![]()

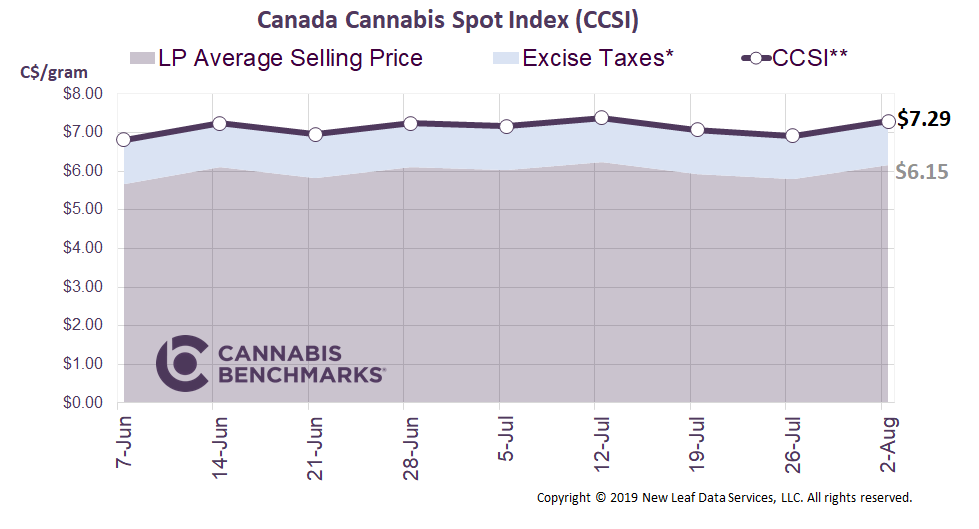

Canada Cannabis Spot Index (CCSI)

