![]()

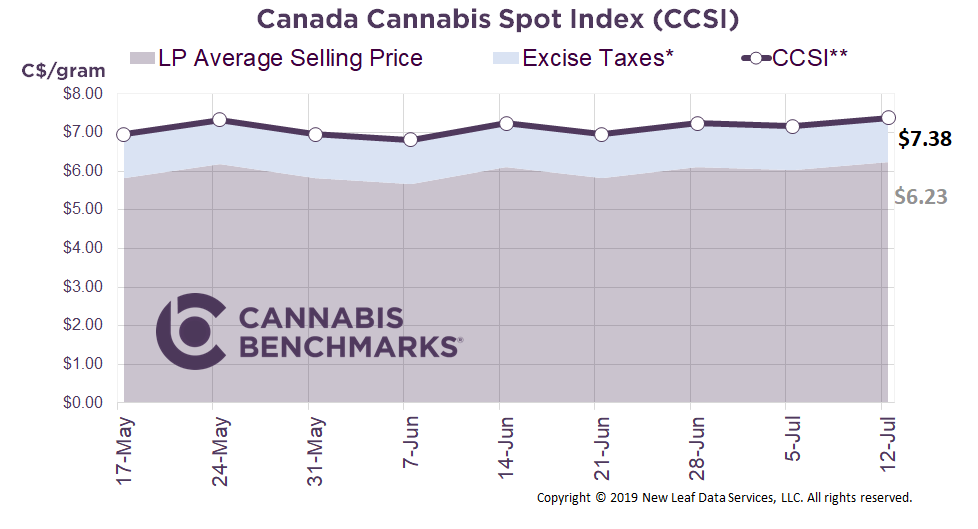

Canada Cannabis Spot Index (CCSI)

