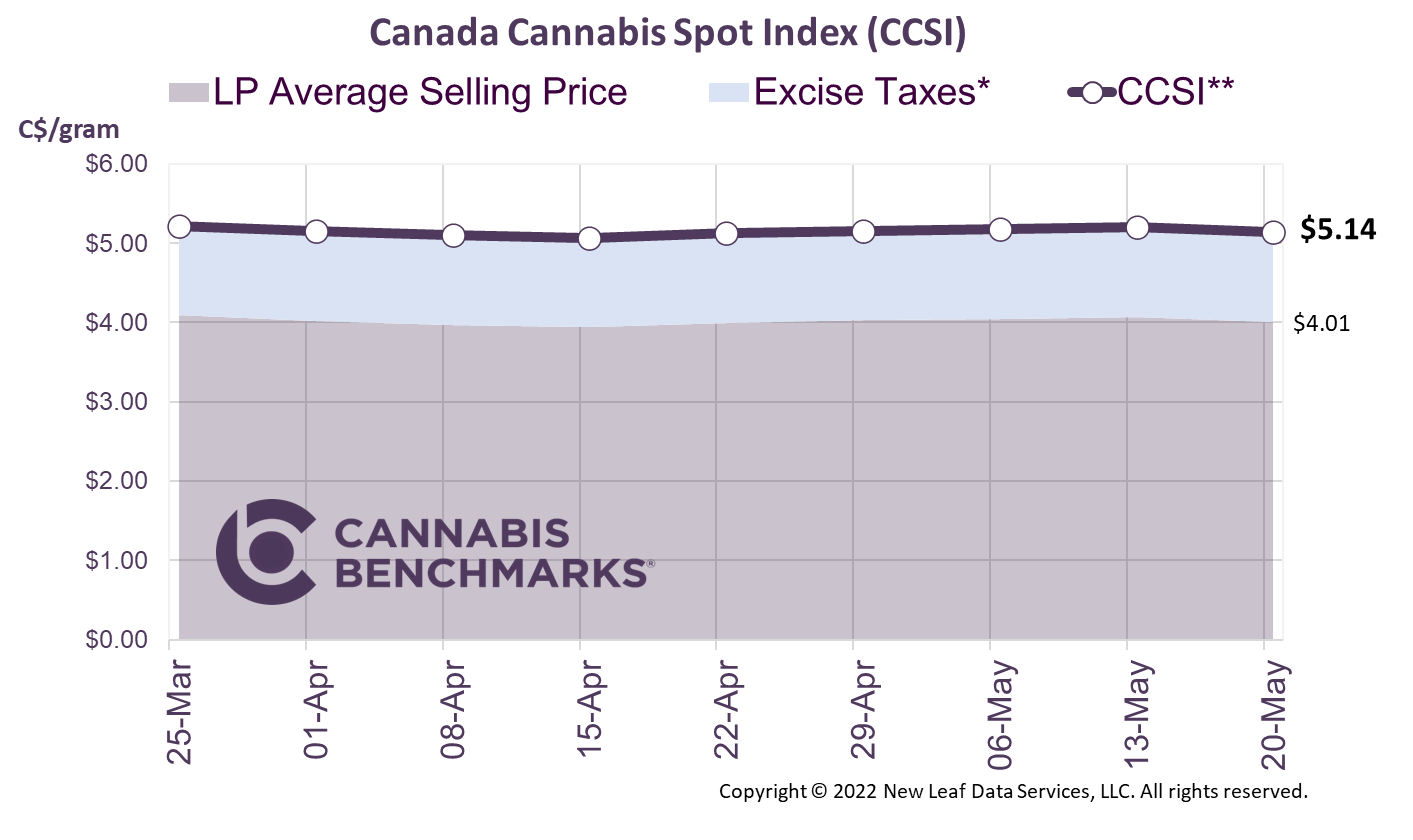

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.14 per gram this week, down 1.2% from last week’s C$5.20 per gram. This week’s price equates to US$1,812 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

