Image: Justin Heap/Unsplash

Image: Justin Heap/Unsplash

MAY 2023 MARKET DATA & ANALYSIS

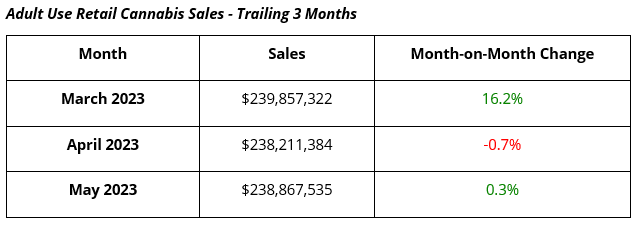

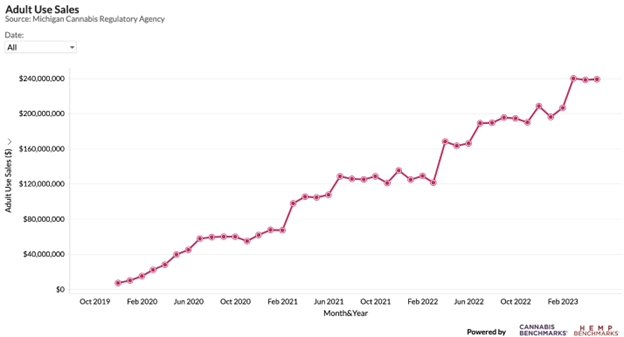

The Michigan Cannabis Regulatory Agency (CRA) issued its May 2023 monthly report detailing sales, licensing, and production data for the state’s adult use and medical cannabis markets. Combined medical and adult use sales, at $245.9 million, were down just 0.1% from April 2023 sales of $246 million, but up 32.6% from May 2022 combined sales of $185.5 million.

May 2023 Adult Use Market Summary

May 2023 adult use retail sales, at $238.9 million, eked out a 0.3% gain over April sales of $238.2 million, but were up 47.3% from May 2022 sales of $162.2 million.

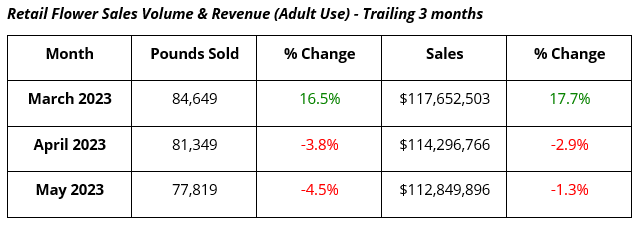

May 2023 adult use flower sales, at $112.8 million, were down 4.5% from April 2023 flower sales of $114.3 million, but were up 39.6% from May 2022 flower sales of $80.8 million. May’s flower weight sold was 77,819 pounds, down 3,530 pounds from April 2023, but up 101.2% from May 2022 flower weight of 38,676 pounds.

Inventories

Inventory of unsold flower held by growers that passed the state’s required testing was 83,684 pounds at the end of May 2023, down just 62 pounds from the April 2023 inventory weight of 83,746 pounds. Combined with flower held at retailers of 98,648 pounds, the amount of immediately available inventory at the end of May 2023 was 182,332 pounds or 2.3 months of supply based on May flower sales.

Plant Count

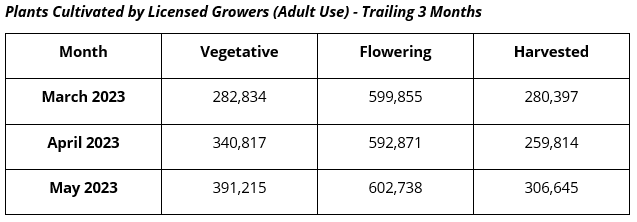

The notable increase in vegetative plants in May indicates outdoor growers were beginning to get plants in the ground last month. Michigan’s climate allows for a short growing season, with outdoor planting extending into June, with an increase in flowering plants in July and August ahead of harvest in September or October, if the weather holds.

Adult Use Retail Flower Pricing

Average retail flower prices for the trailing three months can be found below. Retail pricing continued to climb in May as the wholesale spot market has remained relatively stable, compared to other emerging markets.

Prices may be building a base after an extraordinarily tough sell-off that began in January 2021, when the wholesale spot price reached its peak at $2,970 per pound and then fell to $893 by October 2022, a nearly 70% drop. While price consolidation after such a massive sell-off is fairly typical, the length of this consolidation is not, unless a fundamental change has occurred in the cannabis price market.

Michigan wholesale cannabis prices have been steady since at least January 2023. While some price consolidation is typical after a market crash, these data suggest the market is being bought and sold with some regularity to keep prices within recent ranges. The fact remains there is going to be more cannabis on the market in the United States – and in Michigan, especially come Fall – and price will normalize to supply, first across regions then across the country.