Image: Avery Meeker/Unsplash

Image: Avery Meeker/Unsplash

October 24, 2023

In analyzing legal cannabis market data in recent years, we’ve noted repeatedly that sliding or stagnating sales revenues across a number of legal markets don’t necessarily mean that demand is declining. Instead, in many cases sales have increased in volume terms, with revenues down due to significant price compression.

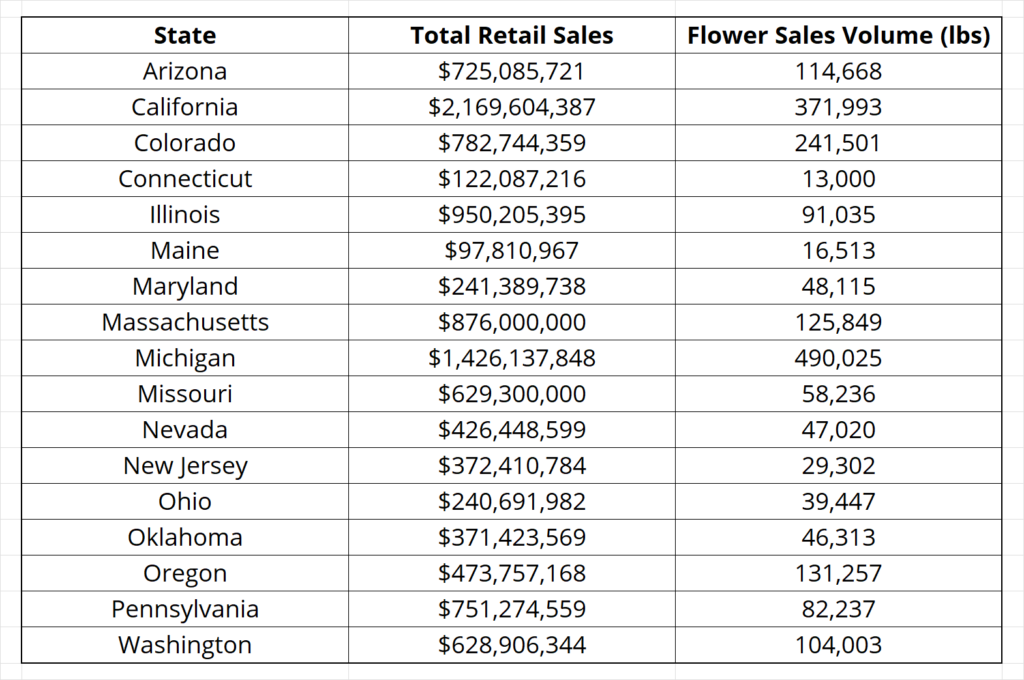

In what follows, we present data on retail sales revenues and flower sales volume at retail for selected states in the first half of 2023, along with some comparisons illustrating how the two have changed relative to prior years.

The revenue figures shown in the table below reflect total retail sales in each state for all products, combining both adult use and medical sales where applicable. Flower sales volume at retail is cited or extrapolated from official state data where available. For several states, we provide estimates based on data and trends for comparable markets, along with consulting retailer menus and other sources to ascertain average prices.

H1 2023 Sales Revenue & Flower Sales Volume

One readily apparent takeaway from the data above is that revenue figures alone can obscure significant divergences in sales volume due to differences in price. For example, New Jersey and Oklahoma saw very similar sales revenue figures for the first half of this year, but Oklahoma’s flower sales volume outpaced New Jersey’s by more than a third.

Looking back to prior years, 2020 stands out for the event-driven demand boost that occurred with the arrival of the Covid-19 pandemic in the U.S. Viewing flower sales volume figures for 2020 compared to those three years later shows significant growth in both mature and newer markets, even where sales revenues have declined notably.

- Arizona’s market was medical-only in 2020. Still, it was one of the larger markets in the country, with patients purchasing almost 190,000 pounds of flower that year. If H2 2023’s flower sales volume matches the first half of this year, then Arizona’s legal cannabis market will see a 21% increase in flower sales volume from 2020.

- California’s legal cannabis market saw roughly 570,000 pounds of flower sold through licensed retailers in 2020. This year, retailers in the state are on pace to sell about 744,000 pounds of flower to consumers and patients, which would represent a 30% increase from 2020.

- In the first half of 2020, Colorado retailers sold around 200,000 pounds of flower to adult use consumers and registered patients. This year’s H1 flower sales volume figure is up 21% from the same period three years ago.

- 2020 was the first year that Illinois’ adult use market was open for business and we estimated that licensed stores sold almost 82,000 pounds of flower to registered patients and adult consumers. This year, the state’s recreational and medical retailers have already surpassed the full-year 2020 estimate and are on pace to see flower sales volume increase by 122%.

- We estimated that Massachusetts’ adult use market saw about 70,000 pounds of flower sold to consumers in 2020, a figure that likely would have approached 85,000 pounds if retailers had not been forced to close down for a two-month period from late March through late May as part of the state’s response to the Covid pandemic. This year, Massachusetts’ retailers are on pace to sell over 250,000 pounds of flower to consumers and patients, nearly three times the volume of 2020’s Covid-adjusted flower sales volume.

- Michigan’s market has catapulted to one of the largest in the country in terms of both sales revenue and volume. A comparison to 2020, the first full year of adult use sales, illustrates the rapid expansion of legal cannabis in the state. In 2020, Michigan adult use retailers and medical dispensaries sold nearly 95,000 pounds of flower. This year, the state is on pace to see close to 1 million pounds of flower sold, a more than 10X increase that’s been aided by consumers from surrounding states where cannabis remains illegal.

- Oregon retailers sold 305,000 pounds of flower thanks to the pandemic boost in 2020, making it potentially the only state listed above on pace to see a decrease in demand by volume three years on. If H2 2023’s flower sales volume matches the first six months of the year, then Oregon will see about 262,000 pounds of flower sold, which would be a 14% contraction from 2020.

While sales revenue figures are down significantly from 2020 in many more established markets, the analysis above shows that demand has in most cases continued to grow in terms of the amount of product being sold. Meanwhile, states that were just getting their adult use markets going in 2020 have seen dramatic growth, none more so than Michigan, which has become a gargantuan legal cannabis market marked by very low prices.

Image: Avery Meeker/Unsplash

Image: Avery Meeker/Unsplash