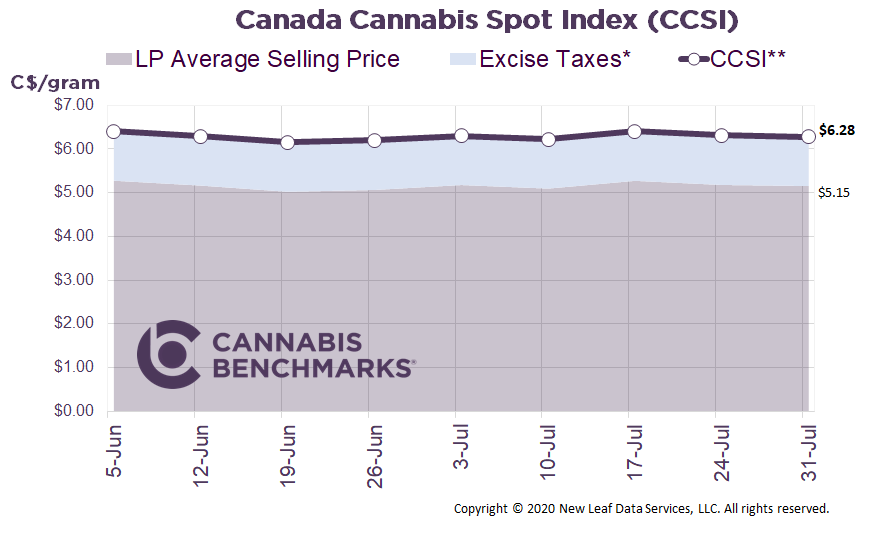

Canada Cannabis Spot Index (CCSI)

Published July 31, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.28 per gram this week, down 0.4% from last week’s C$6.31 per gram. This week’s price equates to US$2,128 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we provide an update on store counts and sales. The Canadian cannabis industry is growing up with more than one thousand retail outlets now open across the country. This is an immense milestone, as there were only 361 stores open at the end of July 2019. With the increased physical retail presence, cannabis is becoming more visible and, presumably, more normalized in Canadian society.

To be exact, we count 1,012 licensed retailers, with an average monthly growth rate of 6% in 2020. This solid growth rate comes despite many store applications and openings being delayed due to COVID-19 shutdowns. The 50 store increase in July was distributed almost equally across Alberta, British Columbia, and Ontario. However, Alberta store counts seem to be hitting a saturation point, while Ontario store openings are taking off after a slow start.

Source: Cannabis Benchmarks

With the expanded store presence, we are also seeing retail sales ramp up. Statistics Canada reported May 2020 sales last week, showing a record C$185.9M in revenue. This new monthly record is up C$7.5M from the month prior, and C$100M from the same month last year.

So all in all, the industry seems to be moving in the right direction. We recalculated our 2020 total sales target this week. The last time we did this was right as COVID closures were setting in and cannabis 2.0 products were starting to hit the shelves.

With many of those events now behind us, we have a better understanding of how all the moving pieces have impacted sales. We project sales will continue to increase each month as new stores open, more cannabis 2.0 products become available, and life returns closer to normal. Our modelling shows monthly sales surpassing C$200M in August and hitting a peak of C$219M in December.

Source: StatsCan, Cannabis Benchmarks

Cumulative Canadian sales for legal retail cannabis in 2020 are set to hit C$2.28B. This is almost double 2019’s sales tally of C$1.19B, according to Statistics Canada.

Source: StatsCan, Cannabis Benchmarks

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.