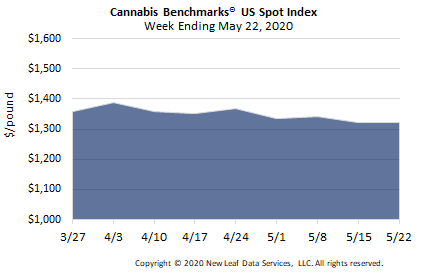

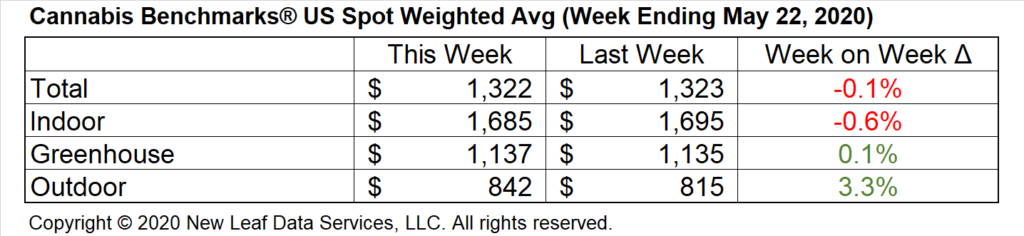

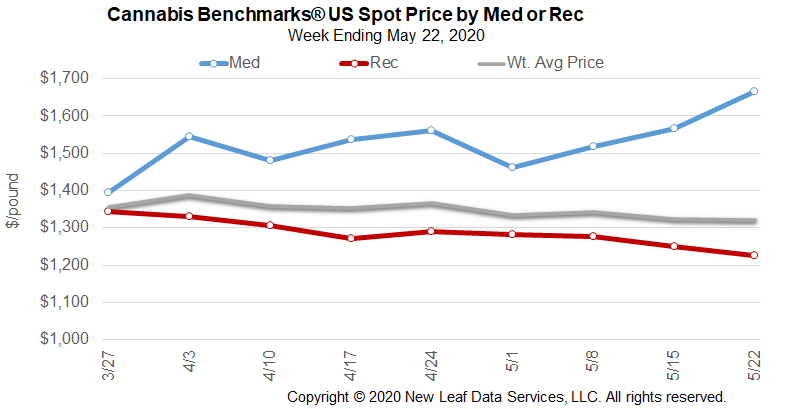

U.S. Cannabis Spot Index nominally unchanged at $1,322 per pound.

The simple average (non-volume weighted) price was unchanged at $1,525 per pound, with 68% of transactions (one standard deviation) in the $784 to $2,266 per pound range. The average reported deal size decreased to 2.2 pounds. In grams, the Spot price was $2.92 and the simple average price was $3.36.

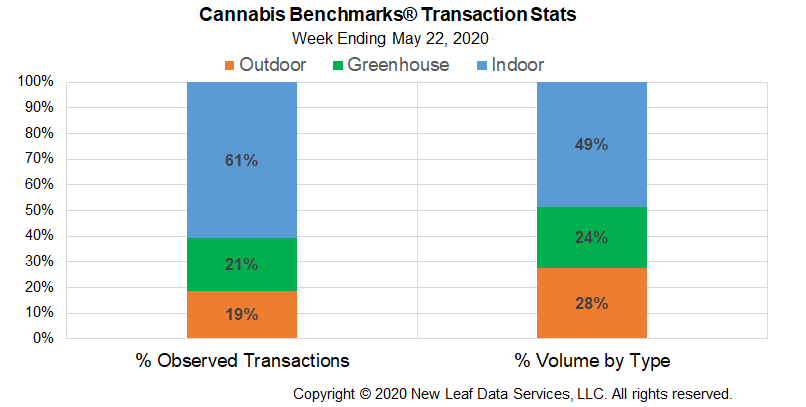

The relative frequency of trades for indoor flower decreased by almost 2% this week. The relative frequencies of deals for greenhouse and outdoor product each increased by about 1%. The relative volumes of each grow type were fairly stable compared to last week, with only marginal shifts observed.

