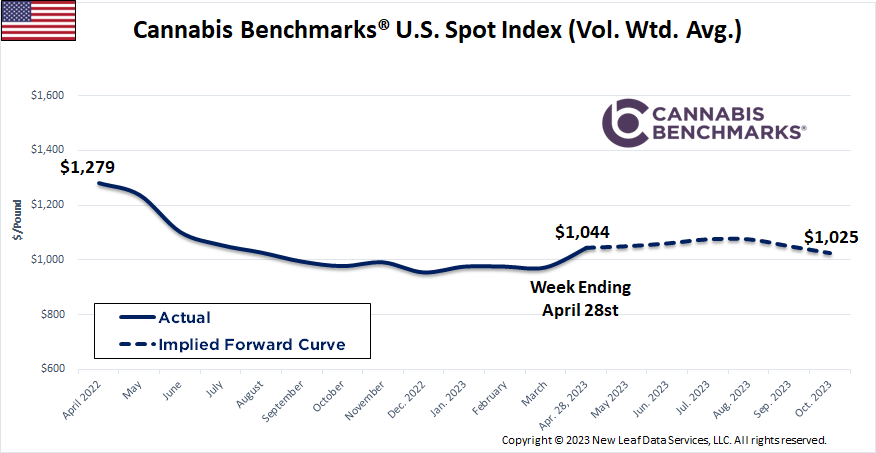

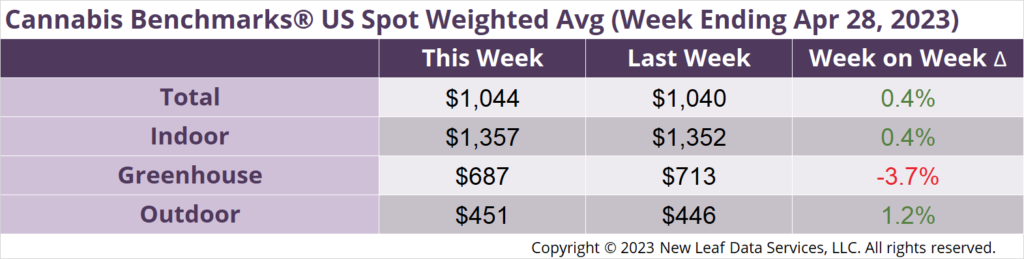

The U.S. Cannabis Spot Index increased 0.4% to $1,044 per pound.

In grams, the Spot price was $2.30.

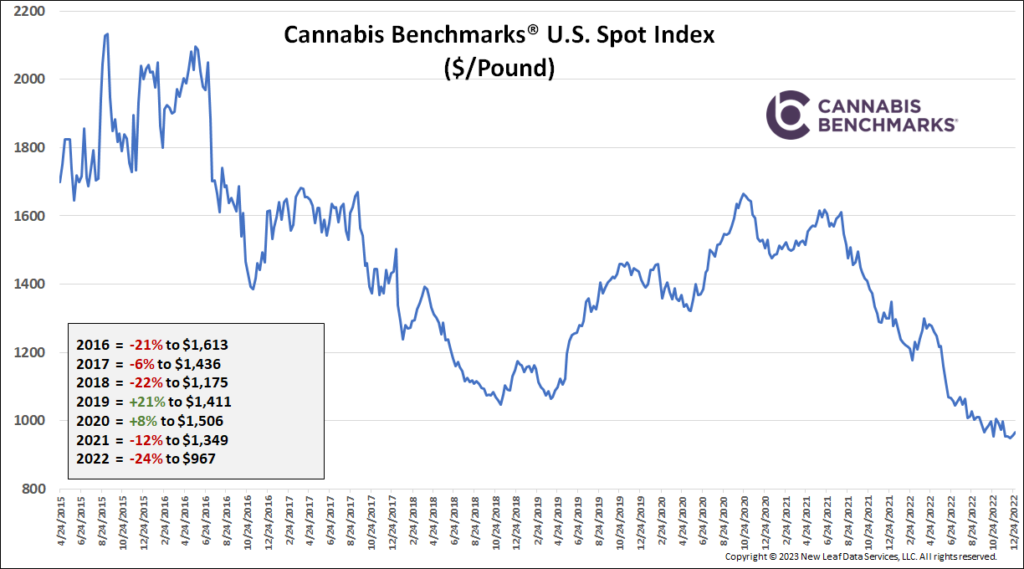

This week marks eight full years of Cannabis Benchmarks wholesale price assessments and reporting, with the very first U.S. Spot Index report published on April 24, 2015. As the chart below shows, while volatile, the overall trend in wholesale cannabis flower prices from 2015 through 2022 was a downward one apart from 2019 – 2020, with the demand-boosting impact of the Covid-19 pandemic driving prices upward in the latter year.

In fact, 2022 saw the U.S. Spot experience its largest proportional decline since inception. A combination of simple oversupply and slackening demand in the wake of the coronavirus pandemic, as well as licensed businesses across the country struggling with cash flow and debt obligations in an environment of tightening fiscal policy, combined to crash wholesale prices at a rate not seen previously.

