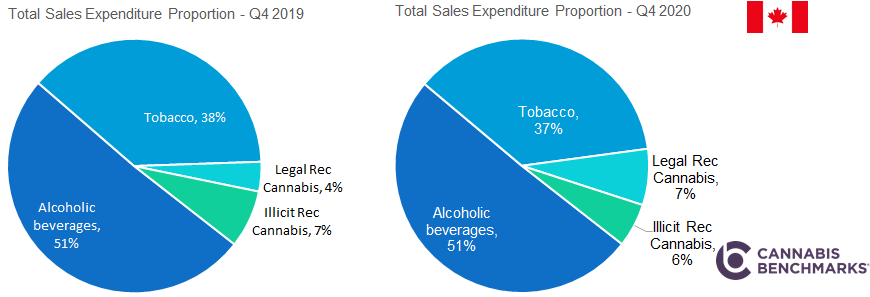

While outdoor cultivation is ramping higher, indoor production capacity has plateaued. This makes sense when one considers that legal markets continue to compete with illicit producers for market share. Outdoor cultivation’s lower production cost makes it more competitive with illicit supply, but the resulting cannabis is usually of lower quality. As a result, significant portions of outdoor-grown product might not be as marketable for smoking in its raw form as that grown indoors. However, it is very suitable as low-cost raw material for manufacturing cannabis 2.0 products such as edibles, beverages, and vapes.

Outdoor cultivation does have risks. In Canada, there is only one growing season for outdoor cannabis. Hail, wind, and early freezes can destroy an entire harvest, leaving farmers with lost revenue. On the other hand, the 544 licensed hectares could conceivably produce a tsunami of additional flower and other plant material that may overwhelm already-inflated supply levels in Canada.

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.