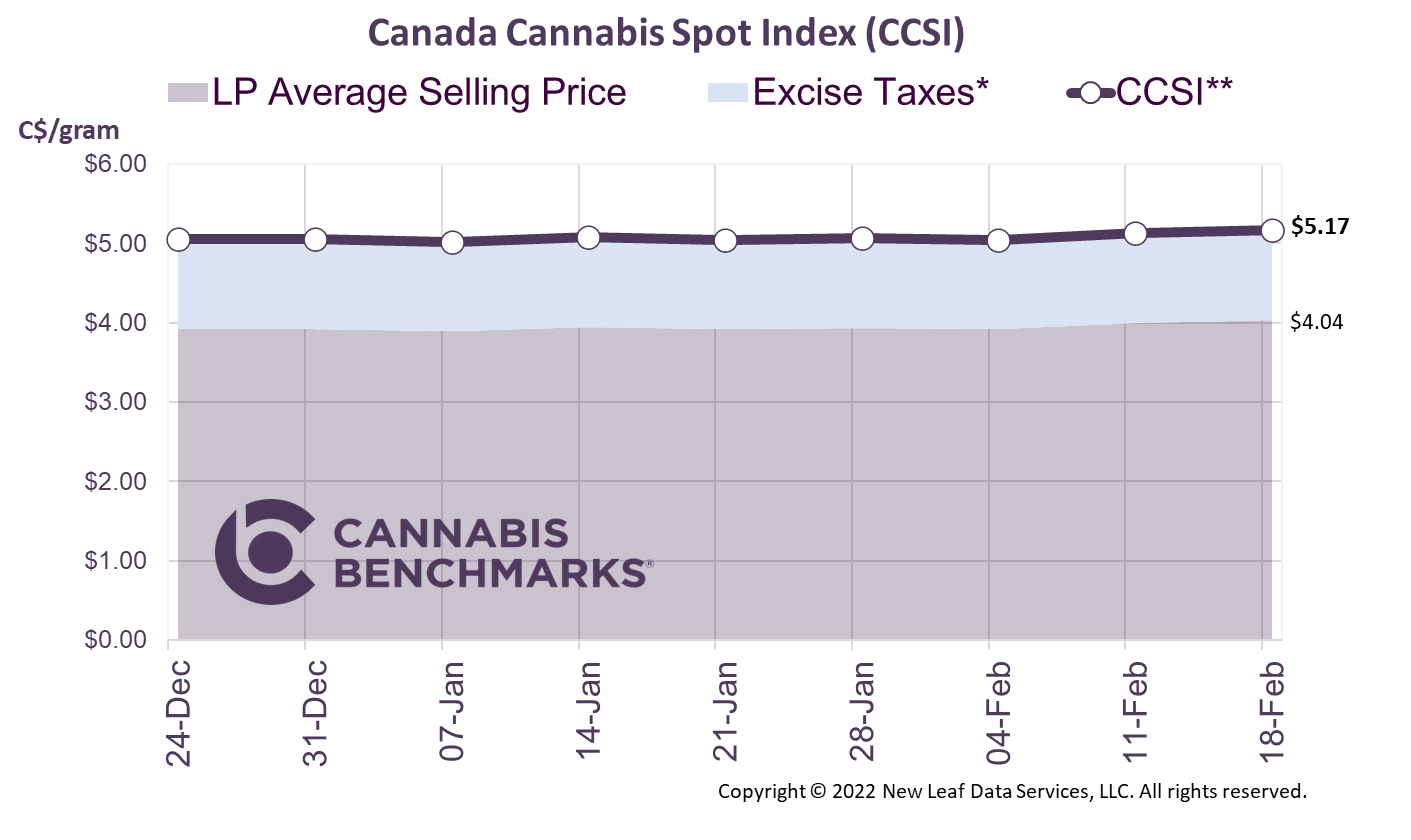

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.17 per gram this week, up 0.7% from last week’s C$5.13 per gram. This week’s price equates to US$1,844 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

