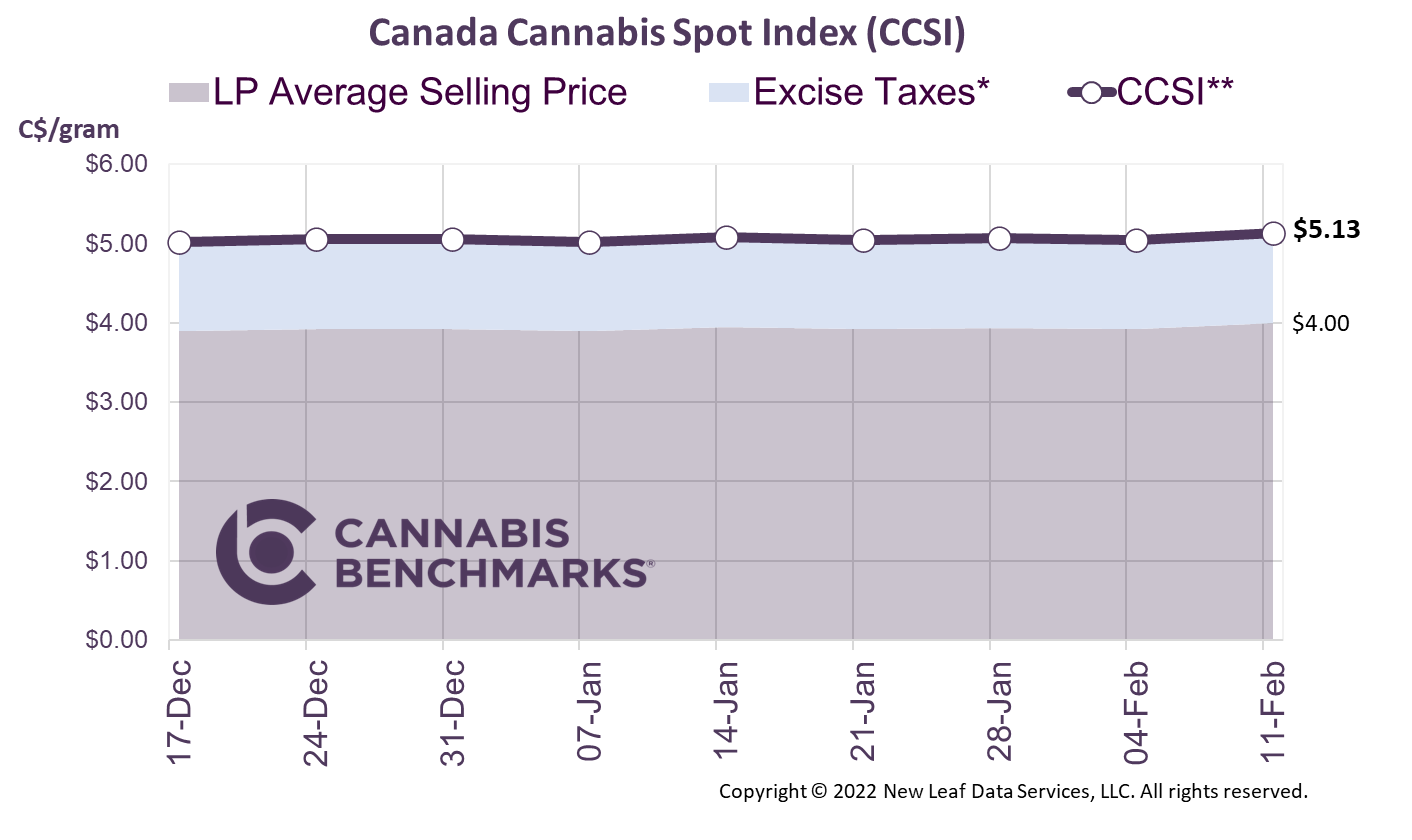

*The provincial excise taxes vary. Cannabis Benchmarks estimates the population weighted average excise tax for Canada.

**CCSI is inclusive of the estimated Federal & Provincial cannabis excise taxes..

The CCSI was assessed at C$5.13 per gram this week, up 1.7% from last week’s C$5.05 per gram. This week’s price equates to US$1,834 per pound at the current exchange rate.

Include your weekly wholesale transactions in our price assessment by joining our Price Contributor Network

If you have not already done so, we invite you to join our Price Contributor Network, where market participants anonymously submit wholesale transactions to be included in our weekly price assessments. It takes two minutes to join and two minutes to submit each week, and comes with loads of extra data and market intelligence.

