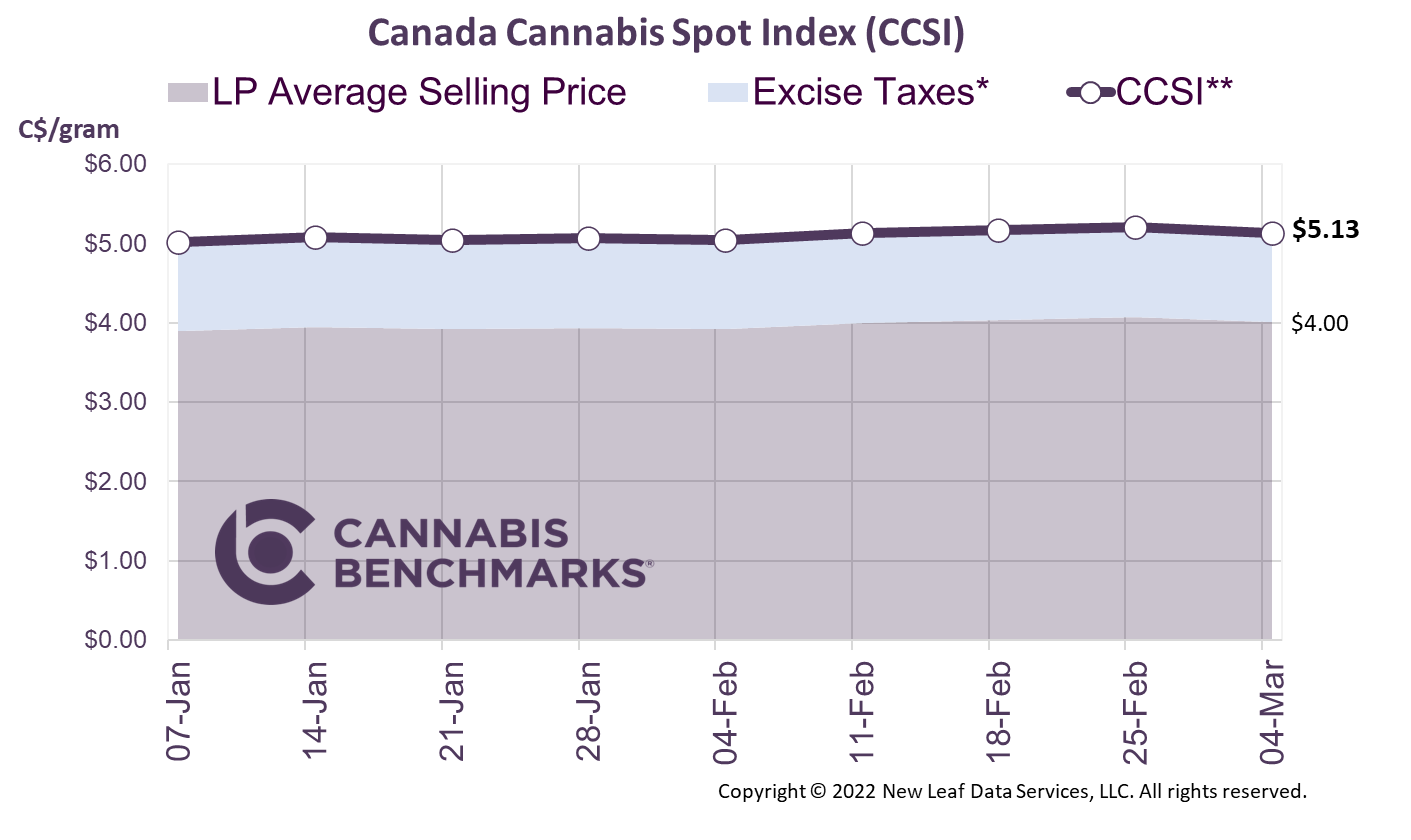

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.13 per gram this week, down 1.3% from last week’s C$5.20 per gram. This week’s price equates to US$1,833 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

