Canada Cannabis Spot Index (CCSI)

Published April 3, 2020

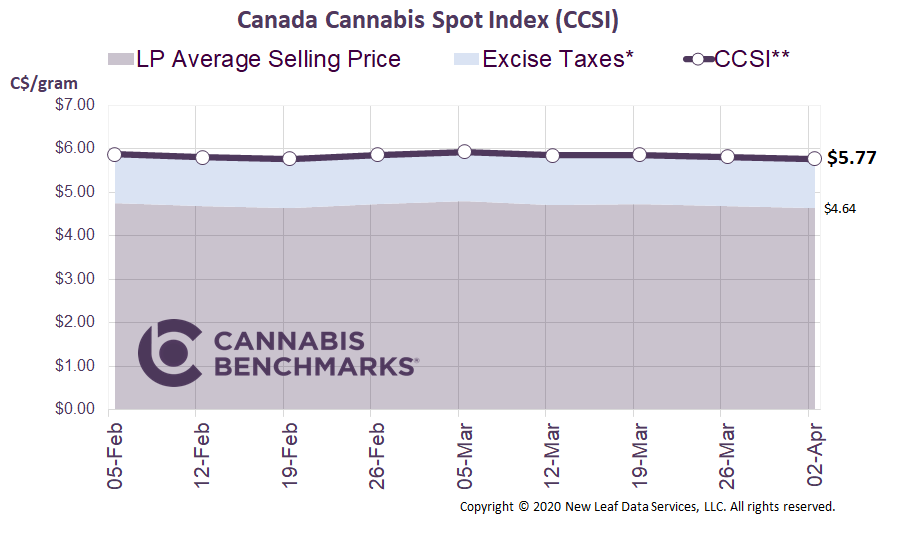

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$6.52 per gram this week, up 2.9% from last week’s C$6.33 per gram. This week’s price equates to US$2,096 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor NetworkIf you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

Time to Shine

Most, if not all, licensed cannabis producers have not seen the level of sales they had expected since the recreational market opened in October 2018. The higher prices and lack of accessibility to legal sources of product have led to weaker-than-projected demand for licensed producers. As we have reported in the past, we believe roughly 80% of cannabis consumed in Canada still comes from the illicit market, but that might be changing quickly.

Since the COVID-19 pandemic reached Canada, universities and colleges have closed, businesses have instituted work-from-home programs, and unemployment has skyrocketed. At the same time, the sale of cannabis in legal channels has spiked across the country. In most provinces, cannabis is now considered an essential business, meaning cannabis retailers will remain open as most other businesses close their doors. Additionally, the Government of Canada has listed cannabis for medical use an essential service at the federal level. We believe that the unprecedented restrictions that have been put in place to contain the coronavirus present a unique set of circumstances that will benefit legal cannabis producers, at least in the short term.

Social or physical distancing is likely to modify purchasing habits. Experienced cannabis users who have continued to buy products from their local illicit dealer may now prefer to purchase cannabis through legal channels – either online or at a physical retail location – rather than risk paying cash for untested product from unknown sources, delivered by someone who is essentially a travelling salesman. Simply getting these consumers in the door of a legal store or ordering through a legal website could be the game-changer that the industry needs. Consumers may now be more attracted to legal channels with a wider variety of tested, traceable products and the ability to pay electronically. Online sales should be particularly strong as consumers stay home and purchase goods remotely for delivery. This could create a structural shift to the legal markets, possibly resulting in increased sales for licensed producers that continue after the virus abates.

We have updated our sales forecast from our pre-COVID-19 base case. We believe the cannabis industry will see a spike in sales in March, which will help cushion the drop in sales expected in April and May. Our base case assumes that life returns to normal in June, with many of the stores that were expected to open in April and May pushed back to the summer, and a new consumer base formed at the expense of the illicit cannabis market.

Source: Cannabis Benchmarks

Our pre-COVID-19 base case showed total recreational Canadian cannabis sales reaching C$2.4B in 2020. Despite a dip in sales in April through June, we believe the cannabis industry will generate higher revenues this year. Our post-COVID-19 base case shows total recreational cannabis sales climbing to C$2.5B this year, which is more than double the C$1.2B in sales recorded in 2019.

Source: Cannabis Benchmarks

Our downside case, which assumes the economy does not recover quickly, shows sales coming in at C$120M, or 5% below the pre-COVID-19 base case. Our upside case, where the economy bounces back and customers switch to the legal markets, shows sales approximately 11.5%, or C$280M, higher than the pre-COVID-19 base case.

For more data and analytics like this, please sign up to become a BETA client of our market fundamentals dashboard. Please click the link below to register and we will email you directly as our platform becomes available.