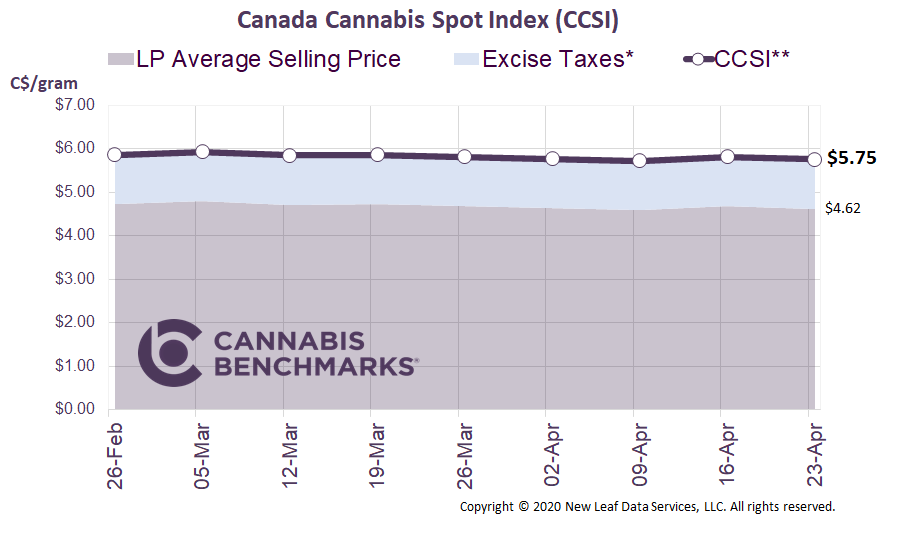

Canada Cannabis Spot Index (CCSI)

Published August 28, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.28 per gram this week, down 2.8% from last week’s C$6.47 per gram. This week’s price equates to US$2,166 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we look at the state of the Canadian medical cannabis market since recreational legalization. The medical cannabis sector faces stiff competition from both the legal recreational market and the still-robust illicit market. That being said, medical cannabis is still a significant area of focus for many of the large cultivators, which can be seen in their financials. For example, Canopy showed its medical cannabis business outperforming in its recent quarterly earnings release for the three-month period ending June 30. They showed growth of 3% in its medical business, while recreational sales to consumers declined by 29% due to COVID and competition.

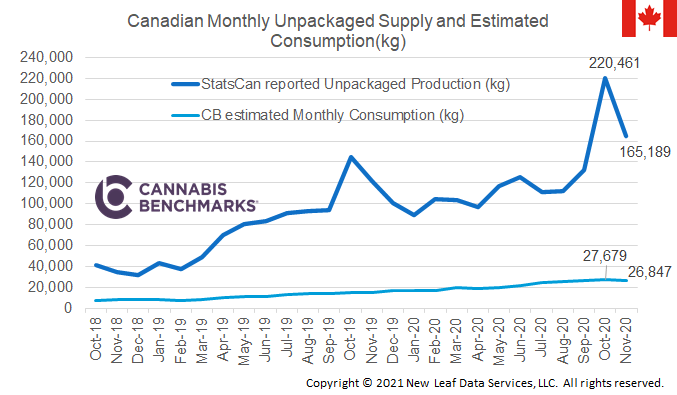

Despite remaining a focus for many licensed producers, trends in the Canadian medical cannabis sector show it contracting for the most part, with no bottom reached just yet. The first dataset we look at is the number of active medical clients registered by licensed producers. The number of medical clients increased during the first year of legalization, but starting in September 2019 we have seen huge declines in registered patients. We attribute this drop to the increase in recreational retail outlets, increased product variety (including Cannabis 2.0 items), and falling prices.

Source: Cannabis Benchmarks

Even as store counts increased significantly, particularly in Ontario, Cannabis Benchmarks projections did not anticipate the sales growth that occurred from May to June. Momentum in the industry was underestimated due to most Canadians being under some degree of lockdown order at the time.

