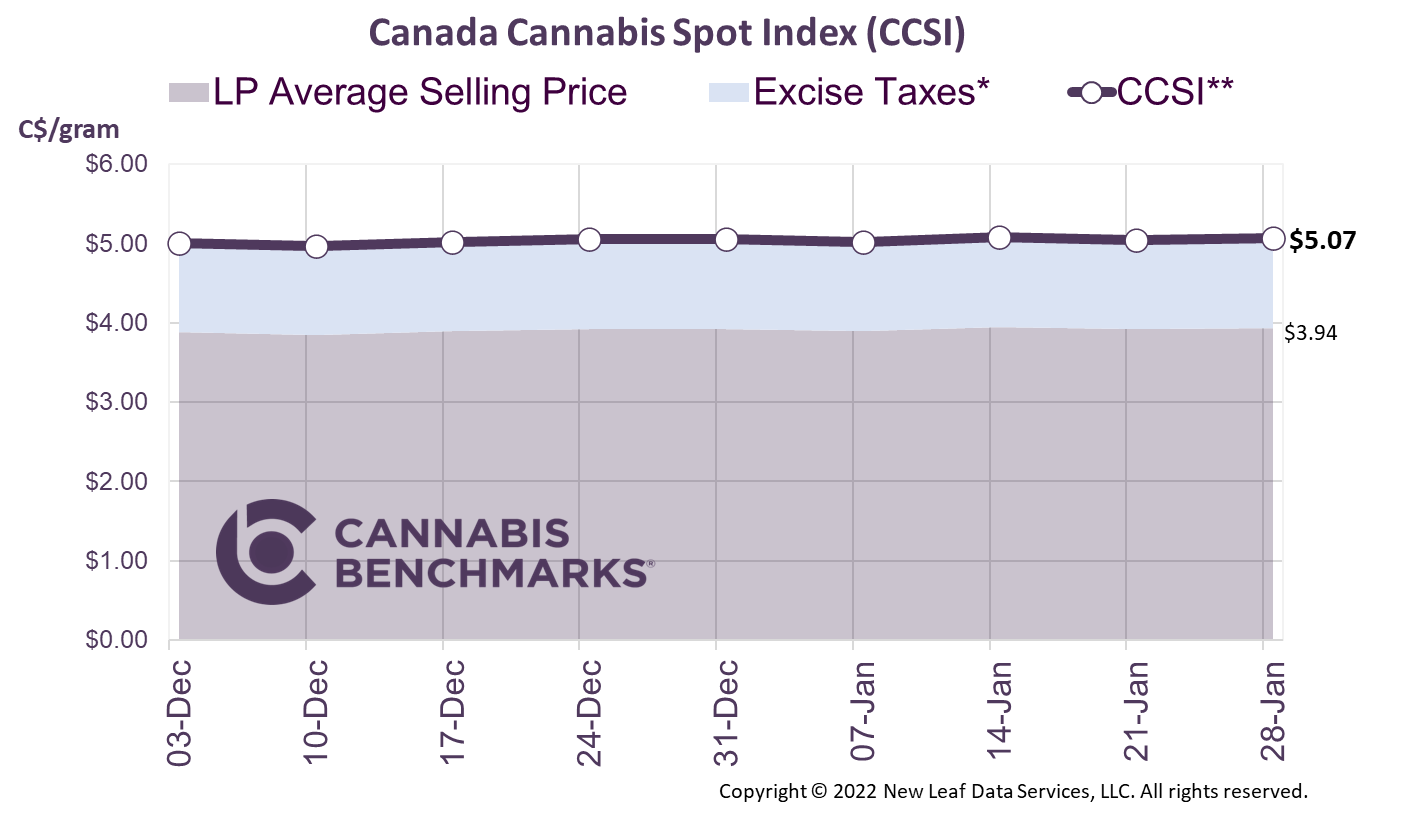

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.07 per gram this week, up 0.4% from last week’s C$5.05 per gram. This week’s price equates to US$1,812 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