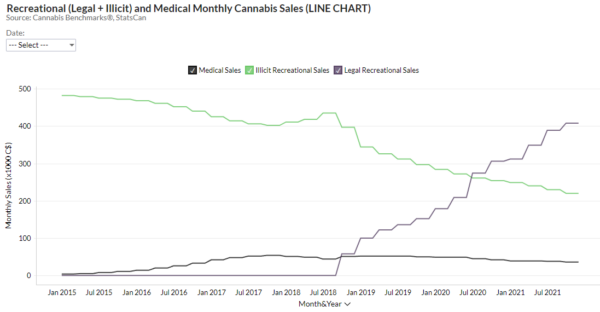

This week we examine updated household expenditure data issued quarterly by Statistics Canada. The data shows some very interesting and positive trends for the legal cannabis sector. To start, we look at the rise of the legal recreational cannabis market across Canada. As seen in the chart below, in Q4 2021 the estimated household expenditure for legal recreational cannabis continued to grow, while estimated expenditures in the illicit market continued to contract.More Canadians are choosing to purchase cannabis through regulated legal channels, as awareness and accessibility continue to evolve. Also fueling that trend is the drop in prices, as new supplies from legal indoor and outdoor cultivation operations became available, making products from licensed businesses more price-competitive with those of illegal sellers.

In Q4 2021, recreational cannabis expenditures grew 33% to C$1,224M and illicit cannabis expenditures dropped by 13% to C$660M compared to the same time frame in 2020. We also note that expenditures for medical-use cannabis dropped 13% to C$108M. Medical cannabis now makes up only 5.4% of the total Canadian cannabis market. Total expenditures on cannabis were C$1.993B for the quarter, or C$21.7M per day.

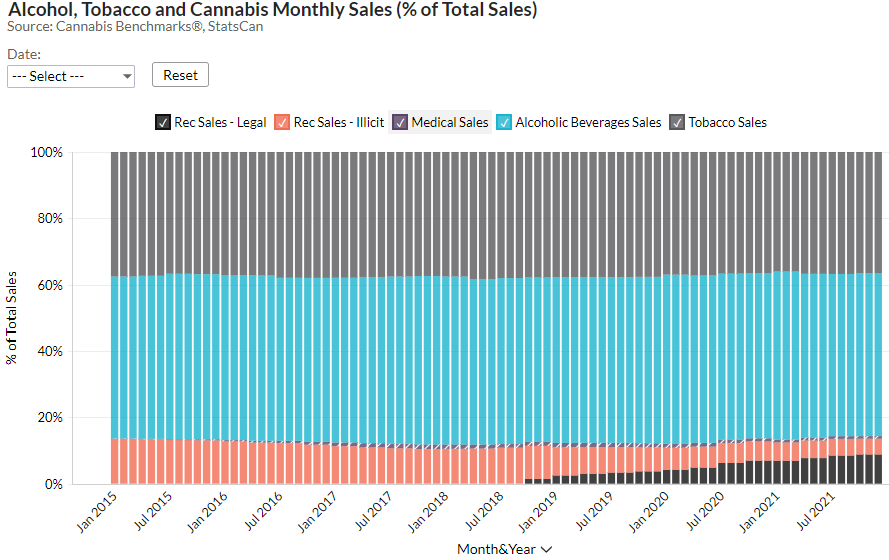

Next we look at cannabis purchasing in comparison to that for alcohol and tobacco. As we have noted in the past, major alcohol and tobacco companies have made significant investments in large cannabis operations over the last few years, in part as a hedge to ensure they do not lose out on the latent demand for cannabis that is being captured gradually by legal businesses. The data released by Statistics Canada for Q4 2021 shows that alcohol and tobacco sales are starting to lose ground to growing cannabis sales. Even though total spending on alcohol, tobacco, and cannabis continues to rise, the portion spent on cannabis now makes up 14.3% of the total.