Canada Cannabis Spot Index (CCSI)

Published June 12, 2020

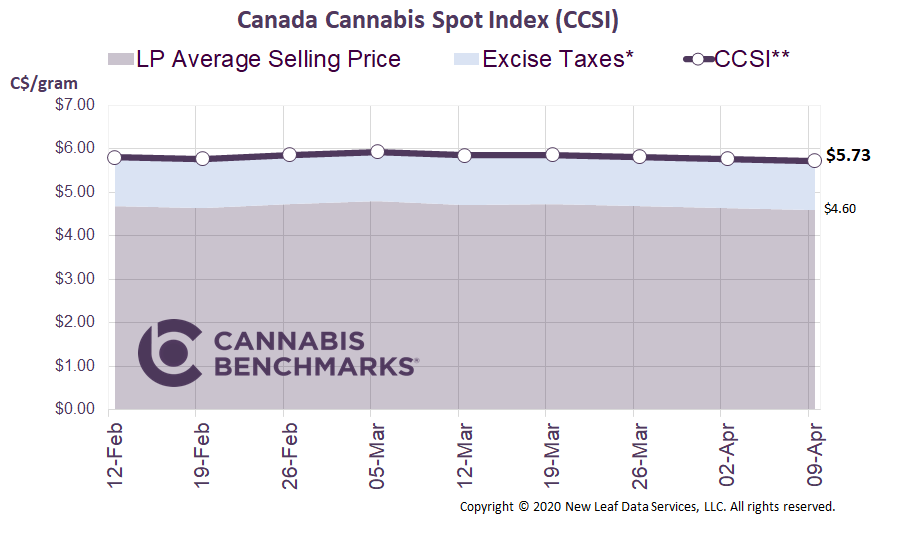

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.30 per gram this week, down 1.7% from last week’s C$6.41 per gram. This week’s price equates to US$2,117 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week, we review data released recently by the Ontario Cannabis Store (OCS) that provides significant detail on the province’s legal cannabis market. The report, entitled “A Year in Review,” follows the development of the Ontario cannabis market from April 1, 2019 through March 31, 2020. This is the first report to show a full year of history and development in Canada’s most populous province. You can read the full report here.