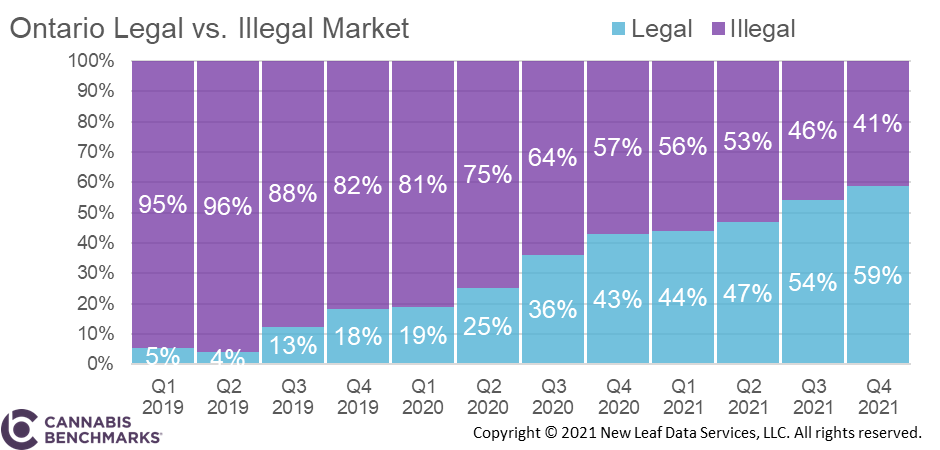

This month the Ontario Cannabis Store (OCS), the body that regulates the province’s cannabis market, released its quarterly Cannabis Insights report for the period from October through December 2021.

In this week’s report, we focus particularly on the battle between legal and illicit supply. In the first few years of cannabis legalization, the regulated Canadian market has faced strong competition from illicit supply chains, but that situation is evolving quickly. Falling retail prices, increased product variety, and better accessibility through storefronts, pick-up / delivery options, and online marketplaces are helping legal cannabis gain the upper hand in this battle.

The story is particularly changing in Ontario, where the most recent report estimates the legal market made up 59% of all cannabis sales as of Q4 2021. As can be seen, the trend of legal cannabis capturing increasing proportions of the total market has been quite dramatic over the past two years, and with it we have seen monthly cannabis sales increasing rapidly. For December 2021, legal recreational cannabis sales in Ontario totaled C$127M, 37% higher than a year prior.

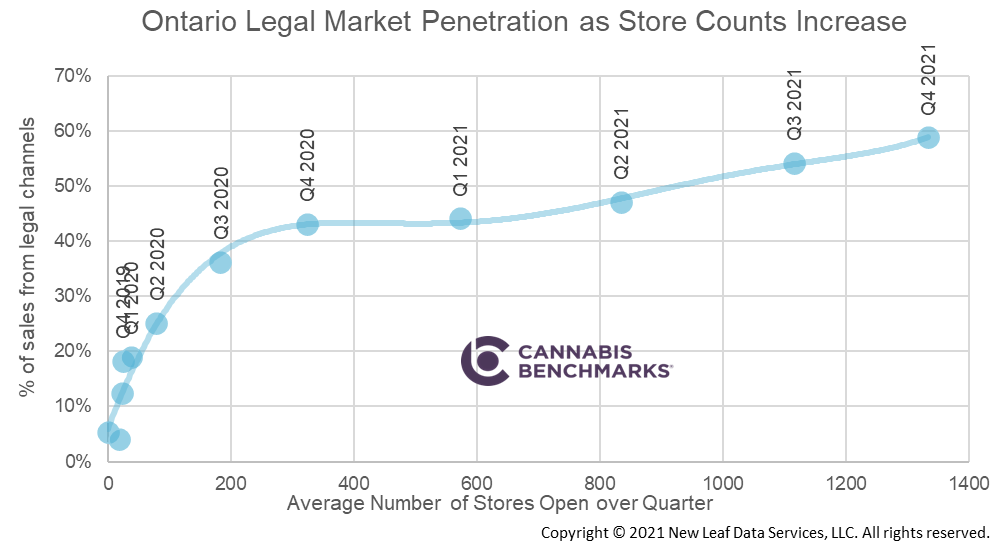

The chart below shows the average number of stores in Ontario over the past twelve quarters, as tracked by Cannabis Benchmarks and the OCS, versus the share of the legal cannabis market. The growth of the legal cannabis sector had a very strong correlation to the number of storefronts open for business in 2020 and that positive relationship continued in 2021.

Based on the 2021 trajectory seen above, we estimate that every additional 100 stores opened will help increase the proportion of total sales from legal channels by about 2%. The Ontario deployment of stores has slowed down in 2022, but our current Ontario store count estimate is 1,503 stores open as of the end of April. Based on that figure we estimate that legal cannabis currently makes up 62% of total Ontario cannabis sales. This is a great feat for the regulated cannabis market.