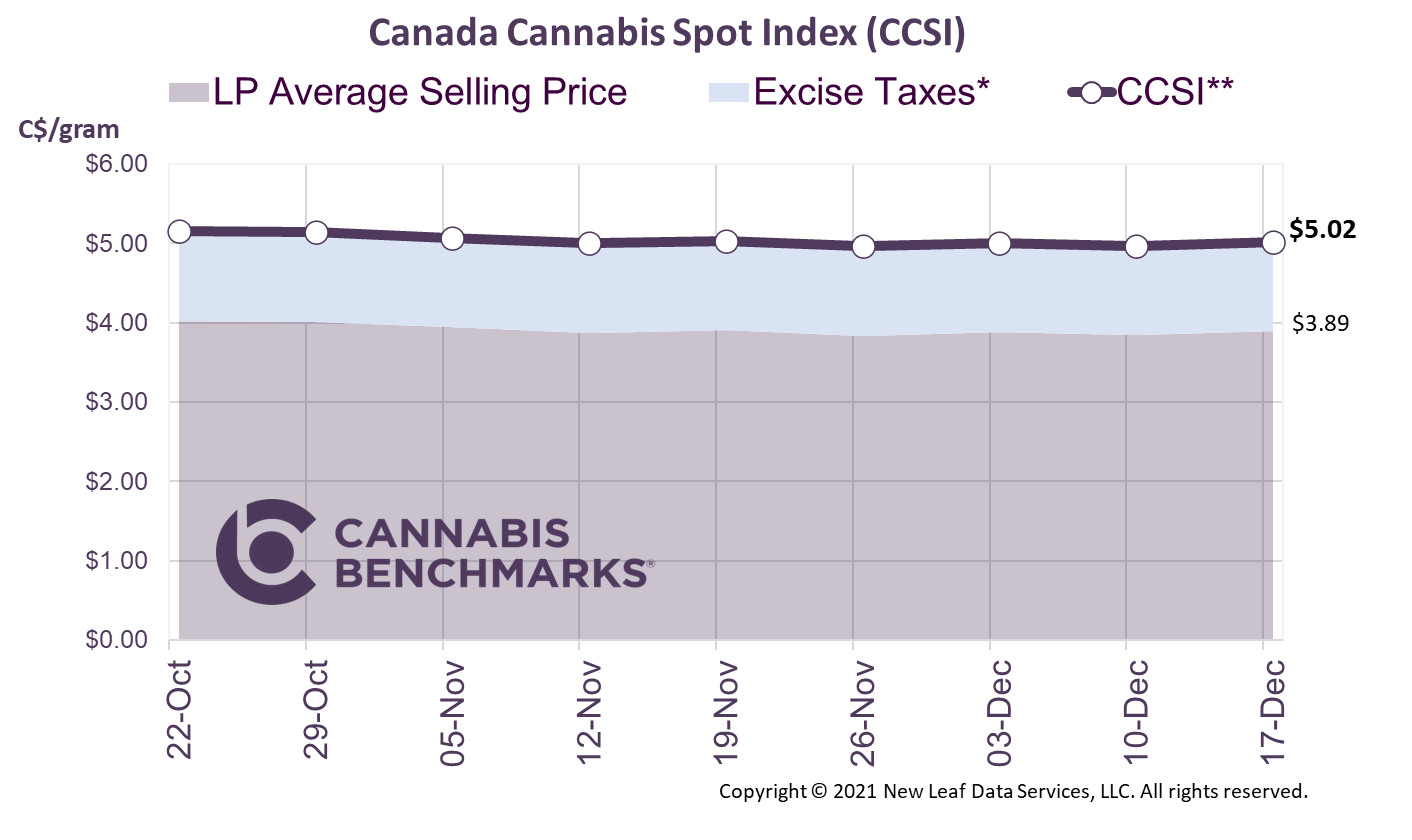

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.02 per gram this week, up 1.0% from last week’s C$4.97 per gram. This week’s price equates to US$1,780 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