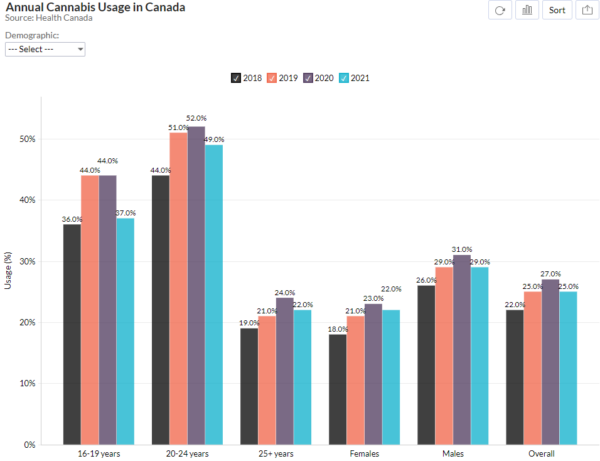

This week we analyze data collected by Health Canada regarding trends in cannabis usage in the country. The agency conducts an annual Canadian Cannabis Survey to obtain “detailed information about the habits of people who use cannabis and behaviors relative to cannabis use.” The 2021 survey had over 10,000 responses split almost evenly between males and females from various provinces. The data is all reported at the national level, despite the agency having specific provincial data. While there is a plethora of data collected, in this week’s report we focus on a few high-level trends in cannabis usage and sources of cannabis.We begin by looking at the trends in Canada’s cannabis usage rate since 2018. In all categories, cannabis usage rose from 2018 through 2020, with a small drop in 2021. The drop-off in usage for 2021 can likely be explained by anomalously elevated usage in 2020, when stay-at-home orders during the initial surge of the COVID pandemic were in place, resulting in more free time and disposable income for consumers. At the national level, approximately 25% of the population used cannabis in 2021, down from 27% the year prior, with provincial estimates ranging from 17% to 38%. Also apparent in the data is that the male population is more likely to use cannabis products, with 20 to 24-year-olds the age group in which cannabis usage is most prevalent. The data indicates a steep drop-off in usage rates for those over 25.

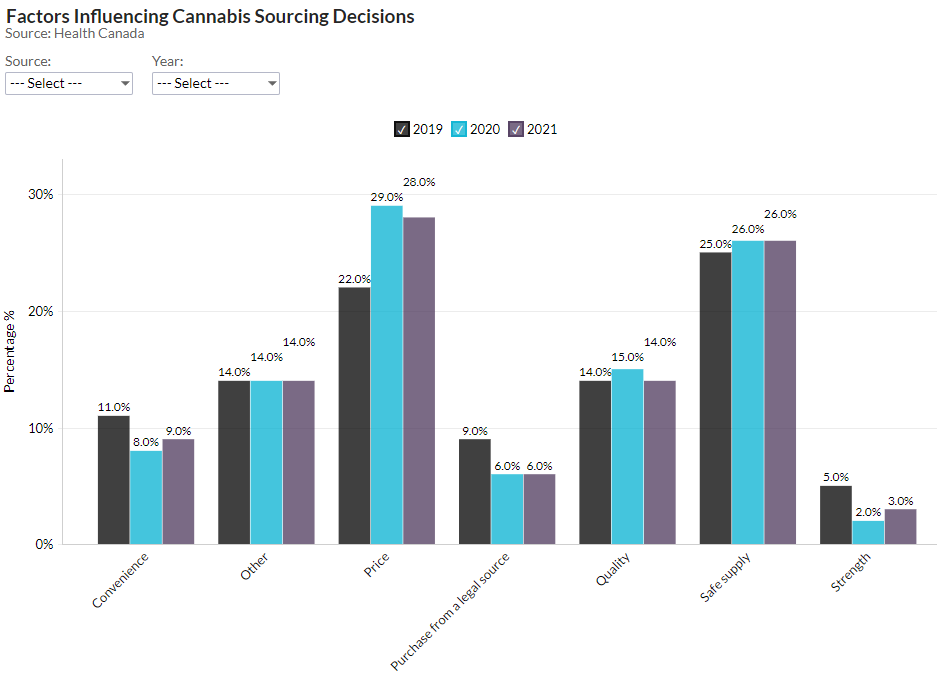

The next trend we examine are the factors that influenced where consumers sourced their cannabis over the past three years. The data was complete for 2020 and 2021, but we did need to make some assumptions for the 2019 dataset, as it was not as complete. What is apparent from the data is that cannabis users are most sensitive to price and safe supply, followed by quality and convenience.

