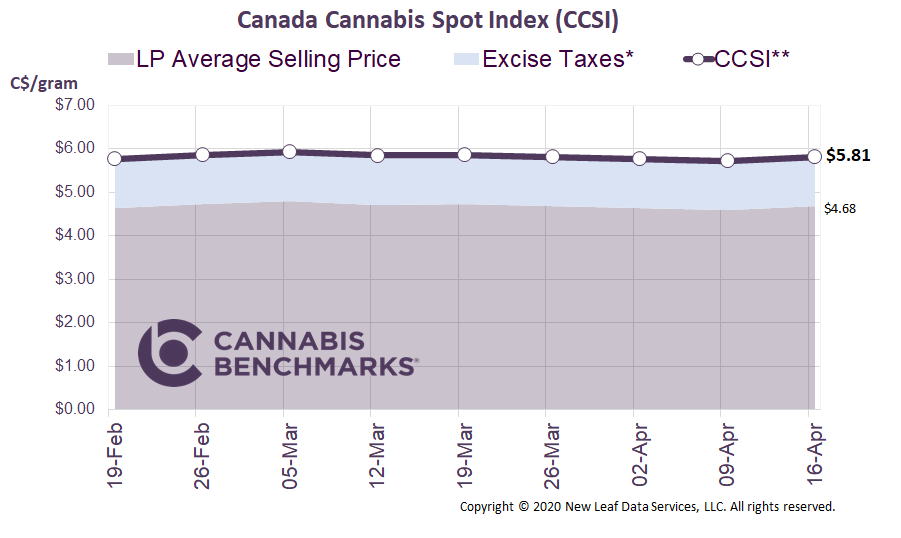

Canada Cannabis Spot Index (CCSI)

Published April 17, 2020

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.38 per gram this week, down 1.3% from last week’s C$6.46 per gram. This week’s price equates to US$2,067 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor NetworkIf you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

Online Sales on a New Course

With the enactment of the Cannabis Act, provinces and territories were given the responsibility for determining how recreational cannabis would be distributed and sold in their jurisdictions. Each instituted a variety of regulatory frameworks, resulting in an industry structure composed of public, private, and hybrid systems for brick-and-mortar and online stores.

Below is a summary of the structure set out in each province.

Source: Cannabis Benchmarks

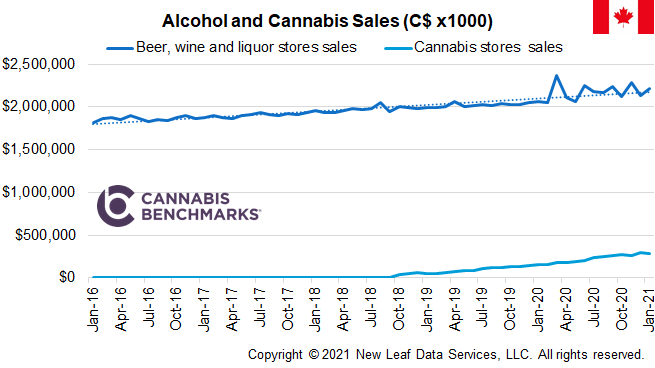

All provinces, other than Manitoba and Saskatchewan, have some government intervention in the sales of cannabis products. In most cases, the provincial government controls the online sales channel of cannabis. Surprisingly, Canadian cannabis consumers have preferred purchasing their cannabis in stores rather than online from the comfort of their home. This has been evident in the correlation between the rapid increase in monthly sales and the establishment of new stores.

Cannabis Benchmark estimates the total number of cannabis retail stores in Canada at 806 as of March 2020, an increase of 615 from the previous year. Alberta has held the top spot in terms of the number of cannabis stores, as well as the lowest average distance between consumers and the nearest cannabis store. The Alberta regulatory framework for issuing new retail licenses is the quickest and most relaxed, unlike Ontario, which was slow to issue licenses.

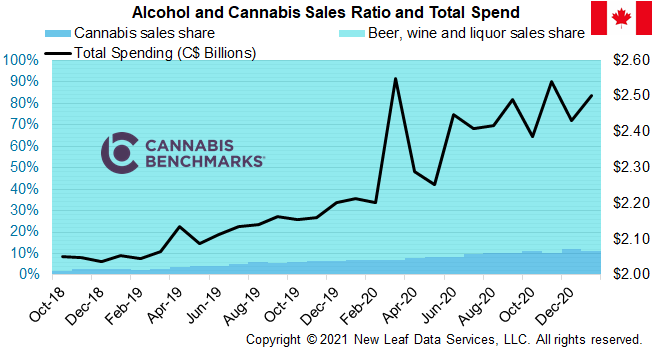

As more physical retail locations get built out, the average distance between Canadians and the nearest licensed cannabis store is decreasing. This is leading to higher monthly sales in the legal market and, presumably, lower sales through illegal channels. Additionally, as more consumers head to brick and mortar stores, online stores sales have been falling dramatically – until the COVID-19 pandemic and the accompanying mitigation measures taken by the federal and provincial governments.

As reported in a BloombergBNN article, the Ontario Cannabis Store reported an explosion in online sales as consumers stuck at home stocked up on cannabis. In the second half of March, daily online orders nearly tripled to 5,000 orders; April sales are even higher at 9,000 orders per day month-to-date. Of all the orders, more than 33% are being placed by customers new to the OCS, indicating that the illicit market is losing market share during this crisis.

In past reports, we estimated total March retail cannabis sales across Canada spiked to C$216M. This is a massive jump from C$154M reported for January 2020 by Health Canada, and more than three-and-a-half times greater than March 2019’s sales of C$59M.

Today we add to that analysis by breaking out the portion of sales we expect to come from online sales. While online sales had been on a decline, the global COVID-19 pandemic seems to be setting them on a different course. Our estimates show Canadian online sales reaching a total of C$14M throughout March, or C$450k daily. In April, the trend will continue higher as more consumers rely on home delivery of cannabis.

Source: Cannabis Benchmarks

This prompts the debate of whether cannabis producers should be able to bypass the provincial governments and retail networks to sell directly to consumers. This would allow licensed producers to better compete against their number one competitor – the illicit market. By selling direct to consumers, LPs could keep prices lower by cutting out unnecessary transport to provincial facilities, storage at public distribution points, and provincial sales margins. After all, LPs already sell medical cannabis directly to patients. Email us with your thoughts at [email protected].

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.