This week we explore the state of British Columbia’s (BC) cannabis market. BC has long been one of the cannabis cultivation capitals of North America. Prior to legalization, its ideal climate helped allow the province to develop a deep underground network of craft growers, which in turn supplied cannabis across the country.

However, the robust illicit market is now plaguing the legal industry. Cannabis retail sales in the province are not as large as one might expect due to the continued, large presence of the illegal cannabis trade. To curb supply from the illicit market, the BC government is working with many illegal cannabis growers; part of efforts to convert them to the legal sector by helping them through the official application and regulation process.

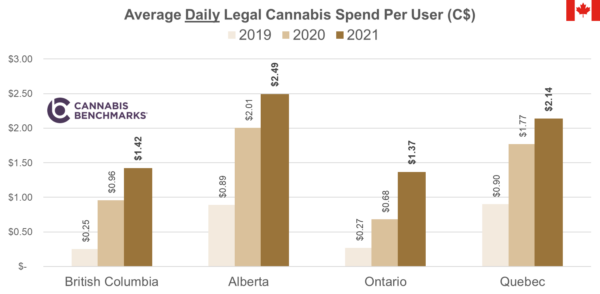

BC has the third-largest provincial population in Canada. The latest monthly sales data from Statistics Canada post-November has sales there at C$47.8M for the month. For a province that is known for its cannabis roots, this falls far short of expectations. Looking at the monthly sales by population size and the proportion of the population that uses cannabis, we calculated the average legal spend by cannabis users in the top four provinces. As part of that process, we take the reported monthly sales numbers from Statistics Canada, convert them to a daily figure, and then divide it by the number of estimated cannabis users in the province.

Based on a survey done by the Canadian government, roughly 20% of the BC populace is estimated to use cannabis regularly. Based on our analysis, the average cannabis user in BC spends C$1.42/day on legal cannabis products.

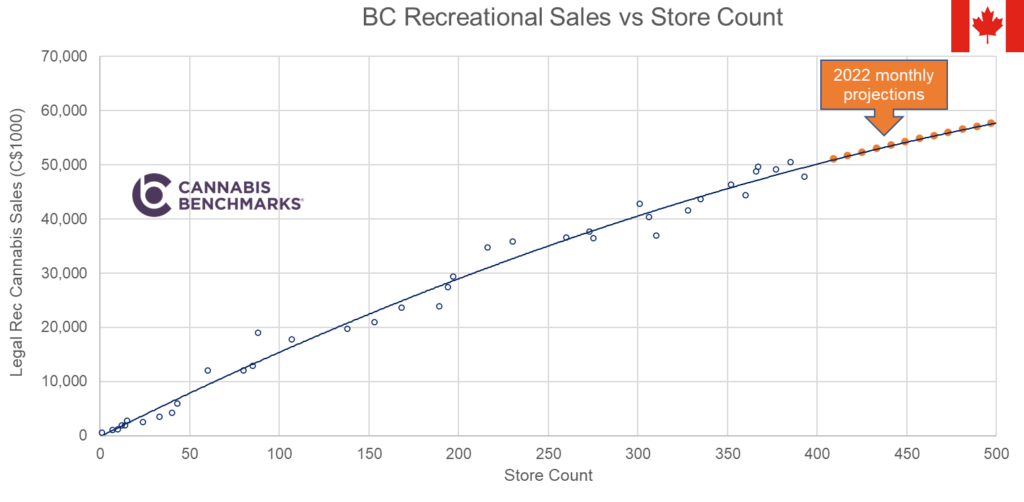

We believe this number could be substantially higher, but the legal BC markset faces two main obstacles.The first is that many cannabis users still purchase products from the illicit sector. So, while they may identify themselves as cannabis users their purchases do not show up in official stats. The second is a low store count relative to other legalized jurisdictions with, in some cases, illegal stores still in operation. The relationship between store counts and sales is very strong, so with the slow rollout of stores we do not expect BC sales to jump substantially in 2022.

We estimate BC sales for 2022 to total $C654M, an increase of C$104M or 19% compared to 2021. While this is a substantial year-on-year increase, there is still significant room for sales growth in the province. There are other factors that could help grow the industry, however, including converting current users to the legal channels, the recent push by the BC government to help transform illicit operations into legal ones, the growing number of cannabis stores, and the lower legal wholesale price point.