Published July 12, 2019

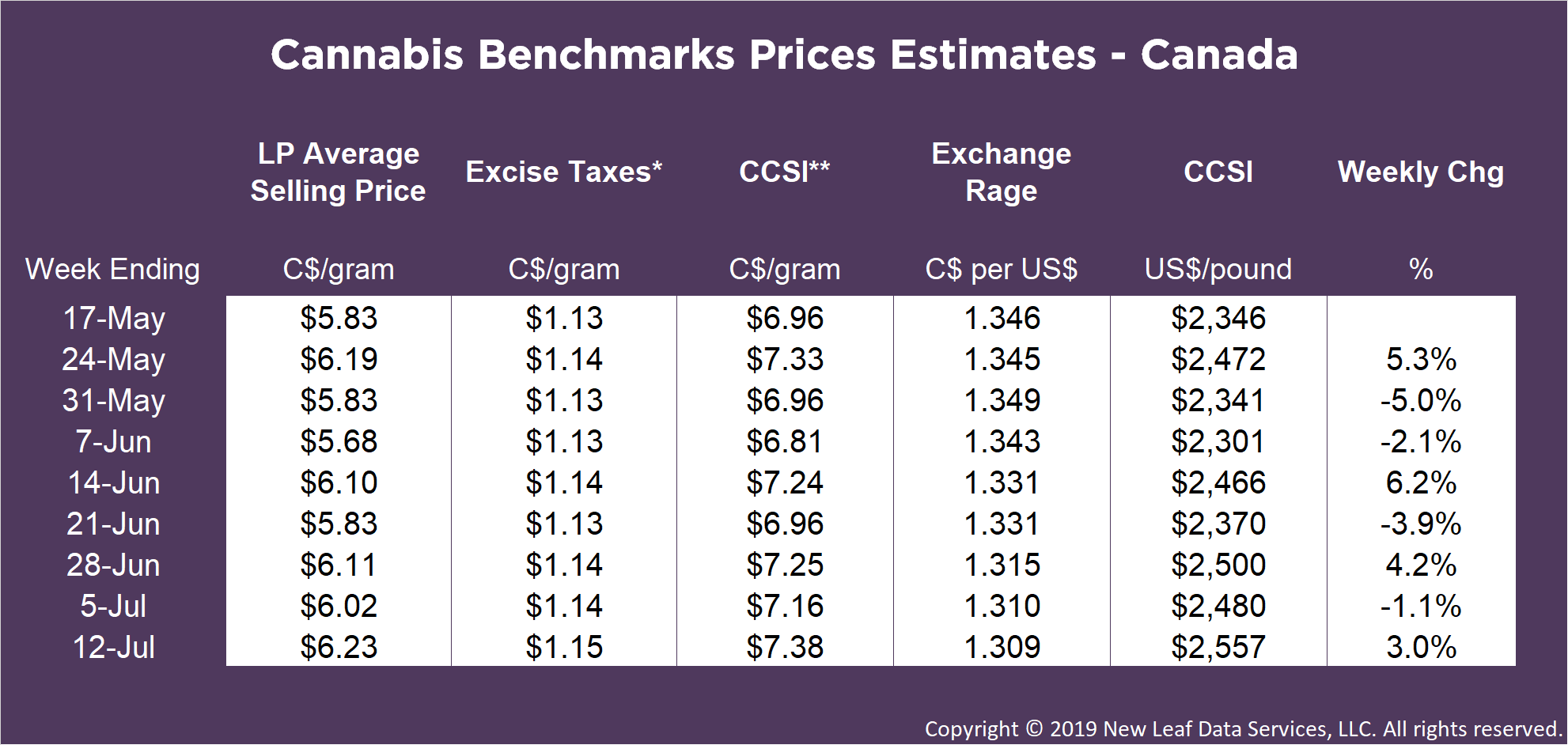

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$7.38 per gram this week, up 3% from last week’s C$7.16 per gram. This week’s price equates to US$2,557 per pound at current exchange rates.

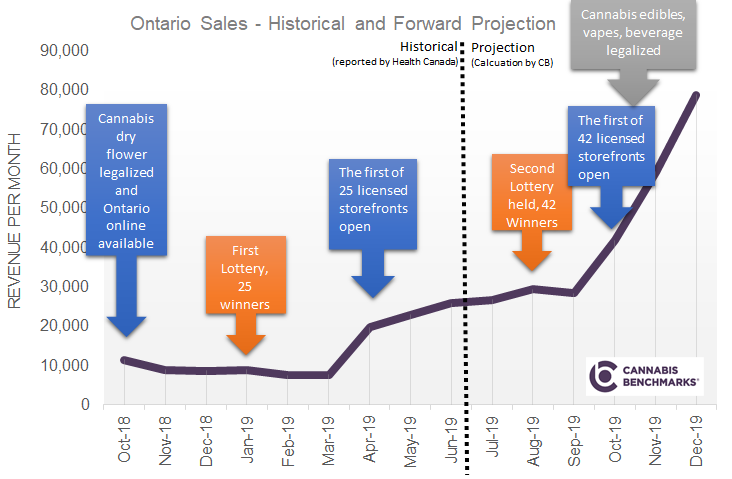

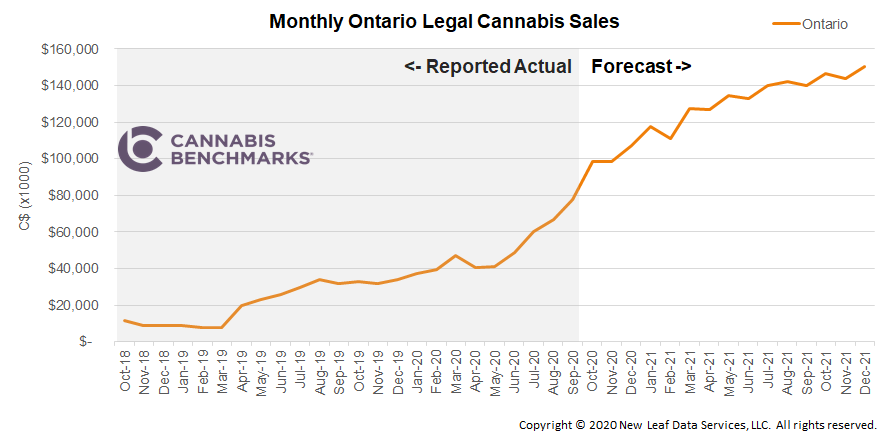

This week we examine data from Statistics Canada showing monthly cannabis stores sales figures by province. This latest issue of the data is quite important. Not only does it give us a glimpse into April sales figures, but more importantly it shows us Ontario retail sales with the opening of the first set of private cannabis stores. Prior to April, the only outlet that sold cannabis legally in Ontario was the provincially-run online store. On April 1, 10 privately-owned storefronts opened across the province, with the number growing to 22 today. With fewer supply concerns, last week the Ontario government announced it will expand the number of authorized brick-and-mortar retail locations to 75.

As seen in the map below, of the current operational stores only seven are located in the Greater Toronto Area, which has a population of 5.9 million people. To put this in perspective, each one of those stores is set up to service an average of 842,000 people, or 2.4% of the entire Canadian population.

As expected, the new Ontario retail outlets did boost cannabis sales. The average daily cannabis spend for Canada as a whole jumped by 27% in April to C$2.5M per day. Daily Ontario cannabis sales grew by a whopping 164% to C$656,000 per day. With the opening of more Ontario stores the expectation is that daily Ontario sales will continue to climb.

Source: Cannabis Benchmarks, Statistics Canada [Table 20-10-0008-01]

Some other provinces also saw a boost in sales in April. Alberta and Saskatchewan sales jumped by 13% and 24%, respectively. The one province that continues to stick out as a laggard is British Columbia, which saw an 8% month-on-month drop to C$84,000 per day.

The chart below compares each province’s proportion of the country’s total population to the proportion of total cannabis sales. At this point, any correlation between the two is virtually nonexistent. Numerous factors contribute to the disconnect between the two data points, such as number of retail locations, the provincial regulation and excise tax structure, age demographics, and more.

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..