Image: Eric Masur

Image: Eric Masur

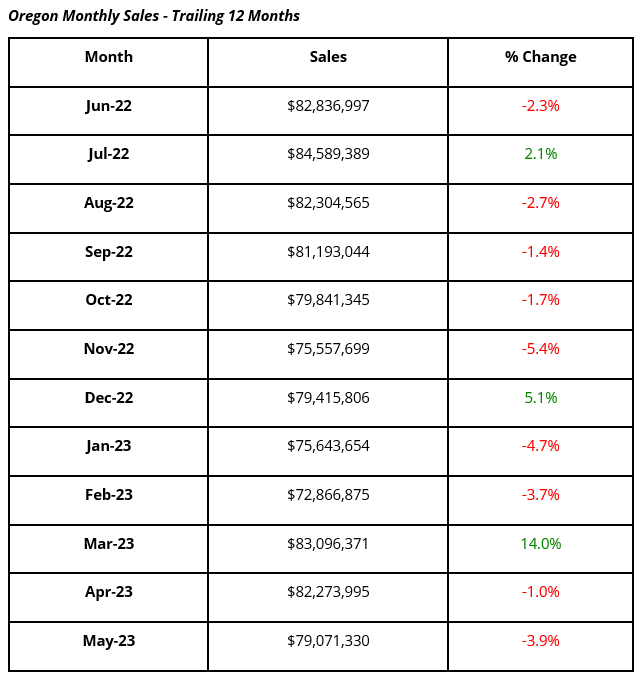

The Oregon Liquor and Cannabis Commission (OLCC) issued sales data for May 2023.

May 2023 sales, at just over $79 million, were down 3.9% from an upwardly revised $82.3 million in April 2023 and down 6.8% year-on-year from sales of $84.8 million in May 2022.

The table below shows the strong downtrend in sales in much of 2022, due largely to the sell-off in cannabis prices.Oregon has perhaps the purest picture of supply swamping prices in recent agricultural history. Efforts to reign in supply – both legal and illicit – have been somewhat effective in that Oregon spot prices have risen from recent lows in the legal market, but price increases have been met with excess supply erasing gains. The spot market has gained 15.8% since the three-year low made in June 2022 down at $669 per wholesale pound basis spot.

Outdoor flower prices have gained 23% after reaching a new five-year low in April 2023. The outdoor market remains vulnerable to the downside despite smaller harvest figures last fall, indicating there is still plenty of product from 2022’s crop left unsold despite some growers pulling back.

PRODUCT SALES DATA

May 2023 Usable Marijuana sales, at $38.9 million, were down 2.2% from April sales of $39.7 million and down 9% from May 2022 sales of $42.7 million. Usable marijuana sales were 49.1% of total sales in May 2023, up from April’s 48.4% market share.

May 2023 Concentrate / Extract sales, at $19.4 million, were down 5.8% from April 2023 sales of $20.64 million and down 5.4% from May 2022 sales of $20.55 million. Concentrate / extract sales had a market share of 24.6% in May 2023, down from April 2023’s market share of 25.1%.

May 2023 Edible / Tincture sales, at $10.7 million, were down 9.5% from April edible / tincture sales of $11.8 million and down 5.3% from May 2022 sales of $11.3 million. Edible / tincture market share was 13.5% in May 2023, down from April 2023’s market share of 14.2%.

HARVEST DATA

Total production in May 2023 was 267,892 pounds of wet weight, up 24.5% from April’s total production of 215,103 pounds. Outdoor production was slightly over 2,900 pounds in May 2023, down nearly 1,000 pounds from May 2022. Mixed light production was 35,533 pounds, up about 9,000 pounds from April 2023’s production, but down nearly 11,000 pounds from May 2022 production. Indoor production rose to 229,445 pounds, up 21.4% from 188,995 pounds in April 2023, but down 4,237 pounds from May 2022.

The year-on-year changes in outdoor production might be meaningless given last year’s extremely wet spring season, which delayed planting for outdoor and light deprivation growers and ultimately pushed harvests back a bit further than usual. The true tale of the tape will be measured by fall production, better known as Croptober.

RETAIL PRICES

OLCC shows the median extract / concentrate price at $4,436 per pound for the past eight months. The $4,436 per pound price has been a hard floor for extract / concentrates since December 2018.

OLCC also reports the median usable marijuana price at $599 per wholesale pound in May 2023; it has remained within a $80 range since December 2022.

WHOLESALE PRICES

While spot prices cannot be said to be in a broad downtrend anymore, upside movement has been a stutter step to higher prices. Volatility in the greenhouse market picked up again in January 2023, with a downdraft that erased gains made in November 2022 to January 2023. Since January 2023, greenhouse spot price has fallen 34.6%. Meanwhile, the spread between greenhouse and outdoor product has fallen from $334 in January 2023 down to just $63 as of the end of last week. Greenhouse prices are now where outdoor-grown product prices were a year ago.

Indoor product prices are in a slow upturn rising nearly 20% from the low price mark in the Fall of 2022. It has not been a steady rise, but one characterized by pullbacks that have thus far been truncated.