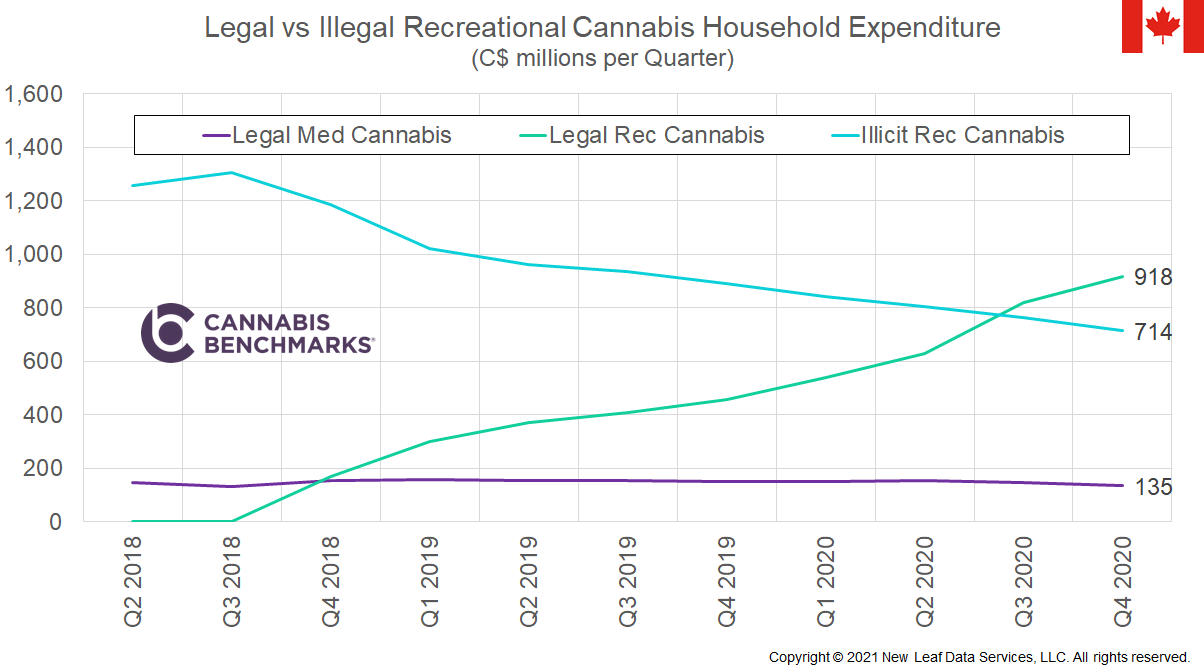

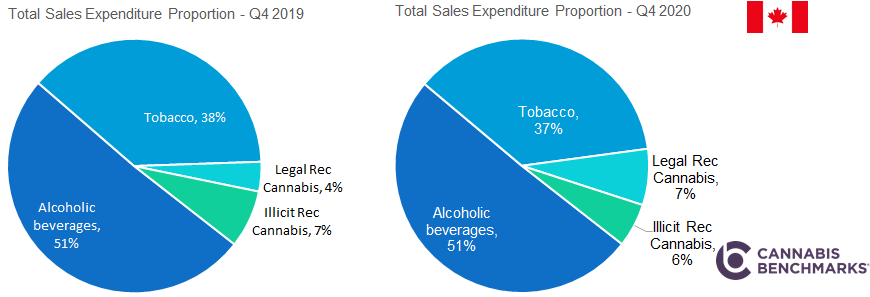

One of the biggest challenges facing the Canadian cannabis sector is robust illegal operations and distribution. The OCS estimates that the legal market accounted for only 19% of total cannabis commerce in the province in Q4 2019. The lack of licensed retail infrastructure and higher prices in the legal sector helped keep the illegal markets very active. OCS expects that the legal market share will increase dramatically over the next couple of years, as the restructured licensing process accelerates the build out of retail locations. The current Ontario store count stands at 87.

Source: Cannabis Benchmarks, OCS

The establishment and build out of licensed retail stores has proven to be a key element in the growth of the legal market. Ontario has lagged behind the other provinces in licensing new stores. The first set of 10 stores opened on April 1, 2019; since then the roll out of new locations has been slow. Despite only having a total of 53 stores open in the province by March 31, 2020, 81% of all legal sales over the preceding twelve months were generated by these physical retail locations. Online sales did not appear to provide a sufficient consumer experience to compensate for the limited number of stores in the province and take market share from the illicit market.

Source: Cannabis Benchmarks, OCS

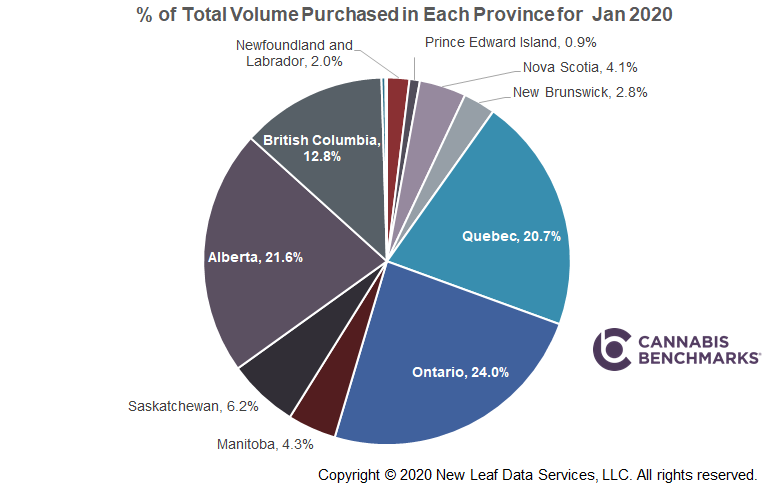

Ontario online sales are higher than the national average, which we estimate to be 7% over the same time frame. This is no surprise, as provinces such as Alberta and British Columbia, which have relatively larger retail presences, have a small percentage of sales that occur through their provincial online stores.

Cannabis 2.0 products – such as vapes, beverages, concentrates, edibles, and topicals – have also provided a boost to sales levels. In March 2020, cannabis 2.0 products produced C$9M in sales, or 19% of the total. This number is expected to continue to grow as consumers become more familiar with these products, and as a wider variety of products becomes available.

Source: Cannabis Benchmarks, OCS

Drilling deeper into the sales mix, OCS reports cannabis 1.0 products (mainly dry flower) make up 81% of sales. Vapes are the next most popular product category at 14%, with the other cannabis 2.0 products constituting only a sliver of total sales.

Source: Cannabis Benchmarks, OCS

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.