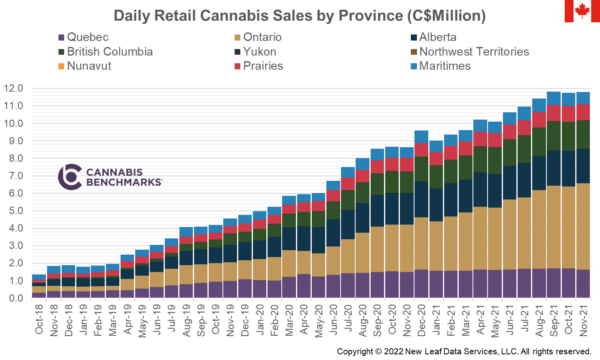

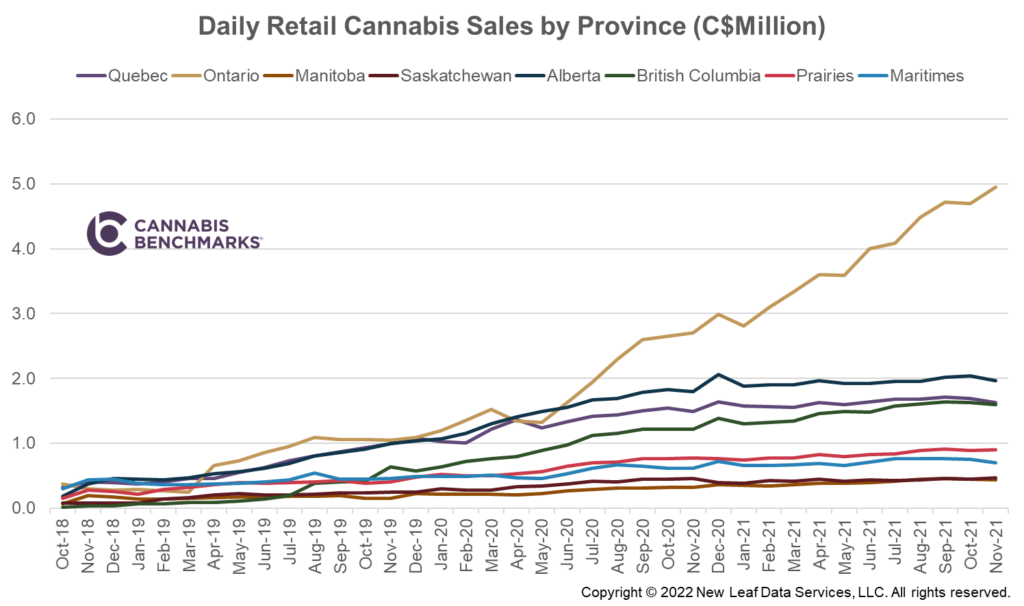

Statistics Canada recently released retail sales data for November 2021, showing nationwide legal cannabis sales began to plateau in the second half of 2021. Sales in November fell to C$353.6M. To correct for the different number of days in each month, we look at average daily sales. As seen in the chart below, November 2021 sales reached C$11.79M per day.

From August 2021 to November 2021, sales were essentially flat on a daily basis, which is somewhat concerning for the cannabis industry. Previously, expanding store counts and lower retail price points resulted in more consumers moving from the illicit to the legal sales channels, but this trend seems to have been broken in much of the country in recent months. As Canada’s cannabis market matures, we may also be seeing the development of seasonality in demand, rather than the steady growth that has characterized the market’s first three years. If state-legal markets in the U.S. are any indication, the period from September through November is typically marked by slower sales, especially relative to spring and summer months, providing the possibility that more widespread growth may resume later this year.

When we look at the data on the provincial level, all provinces with the exceptions of Saskatchewan and Ontario dropped in daily sales. Ontario’s growth will continue to fuel the Canadian cannabis market in 2022. As the store count in that province grows, more consumers will access cannabis through legal channels, further driving sales. Alberta will also potentially see a growth in sales as private retailers there are expected to launch their online stores in March.