Image: Diyahna Lewis/Unsplash

Image: Diyahna Lewis/Unsplash

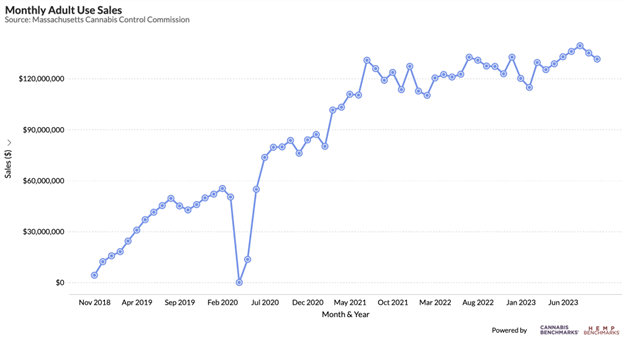

The Massachusetts Cannabis Control Commission (CCC) recently issued October 2023 adult use and medical cannabis sales data. Total legal cannabis sales in Massachusetts in October reached $148.8 million, down 2.6% from $152.8 million in combined adult use and medical sales in September.

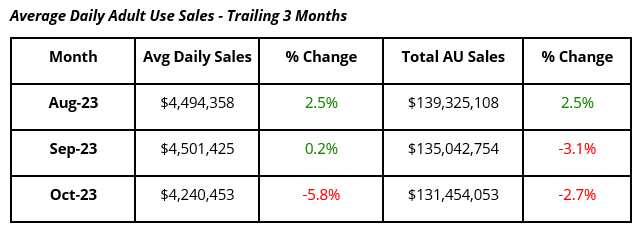

Sales slowed in October – a not unexpected development based on historical trends. Adjusting for days in each month reveals a more pronounced decline, however, while the chart above indicates that the overall uptrend in monthly revenues is flattening.

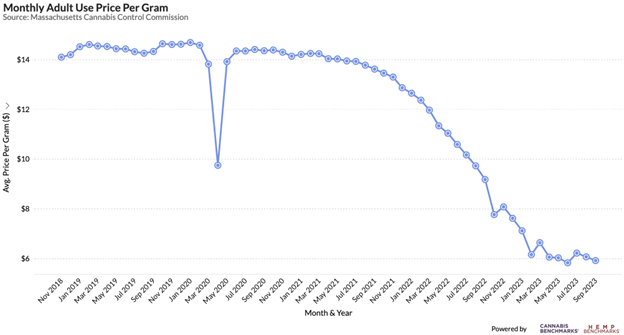

CCC reports the average retail price per gram of flower in the adult use market fell to $5.68 in October, down 3.9% month-on-month. October’s mean retail flower price is the lowest on record, falling below June 2023’s $5.82 per gram. Still, losses in average daily sales outpaced the proportional decline in flower prices. Flower made up 41.3% of adult use sales in Massachusetts in the most recent week reported.

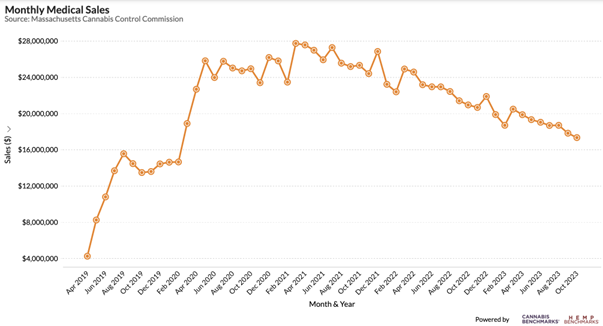

Medical cannabis sales dropped to $17.3 million in October, off 2.7% month-on-month. Sales in the medical market are approaching those seen prior to the Covid-19 pandemic, when monthly sales hovered around $14.5 million from December 2019 through February 2020.

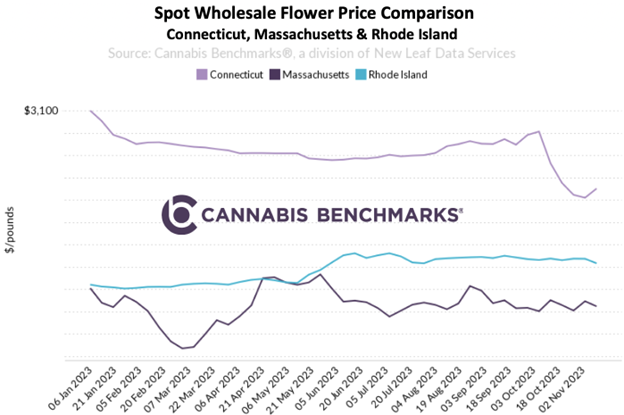

In the chart below, we compare the spot wholesale flower prices of three New England states.

Massachusetts and Rhode Island spot wholesale flower prices have been fairly steady from September, with both exhibiting slight downtrends. Despite opening a new adult use market in December 2022, Rhode Island regulators have not issued new business licenses and do not expect to until sometime next year. This has resulted in a market heavy on the supply side, with roughly 60 cultivators producing for seven retailers, five of which also have their own cultivation. Given the unchanged supply-demand balance – overall retail sales have been fairly stagnant for the past six months – stability in wholesale pricing is unsurprising.

Massachusetts is also seeing the demand side of its market settle, with slowing growth on the adult use side and declining sales in the medical sector making for plateauing overall sales revenue. Similar to a number of other states with outdoor cultivation, Massachusetts has not yet seen a notable impact on wholesale flower prices from the seasonal harvest.

Connecticut, on the other hand, saw its spot wholesale flower price drop almost $600, or 20.4%, from the first week of October to the first week of November despite outdoor cultivation not being allowed in the state. Instead, the general downward trend in Connecticut wholesale prices is likely due to organic market expansion, with more businesses coming online and previously-existing medical operations expanding.

The recent decline in Connecticut wholesale prices coincided with an announcement from state regulators that the retail purchase limit of a quarter ounce of flower or its equivalent that has been in place since the adult use market opened in January would be raised to a half-ounce beginning in December. This move, along with wholesale price trends, signals that more supply is becoming available.