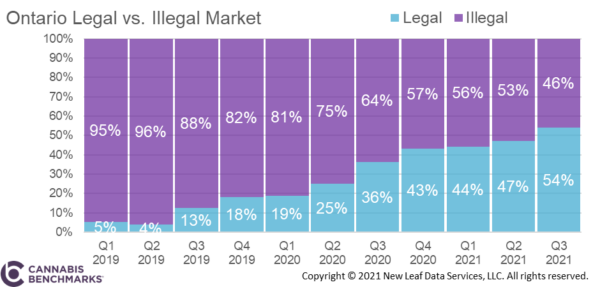

This week the Ontario Cannabis Store (OCS), the organization that regulates the province’s cannabis market, released its quarterly Cannabis Insights report for the period from July through September 2021. The report contains a wide variety of useful data, detailing how Ontario’s market has developed.

In the first few years of cannabis deregulation, the legal Canadian cannabis market has faced strong competition from illicit supply chains, due in part to high product prices and few stores. That story has changed dramatically, however, especially in Ontario, Canada’s largest province by population.

The most recent report shows that Ontario’s brick-and-mortar retail footprint grew rapidly in 2021, leading to a big jump in legal cannabis sales. The latest report shows the legal cannabis market in Ontario makes up 54% of total cannabis sales, which was a big jump from the previous quarter.

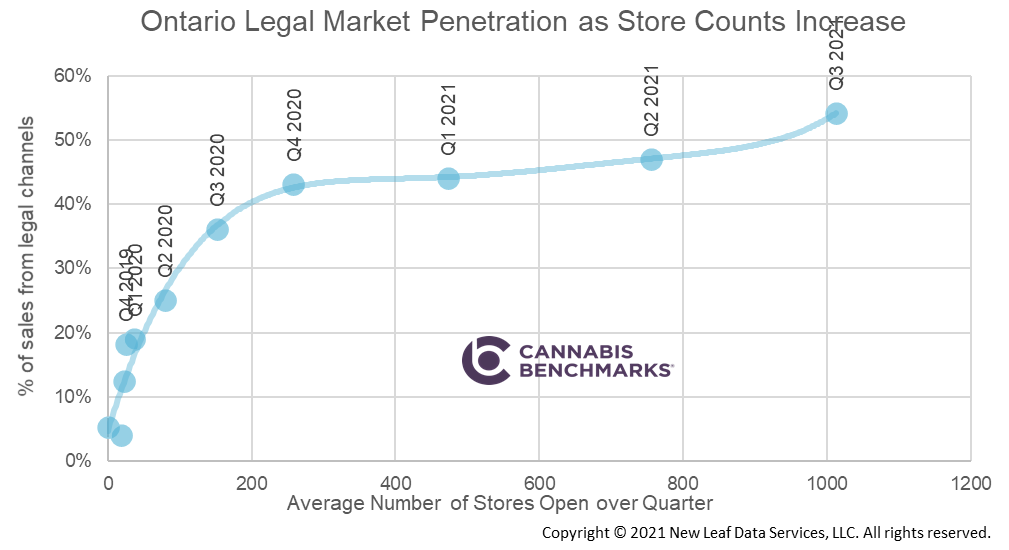

The chart below shows the average number of stores in Ontario over the past eleven quarters, as tracked by Cannabis Benchmarks, versus the share of the legal cannabis market. The growth of the legal cannabis sector had a very strong correlation to the number of storefronts open for business before 2021, but this year that relationship has broken down.

This is not all bad news though, because total recreational sales continue to pick up each month. We believe that legal sales would be much higher if stores were more evenly spaced out. In Ontario, stores are in close proximity in densely populated areas and shopping districts; hence the recent rising store count is not necessarily pushing out the illicit suppliers. The increasing store count in these areas is simply increasing competition amongst legal operators, leading to lower customer traffic and poorer margins. There are calls for the provincial and municipal governments to better regulate licensed locations, and we expect that will happen and be a big positive for the industry.