Image: Robert Murray/Unsplash

Image: Robert Murray/Unsplash

MARCH & APRIL 2023 MARKET DATA & ANALYSIS

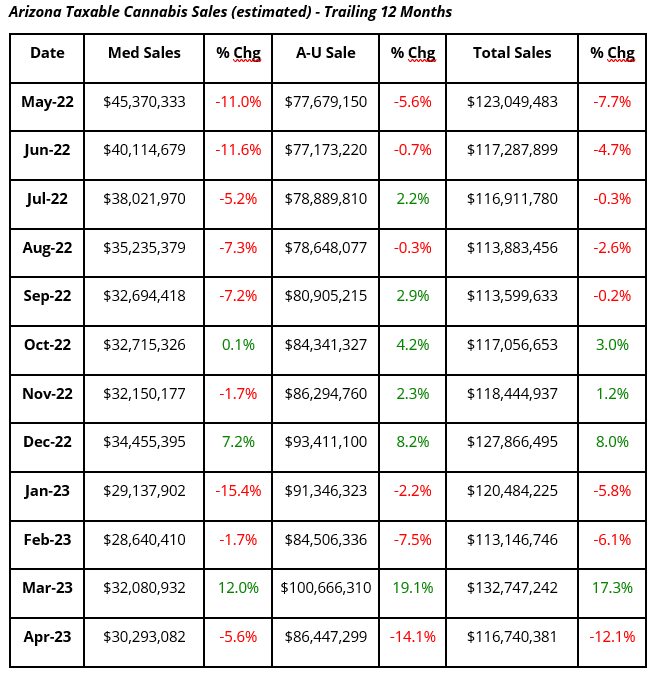

The Arizona Department of Revenue (ADOR) released cannabis tax collections and estimated sales information for March and April 2023. March 2023 combined medical and adult use sales were $132.7 million, up 17.3% from an upwardly revised $113.4 million in February 2023, but down 3.1% from March 2022 combined sales of $137 million. The bump in March sales is fairly typical across states with the month having an additional three days compared to February.

April 2023 combined medical and adult use sales, at $116.7 million, were down 12.1% from March 2023 sales of $132.7 and down 12.4% from April 2022 sales of $133.3 million.

Adult Use Sales

March 2023 adult use sales, at $101 million, were up 19.1% over February 2023 sales of $84.5 million and were up 23.6% from March 2022 sales of $81.5 million.

April adult use sales, at $86.4 million, were down 14.1% from March 2023 and were up 5.1% from April 2022 sales of $82.3 million.

Medical Sales

March 2023 medical sales, at $32 million, were up 12% from February 2023 sales of $28.6 million, but were down 42.2% from March 2022 sales of $55.5 million.

April 2023 medical sales, at $30.3 million, were down 5.6% from March 2023 and were down 40.6% from April 2022 medical sales of $51 million.

The table below shows Arizona medical and recreational sales for the past 12 months. Medical sales losses have clearly benefited adult use sales, an unsurprising outcome in markets in which adult use sales were introduced into an existing medical market.

Arizona oversupply has driven wholesale spot prices down 36.4% from April 2022 to the end of April 2023. Wholesale price losses of this magnitude make their way to retail and affect monthly sales totals, as seen in the table below.

Competition in Arizona’s adult use market ushered in an explosion of cultivation expansion by the state’s existing medical providers, many of which are vertically integrated and were quickly granted licenses to sell to general consumers. With no cap on the production capacity of individual operators, the state very quickly became oversupplied, and prices tanked. The sharp bounce upward in Arizona indoor prices likely reflects bargain-hunting and will be short-lived unless some state effort is made to limit cultivation canopy, or market forces compel licensees to pull back on production.

Arizona indoor-grown cannabis flower reached an all-time low of $650 per wholesale pound in February 2023. It has since risen nearly 66% per wholesale pound, putting it in the middle of legacy state pricing. Arizona indoor product is trading $67 below California indoor flower’s price; it is trading over Oregon’s indoor price by $98 and over Colorado’s price by $160. Given the glut of supply in the state, it is likely Arizona cannabis will revisit the $650 per indoor pound price before it sees a significant price stabilization.