Published August 2, 2019

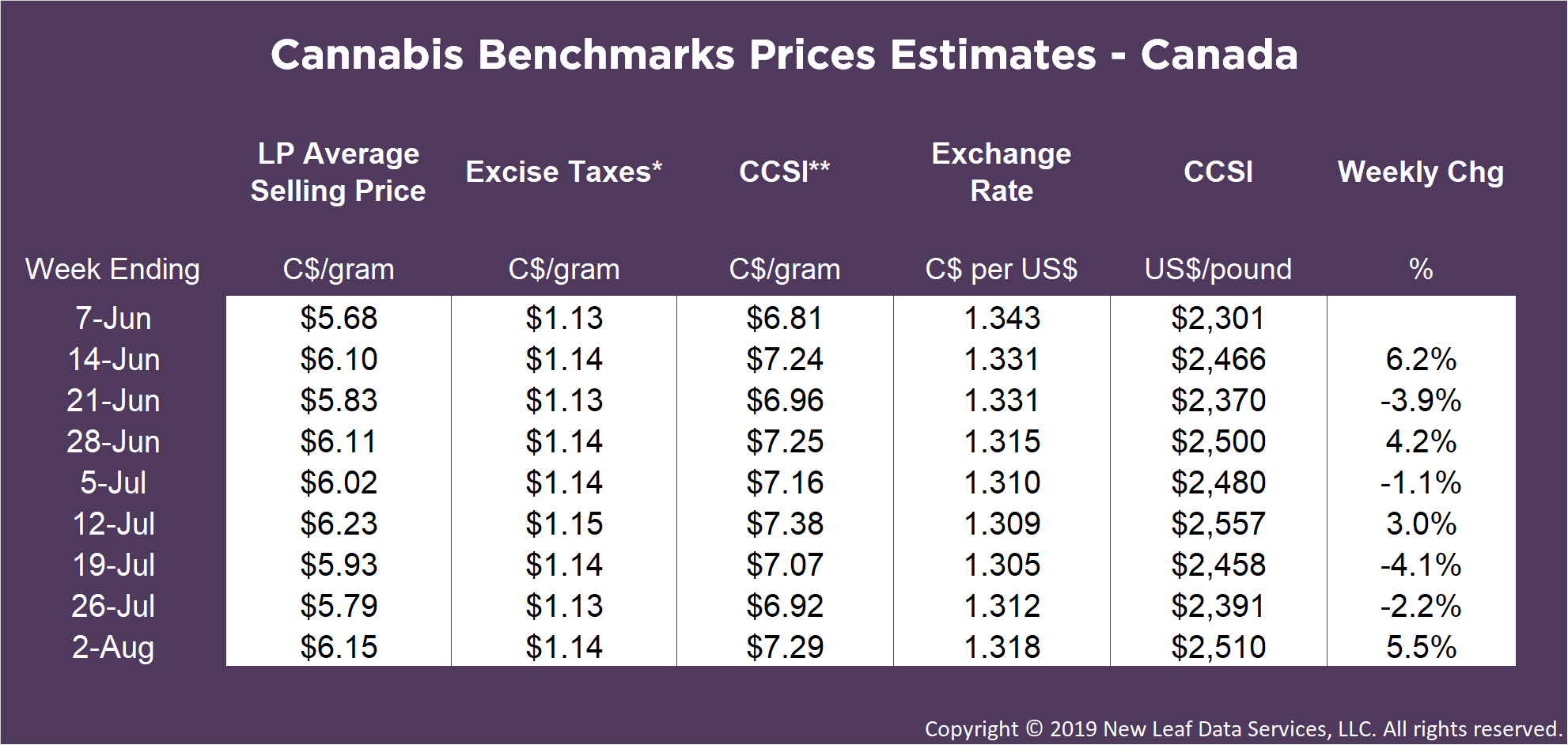

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$7.29 per gram this week, up 5.5% from last week’s C$6.92 per gram. This week’s price equates to US$2,510 per pound at current exchange rates.

Canada is the only G7 country that has legalized cannabis for both medical and recreational purposes, but the growing number of licensed producers (LPs) and their production capacity is causing a big discrepancy between supply and current demand at home. However, the imbalance can be viewed as intentional when considering that Canadian companies are building capacity and expertise to capitalize on capturing a large portion of total global cannabis revenue.

As part of each of their growth plans, these major multi-billion dollar companies recognize the international medical and pharmaceutical cannabis market as having significant long-term business potential.

Despite its geographic proximity, export to the U.S. is not expected to be feasible for Canadian companies due to overproduction in numerous states, apparent in the significant price erosion observed in the most advanced adult-use markets in recent years, in addition to a robust illicit market in states that have not legalized.

Europe and Latin America seem to be the preferred destination for Canadian cannabis. In both regions there is growing demand for medicinal cannabis but limited production infrastructure, regulation, and technology. Canadian LPs have an edge in these markets, which is allowing them to export not only products to these countries, but also cultivation technology, extraction techniques, cultivars, and business knowledge.

Thirty countries have legalized medical cannabis. Major Canadian LPs are either exporting their production to, or building a physical presence in many of them. The simple intent is to be the dominant player in this emerging global space. As of mid-2019, Canada is one of the largest exporters of legal cannabis products. Major LPs are responsible for the export of thousands of kilograms of cannabis to supply medicinal markets in countries that lack cultivation capacity. The export destination to date include: Croatia, Cyprus, Czech Republic, Germany, New Zealand, South Africa, and the United States.

What is the process of exporting?

Under the Cannabis Act, Canadian LPs require a permit to export cannabis and related products for medical use. An application is submitted to Health Canada, which requires that the applicant holds an import permit from the final destination country and confirmation the destination country has not met or exceeded its import limit for the current year. This process can take as little as 30 days, according to a statement made by Aurora Cannabis.

For recreational cannabis, the rules are inflexible and undeveloped. A number of international treaties ban the movement of cannabis for recreational purposes, regardless of the domestic legal status of cannabis in a specific nation. Canada is a signatory to three international treaties that prohibit the movement of cannabis for recreational purposes:

Consequently, Canadian LPs will be restricted to international cannabis trade for medical and scientific purposes until the World Health Organization and United Nations take steps to adjust the terms of the treaties noted above, or reclassify cannabis and cannabis products in some way.

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..