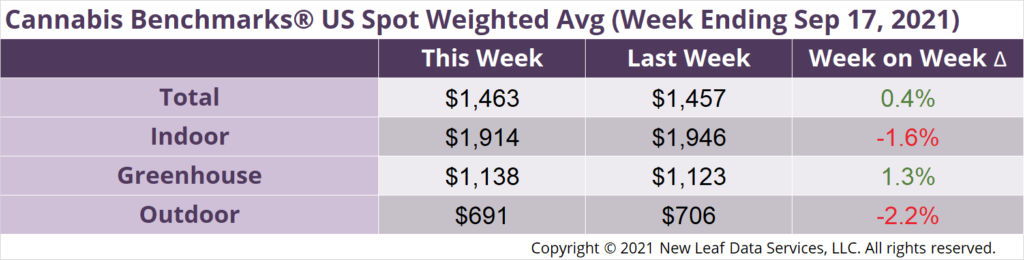

U.S. Cannabis Spot Index increased 0.4%% to $1,463 per pound.

The simple average (non-volume weighted) price decreased $18 to $1,724 per pound, with 68% of transactions (one standard deviation) in the $895 to $2,552 per pound range. The average reported deal size decreased to 2.3 pounds. In grams, the Spot price was $3.23 and the simple average price was $3.80.

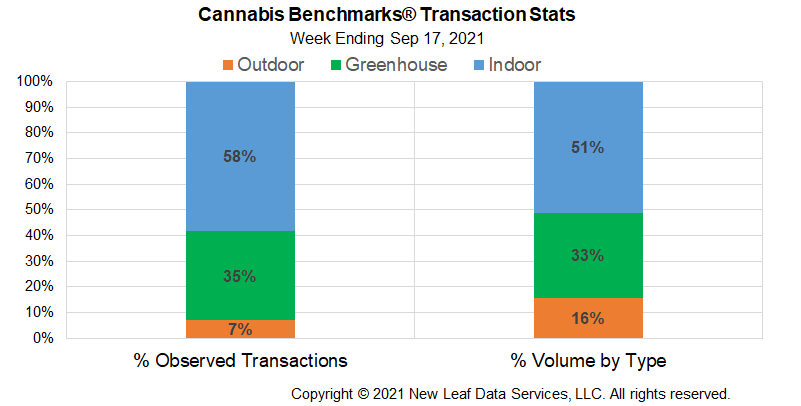

The relative frequency of transactions for indoor flower were unchanged this week at 58%. The relative frequency of trades for greenhouse product was also unchanged, but outdoor flower transaction slipped by 1%.

The relative volume of indoor product increased by 2% this week. The relative volume of greenhouse flower was was down by 1% versus last week, while outdoor flower’s relative volume decreased by 1%.

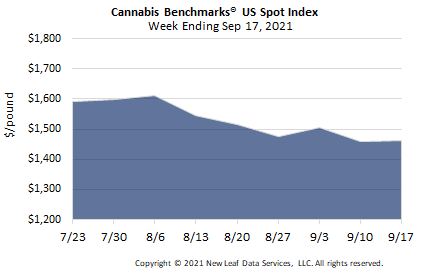

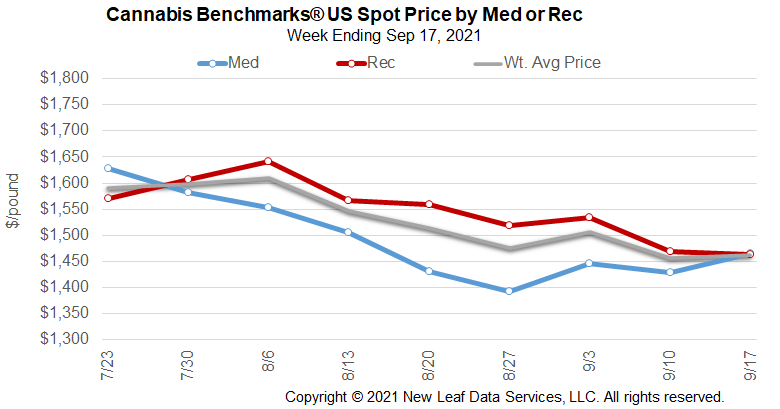

U.S. Spot is still under pressure but ticked up about $6 this week, as legacy states continue to see falling prices. Spot is currently trading at $1,463 per pound, near its lowest level since July 2020. The spot market rallied from $1,322 in May 2020 to a peak at $1,665 in October 2020, reflecting widespread demand during the initial phase of the pandemic. As noted previously, California and Oregon prices have been under persistent pressure, due primarily to ongoing oversupply issues. Indeed, growers see little reprieve on price. Some cultivators say they expect oversupply to remain a permanent condition, as states prepare for federal legalization within, possibly, the next two years. The sell-off in U.S. spot price may slow as new adult use states see increasing consumer demand. That process is expected to be slow, however, as demonstrated in high-population states like Connecticut — where initial adult-use sales were pushed out to the end of 2022.

Economists were somewhat vindicated by this week’s lower-than-expected Consumer Price Index (CPI) data, with overall annual inflation falling 0.1% to 5.3% and monthly core inflation falling to 0.1%, the smallest increase since February 2021. As noted previously, retail sales have been falling and consumer spending has been slipping, with personal consumption expenditures falling from 1.1% in June to 0.3% in July; another indication that consumers are paring back spending. When consumers decide to cut spending, discretionary spending is first — and cannabis is largely a discretionary item. That being said, Alaska, Arizona and Colorado all reported sales increases month-over-month.

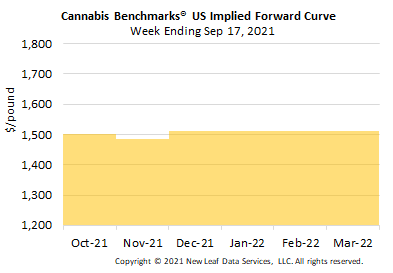

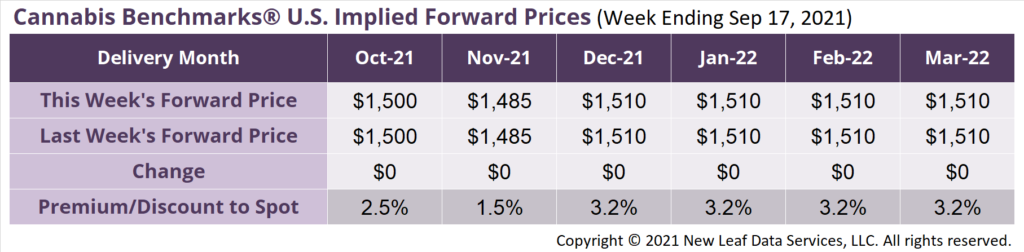

October 2021 Implied Forward unchanged at $1,500 per pound.

The average reported forward deal size was 68 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 45%, 39%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 91 pounds, 58 pounds, and 29 pounds, respectively.

Colorado

Colorado on Pace to Exceed 2020 Cannabis Sales

Connecticut

Connecticut First Adult Use Retail Sales Pushed to End of 2020

Arizona

Arizona Adult Use and Medical Sales Turn Higher