Canada Cannabis Spot Index (CCSI)

Published August 21, 2020

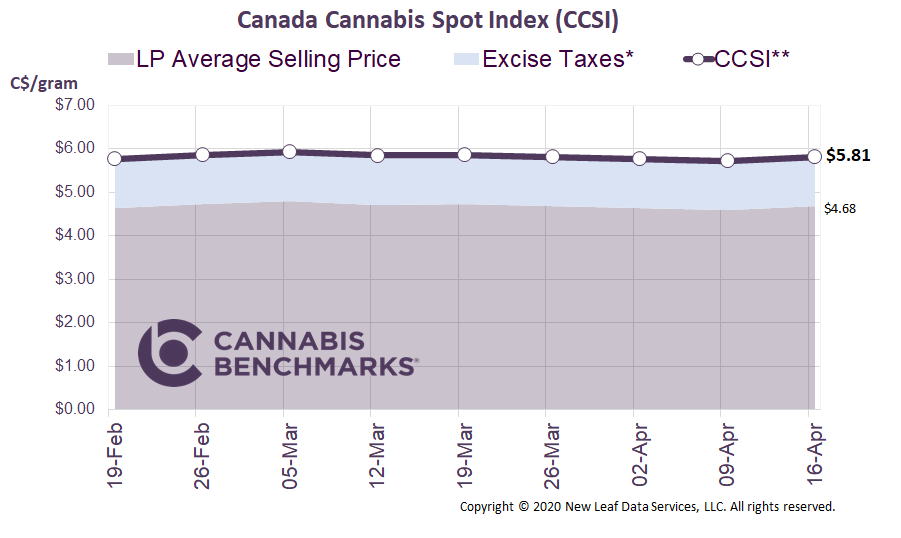

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.47 per gram this week, up 3.8% from last week’s C$6.23 per gram. This week’s price equates to US$2,220 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we look at the state of the Canadian medical cannabis market since recreational legalization. The medical cannabis sector faces stiff competition from both the legal recreational market and the still-robust illicit market. That being said, medical cannabis is still a significant area of focus for many of the large cultivators, which can be seen in their financials. For example, Canopy showed its medical cannabis business outperforming in its recent quarterly earnings release for the three-month period ending June 30. They showed growth of 3% in its medical business, while recreational sales to consumers declined by 29% due to COVID and competition.

Despite remaining a focus for many licensed producers, trends in the Canadian medical cannabis sector show it contracting for the most part, with no bottom reached just yet. The first dataset we look at is the number of active medical clients registered by licensed producers. The number of medical clients increased during the first year of legalization, but starting in September 2019 we have seen huge declines in registered patients. We attribute this drop to the increase in recreational retail outlets, increased product variety (including Cannabis 2.0 items), and falling prices.

Source: StatCan, Cannabis Benchmarks

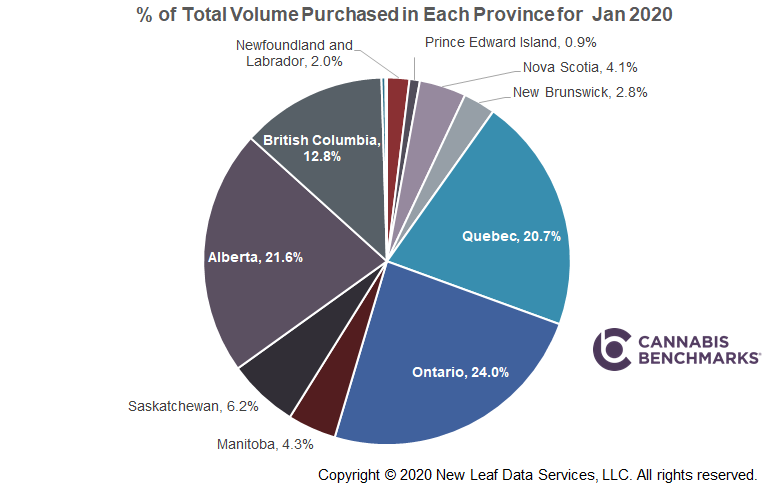

In October 2018, when recreational cannabis was federally legalized, two provinces – Alberta and Ontario – were home to 78% of the country’s active registered medical cannabis clients. The two provinces can be seen as case studies in how the development of the recreational market can impact demand in the medical sector.

Alberta on one hand made it quick and simple to open a new recreational retail location, while Ontario’s licensing process was much slower. This shows in the number of retail stores open in both provinces. Ontario, with 14.4 million citizens, had 116 stores open by the end of July; Alberta, with 3.4 million citizens, had 500 stores open.

With more convenient access in Alberta, a significant portion of medical cannabis clients let their registrations lapse and shifted to purchasing in the recreational sector. Contrastingly, with few stores open, Ontario saw an increase in medical cannabis clients up until September 2019. With more Ontario stores opening, the previous increase in registered medical cannabis clients is being reversed, as they can obtain product via recreational retailers without going to the trouble of registering with the medical program.

Alberta currently has 73,000 medical cannabis clients, down 19% from October 2018. Ontario currently has 171,000 medical cannabis clients, 1% lower than the number registered in October 2018.

Source: StatCan, Cannabis Benchmarks

Another dataset that illustrates the downward trend in Canada’s medical market is the number of monthly medical cannabis cannabis shipments from licensed producers to patients.

Source: StatCan, Cannabis Benchmarks

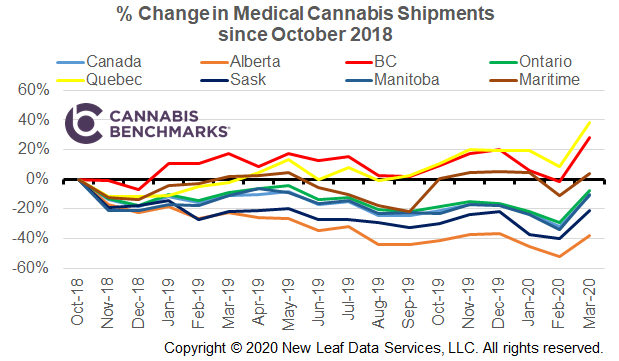

As seen above, there is a clear downward trend from October 2018 to February 2020. However, that trend was disrupted notably in March 2020. The reason behind the spike in shipments in March is that registered medical clients placed an outsized amount of online orders, as Canadians became subject to COVID-related lockdowns.

Province by province we see a similar trend, as shown in the chart below, with the exceptions of British Columbia (BC) and Quebec. Although BC has built out a robust retail footprint, residents still rely heavily on the illicit market, which is traditionally strong in Western Canada. While Quebec has some of the most inexpensive recreational cannabis prices in the country due to a low provincial mark-up, it does not have a well-built recreational retail network. This has led to medical cannabis shipments holding steady, and even increasing.

Source: Cannabis Benchmarks

For more data and analytics like this, subscribe to the Cannabis Market Insights report developed in collaboration Nasdaq. This in-depth monthly report provides exclusive data and analysis on the legal cannabis industry, focusing largely on the Canadian cannabis market, as well as the cannabis equities market in the U.S.