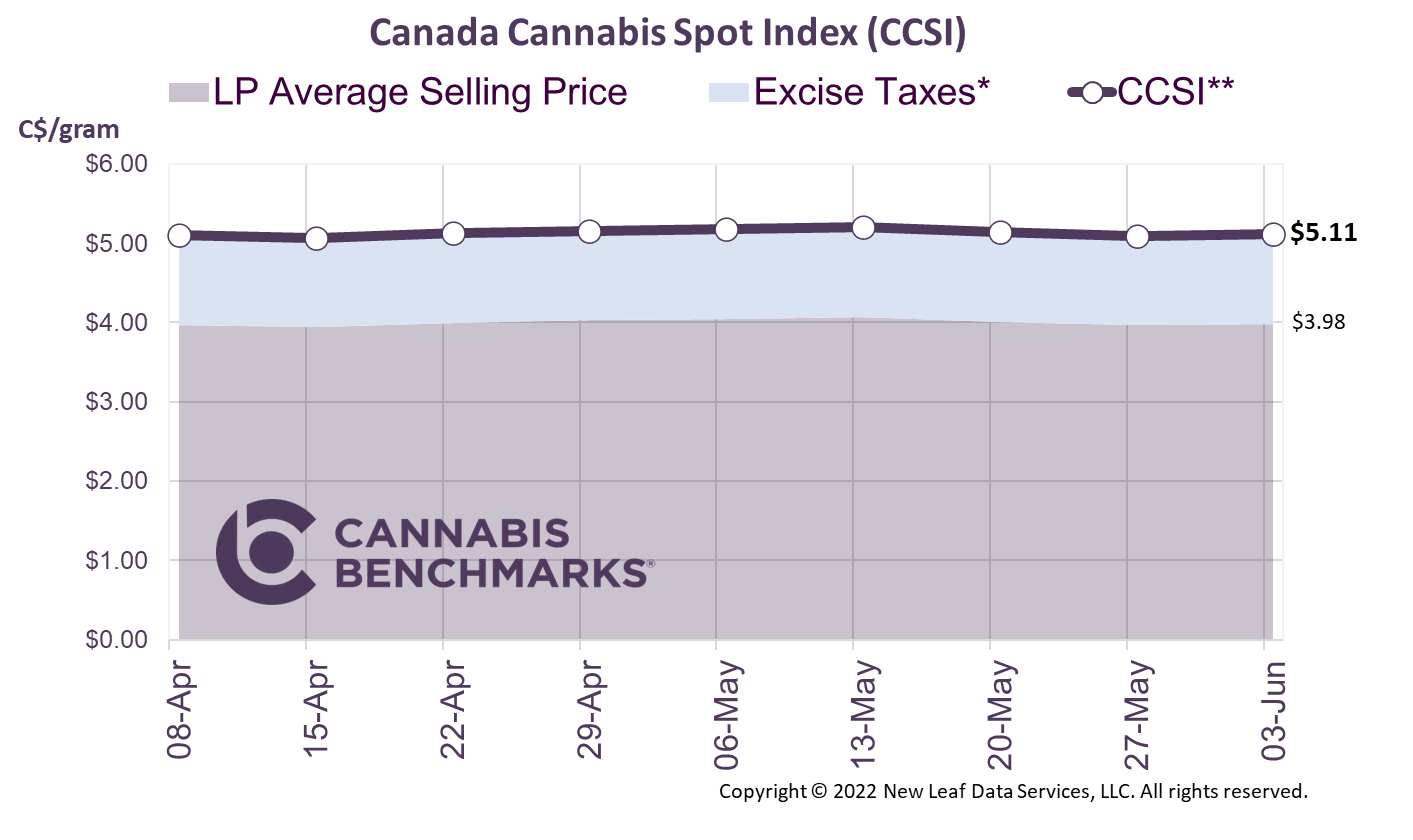

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.11 per gram this week, up from last week’s C$5.09 per gram. This week’s price equates to US$1,838 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

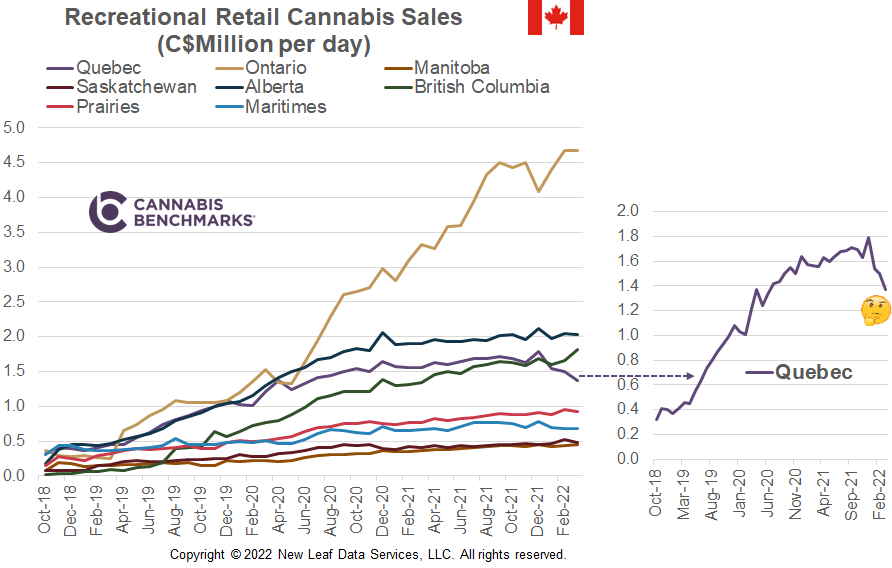

This week we review the latest retail cannabis sales data published by Statistics Canada. The latest release shows cannabis sales increasing by 10.7% from February to March, to reach C$358.8M. February sales, however, were revised downward to C$324.1M from C$336.4M. Average daily sales have been flat for the past eight months, which is causing concern for the cannabis industry. This overall concern has been amplified after the February 2022 sales figures were revised lower, a trend we continue to see. We raised this issue in a recent report, noting the big changes to past reported figures.

Recreational sales have recently been fairly flat across most provinces, with the exceptions of Ontario and Quebec. Ontario sales continue to grow, with added storefronts bringing new customers to the legal market. Quebec, on the other hand, has seen sales drop sharply since a peak of C$1.79M in daily sales in December 2021.

In general, Quebec’s cannabis sales have been much lower on a per capita basis than the other major Canadian provinces, due largely to its regulatory structure. First, the Quebec government has set the legal age for purchasing and consuming cannabis at 21. Other populous provinces have set the minimum age to purchase and consume cannabis at 18 (Alberta) or 19 (Ontario and British Columbia). This has had the effect of pushing new consumers in Quebec straight into the illicit markets.

Second, Quebec has the lowest number of cannabis retail locations of the major provinces because legal cannabis products can only be sold through government-run Société Québécoise du Cannabis (SQDC) outlets. As of the end of May, we counted a total of 89 stores in Quebec, which is drastically lower than Alberta, a province that boasts 759 stores and only half the population of Quebec.

These added restrictions have likely kept the illegal market robust despite government reports stating otherwise. An October 2021 report published by Quebec’s Health Ministry stated that 70% of all cannabis sales over the previous 12 months occurred through legal channels. This is notably different from the recent report from the Ontario Cannabis Store (OCS), which estimated that 59% of cannabis sales were made in the legal market in the last quarter of 2021.