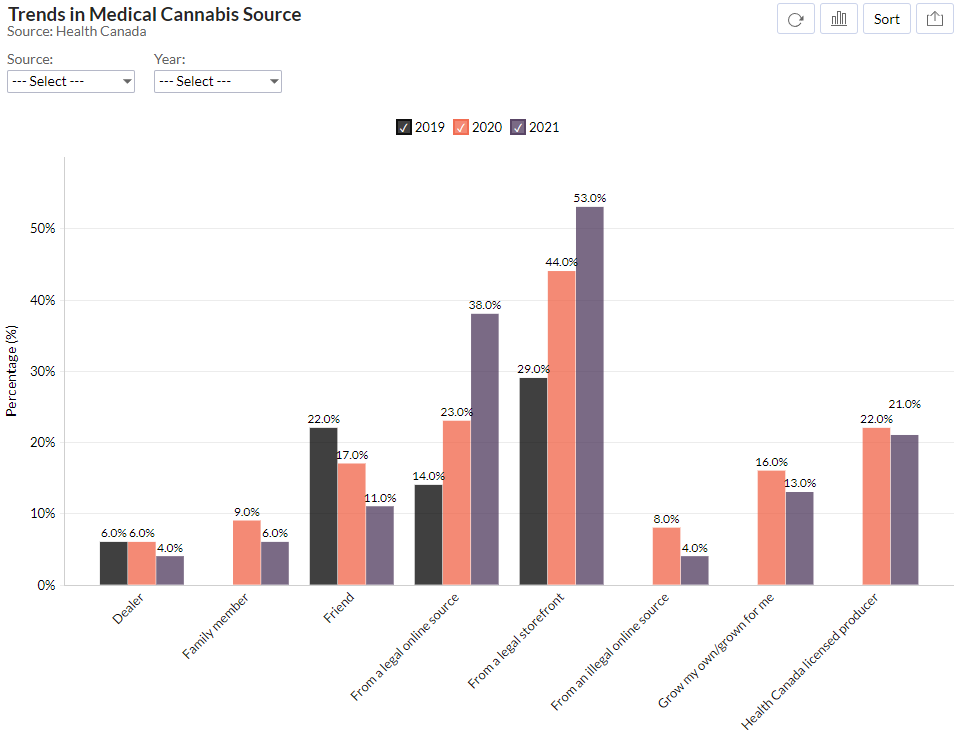

Lastly, we look at some trends in the medical cannabis market. While survey respondents could choose more than one source, the data clearly indicates that legal outlets – including licensed recreational storefronts and online options, as well as Health Canada licensed medical cannabis producers – are preferred to unlicensed sources. As seen over the past three years, there is an increasing trend to purchase cannabis from a legal, recreational source (online or storefront) and a negative trend to acquiring it from a dealer, friend, or illegal online source.

Although this is good news for the legal cannabis industry as a whole, the increasing preference for legal recreational sources also came at the expense of cultivators licensed in the country’s medical cannabis program, which saw the proportion of survey respondents selecting that category as a preferred source wane from 2020 to 2021. As seen in the chart below, the last category, “Health Canada licensed producer,” the cannabis source for registered medical patients, garnered a relatively weak response. Only 21% of medical cannabis users get products directly from licensed medical providers, and it appears they increasingly prefer the convenience and product variety found in the legal recreational markets. Our modeling of demand for recreational versus medical cannabis affirms the survey findings, with total kilograms sold in the medical market consistently constituting only a small fraction of the volume sold in the recreational market.