Canada Cannabis Spot Index (CCSI)

Published July 3, 2020

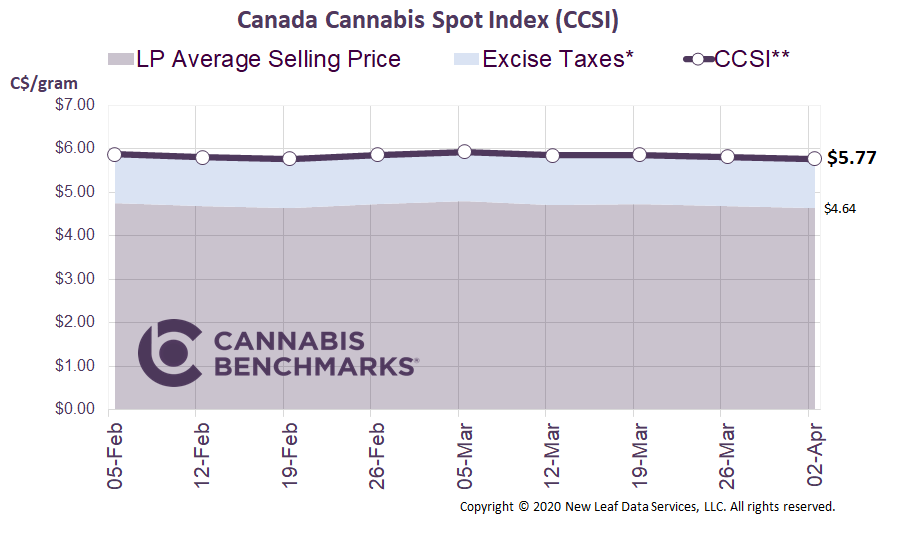

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.31 per gram this week, up 1.8% from last week’s C$6.19 per gram. This week’s price equates to US$2,101 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we look closely at the growth in licensed cannabis stores across Canada, and in Ontario in particular. Nationwide, the licensing of new stores has slowed with the onset of COVID-19 lockdowns, but we still see a steady pace of growth. At the end of June, there were 962 stores across Canada, with 59 stores added since May, and an increase of 672 stores from the same time last year.

Source: Cannabis Benchmarks, Statistics Canada

Alberta still is home to roughly half the national store count with 486 stores, but other provinces are starting to grow their physical retail presence quickly. British Columbia (BC) did not see many new shops open during June, but the BC Liquor and Cannabis Regulation Branch shows 80 new stores coming soon. This would take the total BC count from 197 to 277. There is no specified time frame for these new locations, but an address is provided for each planned new store. Ontario was the province that added the most new stores in June, with 29 coming online last month, bringing the total to 100 licensed retailers across the province.

Source: Cannabis Benchmarks

From March to June, the average increase in the number of legal storefronts in Ontario has been 17 per month. This is a significant acceleration in licensing retailers and comes after Ontario altered its approach to permitting from a lottery system to a simpler application process in late 2019.

This growth rate has occurred as Canada implemented lockdowns to stem the spread of COVID-19, and we anticipate the growth rate will accelerate as the province starts to reopen. Using a conservative growth rate of 17 stores per month would take our year-end total of operational shops in Ontario to 202. With a more aggressive average store growth rate of 35 stores per month, Ontario could have as many as 310 stores by the end of the year.

Source: Cannabis Benchmarks

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.