June’s numbers tell us that more Canadians are using cannabis products whilst under lockdown and they are choosing to buy through legal channels. Such trends have been observed in legal U.S. cannabis markets as well. These conclusions are supported by Ontario’s sales patterns. Ontario saw sales jump by 19% month-on-month in June, while the province’s store count only increased by 6.5%. This indicates that each store is serving a wider base of customers, assuming clients are purchasing similar quantities. Given that legal cannabis stores have been permitted to remain open during the pandemic it is unlikely that consumers are making outsized purchases to stock up or hoard product. This reasoning suggests the assumption that individual buying patterns have remained stable is a sound one.

Looking beyond June, we now see sales continuously expanding and believe that many consumers have been converted from the illicit market to legal channels as a result of the COVID-19 pandemic. We project sales will continue to increase each month as new stores open and more Cannabis 2.0 products become available.

Cannabis 2.0 products seem to be key to higher sales for many of the top licensed producers (LPs). As dried flower prices sag to compete with both the illicit market and other legal businesses, LPs see Cannabis 2.0 products as a major growth sector where they can extract a premium for their production.

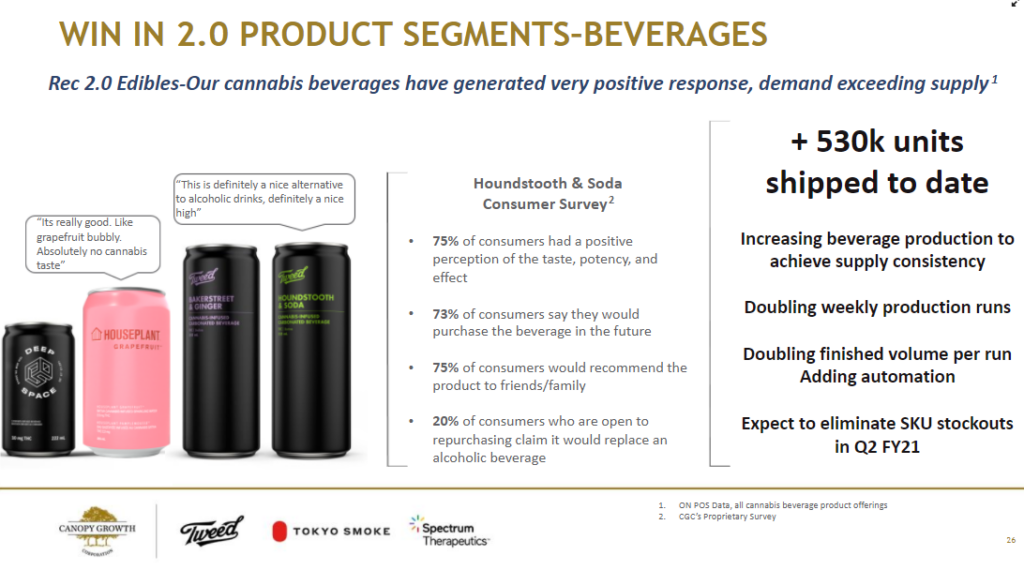

For example, in Canopy’s latest earnings call, management noted cannabis beverages as a key offering to grow its market presence, especially amongst consumers who have no interest in smoking as a consumption method. With the expertise of its investor and partner Constellation Brands, the company announced in a May 2020 investor presentation that it has shipped 530,000 drinks since the launch of Cannabis 2.0 products in Q4 2019.

Beverages, along with other key products such as vapes, accounted for 12% of Canopy’s total sales in the latest earning quarter. The company expects cannabis beverages to soon make up 5% of the total Canadian beverage market. It is still unclear if these sales are one-time novelty purchases or if consumers will make a habit of buying cannabis beverages, but Canopy claims the demand is there and will be consistent. As a result, they have doubled their weekly production runs to eliminate SKU stockouts by mid-2021.

Below are some slides from the May Virtual Investor Meeting.

Source: Canopy Growth Investor Presentation – May 2020

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.