This week, sales data for April was released by officials in Oregon, Arizona, and Michigan, providing a broader look at demand conditions in legal cannabis markets subjected to stay-at-home orders and other restrictions due to the COVID-19 pandemic.

Taken together, the official data available currently indicates that demand has remained elevated and robust despite the coronavirus. Three of the four states mentioned above – Oregon, Michigan, and Illinois – saw sales increase again in April, even after setting records in March. Arizona’s market saw a decline in sales volume from March to April – possibly due to the inability to celebrate 4/20 – but sales figures in the latter month are still the second-highest in the history of the state’s large, mature medical cannabis system.

So far, the available data suggests that cannabis may indeed be a recession-proof commodity, so long as it remains available. Despite record-breaking unemployment levels, along with many Americans facing significant uncertainty about their work and income situations, sales continued to climb in the newer adult-use markets of Michigan and Illinois, while previously-strong growth in Oregon accelerated.

It must be noted that many Americans received stimulus payments of up to $1,200 from the U.S. government in April, while federal legislation passed in response to the COVID-19 pandemic provided for expanded unemployment insurance and increased payments to those who qualify. This assistance may have facilitated spending by consumers in April.

However, the stimulus payments are at this point not recurring and are quite paltry compared to those received by citizens of other countries. (In Canada, for example, residents are receiving C$2,000 per month.) This raises the possibility that cannabis sales could be impacted negatively going forward if the overall economic situation worsens and assistance from the federal government is inadequate or simply not forthcoming. We noted in last week’s report that an official budget forecast out of Colorado anticipates that cannabis tax revenues will decline in the coming fiscal year.

Another preliminary conclusion that can be gleaned from the data is that cannabis consumers – both those purchasing in adult-use markets and those registered as medical patients – appear relatively unconcerned with using smokable or inhalable products during an outbreak of a severe respiratory illness. Flower sales climbed in Oregon, Illinois’ medical system, and in both sectors of Michigan’s legal market in April, along with sales of concentrates and extracts for vaping. Edibles sales also rose sharply in Oregon, but the increase was not out of step with those of other product categories. Notably, in Arizona, recent monthly edibles sales volumes have been down compared to last year.

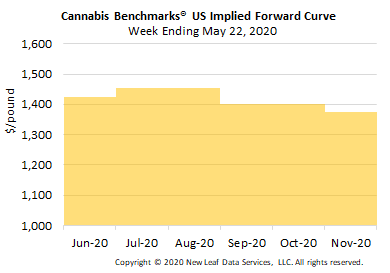

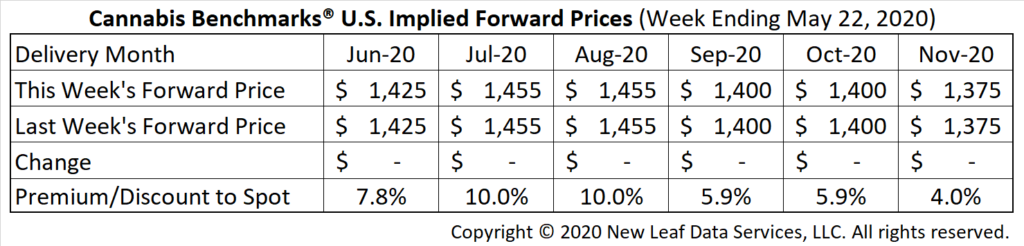

June Forward unchanged at $1,425 per pound.

The average reported forward deal size was 35.6 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 47%, 37%, and 16% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 41 pounds, 28 pounds, and 36 pounds, respectively.

At $1,425 per pound, the June Forward represents a premium of 7.8% relative to the current U.S. Spot Price of $1,322 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Planned Regulatory, Tax Reforms to Legal Cannabis Market Delayed Due to COVID-19

Oregon

Sales Rise to $89 Million in April, Setting a New Record for the Second Straight Month

Michigan

April Sales See Robust Growth in Both Adult-Use and Medical Markets, But Issuance of New Retailer Licenses Slows

Arizona

Purchasing Slips in April, But Total Sales Volume is Still Second-Highest in the History of State’s Medical System