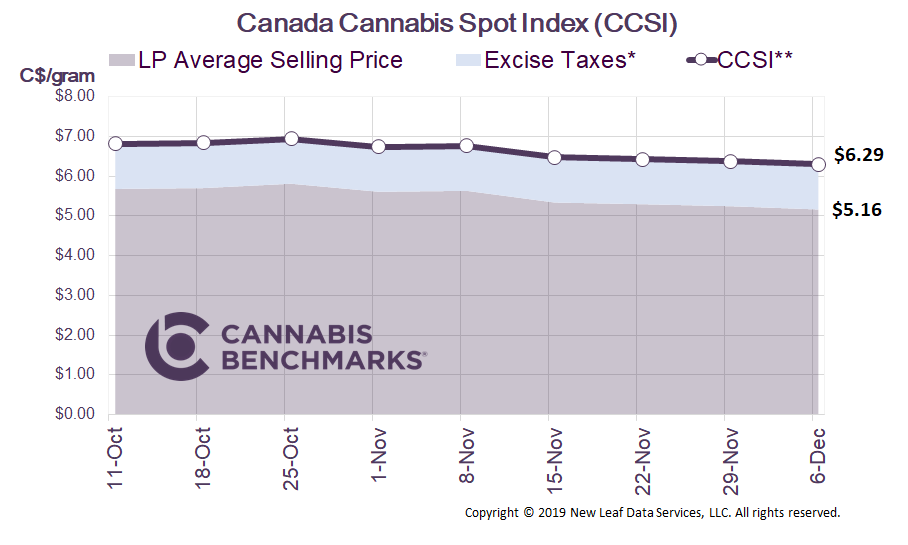

Canada Cannabis Spot Index (CCSI)

Published December 6, 2019

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.29 per gram this week, down 1.3% from last week’s C$6.37 per gram. This week’s price equates to US$2,151 per pound at the current exchange rate.

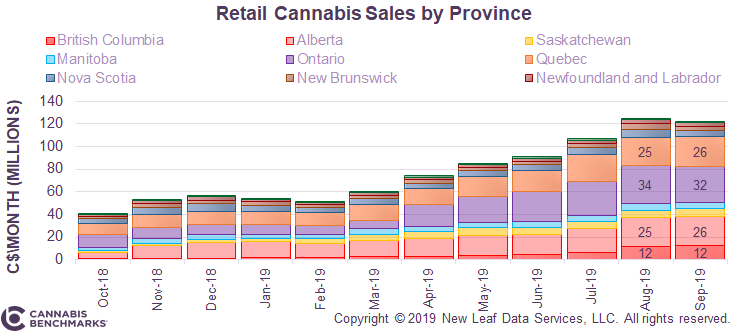

This week we look at retail cannabis sales for September. Statistics Canada reported the unadjusted September sales to be C$123M, which was C$3M or 2.4% below August sales. This recent data point is not positive for the industry as it shows plateauing overall sales, despite a growing number of storefronts in some major provinces.

Cannabis Benchmarks’ estimates approximately 59 new stores opening in September, all of them in Alberta and British Columbia. However, additional retailers in those provinces did not result in significant sales expansion in September. The chart below shows monthly retail cannabis sales by province. In addition to relatively stable sales in the two aforementioned provinces, the other two largest – Ontario and Quebec – saw a small decrease and a small increase, respectively, in revenue generated by legal cannabis retailers.

Source: Statistics Canada, Cannabis Benchmarks

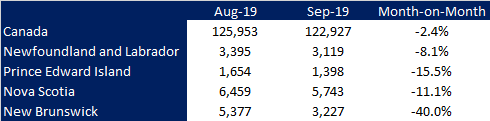

One of the most notable figures from the September report was the large drop in sales from the Maritime provinces. Up until now, these four Eastern provinces have been outperforming the rest of the country in sales per cannabis user. Up until April, sales from the Maritime provinces were higher than all of Ontario and their September sales still exceed those of British Columbia.

Source: Statistics Canada

We are not certain of the exact reason for the drop in sales, but we suspect it is not due simply to a decline in cannabis consumption. We believe the combination of dropping cost of cannabis from expanding inventory at the producer and distributor level is leading to margin compression, hence lower price points and lower revenue. Some of the major producers have already introduced new discounted brands to be more competitive with the illicit market, in the hope of building the legal system’s market share.

Also, it is potentially worth noting that data from more mature adult-use cannabis markets in the U.S. frequently evince downturns in monthly sales from August to September. For example, in four of the previous five years, monthly cannabis sales in Colorado reached their annual peak in August. Of course, we do not yet have enough historical data to determine whether Canadian cannabis sales will mimic trends documented in the U.S., but it is possible that the September decrease is part of a seasonal lull similar to those observed in numerous state markets south of the border.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.