Additionally, we have seen newer adult use markets – Michigan and Arizona are particular examples – mature more quickly in the past and in short order rush through the boom-bust cycles that took several years to develop in older markets. This phenomenon is likely to continue as more states in the Mid-Atlantic and Northeast legalize adult use cannabis markets and firms operating in multiple states are able to quickly scale up using operational models tested in other markets.

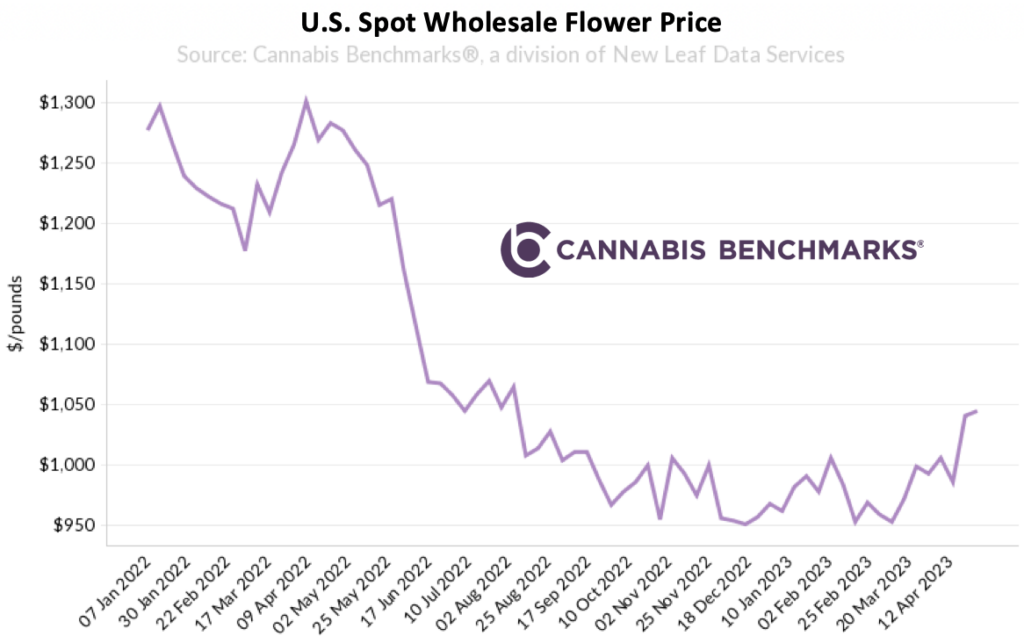

Despite increasingly efficient market maturation, persistent oversupply, and an unfavorable credit environment, the U.S. Spot has this year been building a base and in recent weeks has turned upward.

Recent data out of state markets – covered below here and in previous weeks’ reports – indicates that the customary Spring demand boost arrived in March. Reports and data out of several mature legacy markets shows that growers have pulled back production somewhat, while there are rumblings and suggestions that a significant amount of sun growers will not plant this year, whether they are trying to ride out the tough market conditions or are exiting the industry entirely.

Indeed, the current situation recalls 2019, a year that followed two and a half years of deteriorating wholesale prices, largely due to robust harvests and oversupply in the West Coast markets and Colorado. Although the 2019 recovery may be an encouragement, it is important to note that price was already turning downward again post-harvest that year, only to be boosted upward when sales surged with the arrival of Covid-19.

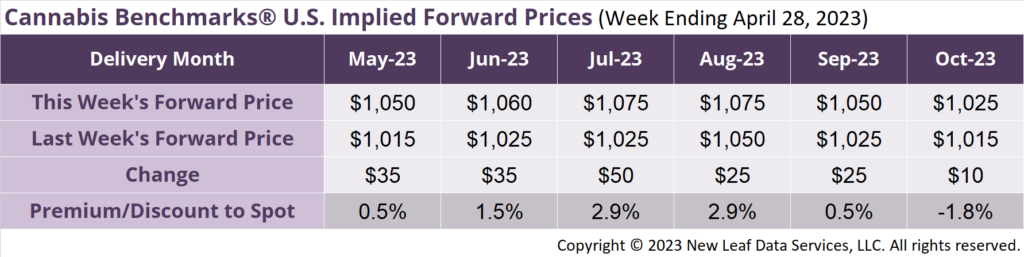

May 2023 Implied Forward assessed up $35 to close at $1,050 per pound.

At $1,050 per pound, the May 2023 Implied Forward represents a premium of 0.5% relative to the current U.S. Spot Price of $1,044 per pound.

Cannabis Benchmarks Marks 8 Years of Wholesale Price Reporting & Analysis

Overall Sales Downtrend Continued in January & February

Q4 2022 Data Shows Patients Appear to Shift to Purchasing from Adult Use Retailers

“Start Low and Go Slow” – Interview with OCM Policy Director